If we consider the long term, it’s clear America’s economy and society have been declining for the average household for 50 years. What if the “prosperity” of the past 50 years is mostly a statistical mirage for the bottom 80% of households? What if whatever real gains (adjusted for real-world loss of purchasing power) accrued only to the top of the wealth-power pyramid, those closest to financial and political power? What if the U.S. economy and society shifted from “everybody wins” to “winner takes all” or at best, :winner take most”? These are not “what if”, they’re reality. The working class, which as I have recently noted, now comprises the entire working populace other than the upper-middle class Misplaced

Topics:

Charles Hugh Smith considers the following as important: 5) Global Macro, Featured, newsletter, The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| As for healthcare: we now have $100,000 operations that work miracles on one side and people being bankrupted by costs on the other, and tens of thousands dying of opioid drugs promoted by the status quo as “safe” and non-addictive. Where metabolic disorders (lifestyle diseases such as diabesity) were once a relative rarity, now up to a third of the entire population is at risk of chronic lifestyle diseases that are difficult and costly to manage–but oh so profitable to those delivering the meds and care.

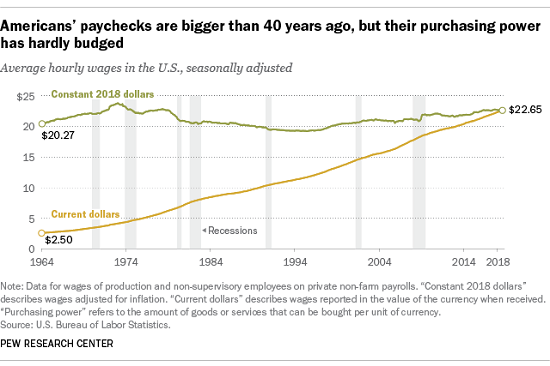

Bottom line: how much housing, higher education and well-being does the average wage buy now compared to decades past? Not much. The statistics are bleak: wages are basically unchanged from the high water mark 50 years ago, which coincidentally was also the high water mark of U.S. energy production until very recently. Adjusted for purchasing power and quality, the average paycheck buys far less than it did 50 years ago. |

U.S. Average Hourly Wages, SA 1964-2018 |

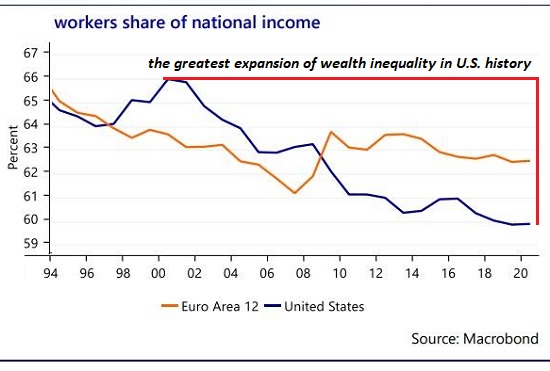

| Wages’ share of the national income has plummeted since the last secular expansion of wages in the Internet boom of the late 1990s. |

Workers share of national income, 1994-2020 |

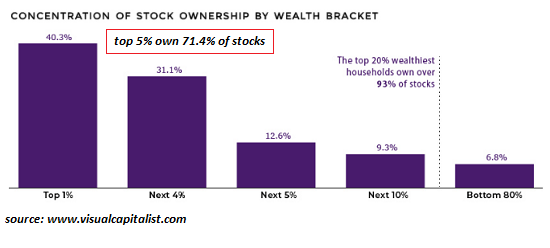

| The average households’ ownership of productive capital, and thus of financial security, has declined. There’s fewer assets within reach and those that are in reach have been reduced to a casino of booms and busts that wipes out all but the most agile gamblers.

If we consider the long term (la longue duree), it’s clear America’s economy and society have been declining for the average household for 50 years.Nobody wants to admit this because it’s politically inconvenient, to say the least. What do we make of a society in which only the top 5% have prospered in terms of their earnings buying more goods and services? Meanwhile, everyone else has compensated for the sharp decline in purchasing power by going ever deeper into debt while the nation has decayed into a landfill economy. |

Concentration of Stock Ownership by Wealth Bracket |

Tags: Featured,newsletter