USD/CHF takes the bids around monthly high. Optimism surrounding the US-China trade deal, global economy confront nearness to data. The US data, trade/political headlines could drive markets afterward. USD/CHF respects the previous day’s Doji formation, coupled with upbeat fundamentals, while taking the bids to 0.9980 ahead of Wednesday’s European session. Comments from the United States (US) President Donald Trump have mostly done the job of spreading market optimism surrounding the US-China phase one deal. The latest one points to the requirement of a good deal. Traders seem to have focused less on the South China Morning Post’s (SCMP) headlines trying to question the US policies for Beijing and signaling restrictions for ZTE and Huawei. JP Morgan recently came

Topics:

Anil Panchal considers the following as important: 1.) FXStreet on SNB&CHF, 1) SNB and CHF, Featured, newsletter, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- USD/CHF takes the bids around monthly high.

- Optimism surrounding the US-China trade deal, global economy confront nearness to data.

- The US data, trade/political headlines could drive markets afterward.

USD/CHF respects the previous day’s Doji formation, coupled with upbeat fundamentals, while taking the bids to 0.9980 ahead of Wednesday’s European session.

Comments from the United States (US) President Donald Trump have mostly done the job of spreading market optimism surrounding the US-China phase one deal. The latest one points to the requirement of a good deal. Traders seem to have focused less on the South China Morning Post’s (SCMP) headlines trying to question the US policies for Beijing and signaling restrictions for ZTE and Huawei.

JP Morgan recently came out with its analysis of the global economy and anticipated macro rebound in 2020 while analysts at Goldman Sachs anticipate the US to roll back tariffs while forecasting a better bid for the Chinese currency.

On the contrary, Moody’s indication of risks to the Chinese housing market and downbeat Industrial Profits from the dragon nation seems to cap the pair’s rise. Furthermore, expectations of further sanctions on Iran and likely additional US intervention into the Hong Kong issue keep the risk tone compressed.

Even so, the US 10-year treasury yields and the S&P 500 stay mildly bid around 1.75% and 3,145 respectively.

While trade/political headlines will keep the driver’s seat, investors are mostly looking for the Swiss ZEW Survey for November as an immediate catalyst. The sentiment gauge is likely to remain unchanged at -30.5. Following that, second estimation of the US Gross Domestic Product (GDP) for the third quarter (Q3) and Durable Goods Orders are likely to decorate the economic calendar.

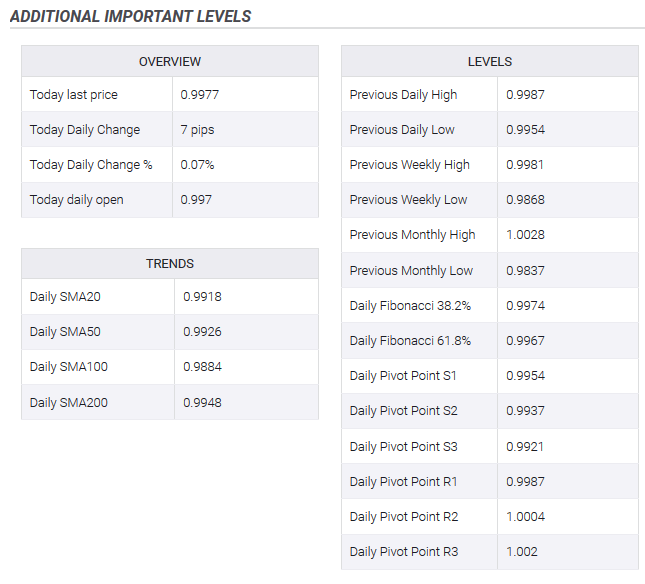

Technical AnalysisAs Tuesday’s Doji formation signals reversal of the previous day’s weakness, prices are likely to rise towards mid-October high around 1.0000 psychological while the previous month top near 1.0030 could question bulls then after. Alternatively, sellers look for entry below Doji’s low close to 0.9950. |

Additional Important Levels |

Tags: Featured,newsletter,USD/CHF