“Something wicked this way comes” warns John Mauldin Shaky China: Chinese landing could be harder than expected Brexit and EU Breakage: “I have long thought the EU will eventually fall apart” Helpless Europe: If Germany sneezes, their banks & the rest of continent catches cold We may see “yellow vests” spread globally: Economics is about to get interesting … by John Mauldin via Thoughts from the Frontline For a couple of years now, the economic narrative has shown a comparatively strong US against weakness in Europe and some of Asia (NOT China). The US, we are told, will stay on top. I agree with that, as far as it goes… but I’m not convinced the “top” will be so great. Americans like to think we are insulated from

Topics:

Mark O'Byrne considers the following as important: 5) Global Macro, Daily Market Update, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- “Something wicked this way comes” warns John Mauldin

- Shaky China: Chinese landing could be harder than expected

- Brexit and EU Breakage: “I have long thought the EU will eventually fall apart”

- Helpless Europe: If Germany sneezes, their banks & the rest of continent catches cold

- We may see “yellow vests” spread globally: Economics is about to get interesting …

by John Mauldin via Thoughts from the Frontline

| For a couple of years now, the economic narrative has shown a comparatively strong US against weakness in Europe and some of Asia (NOT China). The US, we are told, will stay on top. I agree with that, as far as it goes… but I’m not convinced the “top” will be so great.

Americans like to think we are insulated from the world. We have big oceans on either side of us. Geopolitically, they serve as buffers. But economically they connect us to other important markets that are critical to many US businesses. Problems in those markets are ultimately problems for the US, too. Last week I gave you my Year of Living Dangerously 2019 US forecast, but I didn’t discuss important events overseas. Summarizing last week quickly, I think the base case is that the United States economy slows down but avoids recession in 2019. That said, there are significant risks to that forecast, mostly to the downside. Today we’ll make another literary metaphor to frame our discussion. “Something Wicked This Way Comes” is a 1962 Ray Bradbury novel about two boys and their horrifying encounter with a travelling circus. Later it was a movie. In our case, something wicked most certainly is coming this way. Several somethings, in fact, approaching from all directions. The real question is how much damage this circus will do before it leaves town. |

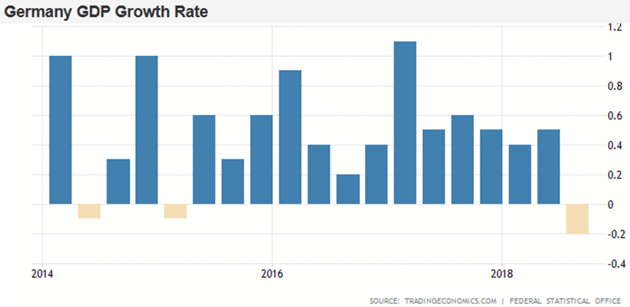

Germany GDP, 2014 - 2018(see more posts on Germany Gross Domestic Product, ) |

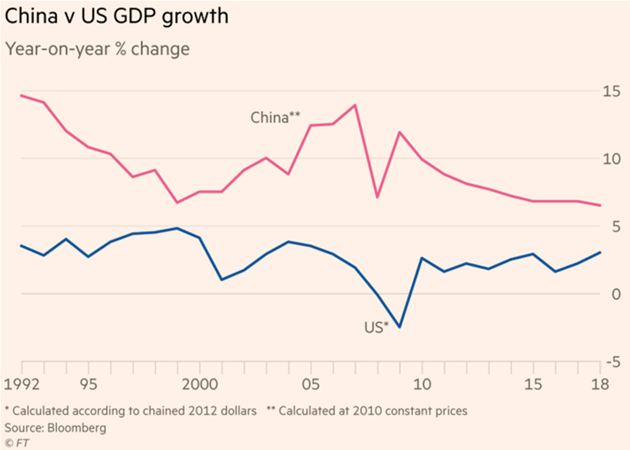

Shaky ChinaMany of our risks emanate from China, and as I wrote this section, I realized it deserves a longer treatment. I will do that in next week’s letter. For now, let’s touch on the big picture. By most measures, the US and China are the world’s largest and second-largest economies. They are also entwined with each other in so many ways that it can be hard to know where one stops and the other starts. Some call it “Chimerica,” which may be an apt description. That’s basically good, in my view. International trade promotes peace and prosperity for all, albeit not always smoothly, evenly distributed, or without issues. Such is the nature of great entanglements. But seen over decades? China’s growth has made the world better. Literally billions of people globally have been lifted out of poverty and destitution. All that said, the US and China are also separate nations with separate interests. We compete as well as cooperate so differences naturally arise. While we need to resolve them, the Trump administration’s methods aren’t helping. They seem not to grasp that intentionally weakening an economy so tied to our own risks weakening the US as well. The US is demanding (rightly, in my opinion) that China respect intellectual property rights and let foreign companies compete fairly, just as we let Chinese companies operate here. But achieving that isn’t like flipping a switch. Entire regions and industries are now optimized for a model we want to change. The change, however necessary, will cause problems if it’s not managed well. Worse, China’s economy is already on shaky ground. Its unique blend of “communism” (whatever that now means in China) and capitalism, along with sheer size, has produced enviable growth rates and I think will keep doing so, but a slowdown is inevitable. China is still subject to the law of large numbers. They can’t maintain 6% or higher GDP growth indefinitely. The gap between US and China GDP growth has been shrinking over the last decade. |

China vs. US GDP Growth, 1992 - 2018(see more posts on China Gross Domestic Product, U.S. Gross Domestic Product, ) |

| It now appears the eventual Chinese landing could be harder than expected. We’ve seen hints in the data for some time now and they’re starting to add up. Automotive sales are rolling over, for instance. That’s partly because ride-sharing services like Didi Chuxing (similar to Uber or Lyft) are gaining popularity, but it also suggests the Chinese middle class is no longer gaining prosperity at the rates it had been. It’s also a result of “front-loading” auto sales for the previous few years. When you pull future demand forward, the future eventually demands repayment.

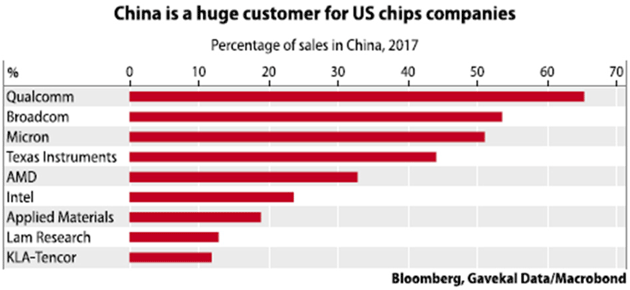

This isn’t just a Chinese problem. US and European automakers export vehicles to China and own factories within China. It is one reason General Motors closed several US and Canadian plants and laid off thousands of workers last year. Then you probably heard Apple’s revenue warning, in which it blamed a nasty surprise on weakening conditions in China. The uncomfortable fact is that a great deal of world growth is directly tied to Chinese growth. And not just absolute current growth, but expected future growth. Business has built 6% Chinese growth, compounded forever, into its models. It’s baked into the forecasts and expectations that keep shareholders happy. And when that growth doesn’t meet expectations, we get surprises. Apple is just the first of many. Yes, the US has a trade deficit with China. That doesn’t mean China buys nothing from us. They most certainly do and certain segments of our economy depend heavily on Chinese customers. Here’s a chart of China’s importance to top US semiconductor companies. |

Percentage of Sales in China, 2017 |

| Listen on SoundCloud , Blubrry & iTunes. Watch on YouTube below |  |

Note this is the percentage of sales, not earnings. We see here five major public companies that got a third or more of their 2017 sales from China. It would not take much change to wipe out all or most of their profits.

Similarly, lots of smaller US companies depend on China for components that have no US alternatives. Rising costs, whether due to tariffs or anything else, hit their bottom lines, too.

A significant part of US growth last year came from a rise in US inventories. In a somewhat arcane accounting methodology, building inventories is what counts for GDP, not actual sales. Many businesses that depend on Chinese materials built inventory ahead of what was feared to be a significant tariff at the end of 2018. Those inventories are going to be sold in 2019 and often not replaced. A large part of the slowing economy in 2019 will simply be a reduction of inventories. The apparent robust growth of the last half of 2018 was essentially pulling production forward from 2019.

China has its own problems, too, namely enormous debt and increasingly strapped consumers. I’ll discuss those next week. The point to remember now is that economic weakness and falling markets in China are going to hurt the US, too. And they will weigh just as heavily on Europe and especially Germany. Which brings us to the next wicked thing that may be coming.

Tags: Daily Market Update,Featured,newsletter