Journal of Economic Dynamics and Control, July 2022, with Martin Gonzalez-Eiras. PDF (local copy). We investigate how politico-economic factors shaped government responses to the spread of COVID-19. Our simple framework uses epidemiological, economic and politico-economic arguments. Confronting the theory with US state level data we find strong evidence for partisanship even when we control for fundamentals including the electorate’s political views. Moreover, we detect an important role...

Read More »“The Political Economy of Early COVID-19 Interventions in US States,” CEPR, 2022

CEPR Discussion Paper 16906, January 2022, with Martin Gonzalez-Eiras. PDF (local copy). We investigate how politico-economic factors shaped government responses to the spread of COVID-19. Our simple framework uses epidemiological, economic and politico-economic arguments. Confronting the theory with US state level data we find strong evidence for partisanship even when we control for fundamentals including the electorate’s political views. Moreover, we detect an important role for the...

Read More »FX Daily, November 6: A Pause that Refreshens?

Swiss Franc The Euro has fallen by 0.03% to 1.0685 EUR/CHF and USD/CHF, November 6(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Investors have piled into risk assets this week, seemingly undeterred by the US elections’ lack of a clear outcome. The coronavirus is still surging, and a new complication has emerged. A mutation of the virus, originating in minks (Denmark), could pose a challenge in developing a...

Read More »Global Asset Allocation Update

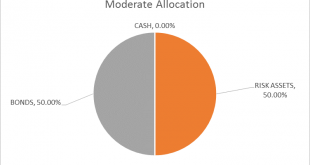

Note: This will be a short update. We are shifting the timing of some of our reports. The monthly Global Asset Allocation update will now be published in the first week of the month, aiming for the first of each month. I’ll put out a full report next week. The Bi-Weekly Economic Review is shifting to a monthly update, published on the 15th of each month. We are doing this to make room for some new reports, podcasts and...

Read More »Market Impact of a Trump Presidential Win

The probability of Republican Donald Trump winning the U.S. presidential election on November 8 seems remote at the moment—economists on Credit Suisse’s Global Markets team put it at less than 10 percent. So if it did happen, it would come as a major surprise for financial markets. The last time that kind of seemingly low-likelihood event came to pass—during last June’s Brexit vote—most investors were caught wrong-footed. So how might they best prepare for something as unexpected as President...

Read More »US Election: Status Quo vs. Who Knows?

What politicians say and what presidents do often have little to do with one another. U.S. President Franklin D. Roosevelt, for example, implemented the New Deal a year after the Democratic Party pledged to slash government spending. Still, with the U.S. presidential election fast approaching, the economists on Credit Suisse’s Global Markets team analyzed the campaign promises made to date in the hope of giving investors some sense of what the future might hold. They determined that if...

Read More »Yellow Lights are Flashing

Summary: Bonds are not rallying despite poor US data. Greater chance that Trump gets elected than the Fed hikes next week. Berlin may be more important than Bratislava. (Two week business trip is winding down, leaving London tomorrow and will be in Canada for the first couple days of next week, then back to NY. Sporadic posts to continue. Thanks for your patience) Yellow lights are flashing. Bonds remain...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org