Isn’t it obvious that repeating the policies of 2009 won’t be enough to save the system from a long-delayed reset? 2019 is shaping up to be the year in which all the policies that worked in the past will no longer work. As we all know, the Global Financial Meltdown / recession of 2008-09 was halted by the coordinated policies of the major central banks, which lowered interest rates to near-zero, bought trillions of dollars of bonds and iffy assets such as mortgage-backed securities, and issued unlimited lines of credit to insolvent banks, i.e. unlimited liquidity. Central governments which could do so went on a borrowing / spending binge to boost demand in their economies, and pursued other policies designed to bring

Topics:

Charles Hugh Smith considers the following as important: 5) Global Macro, Featured, newsletter, The United States

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

| As if this wasn’t enough to guarantee recession in 2019, there’s the unintended consequences of capital flows. Capital famously flows to where it’s treated best, meaning wherever it earns the highest yields at the lowest risk, and where the rule of law protects capital from predation or expropriation.

When all central banks pursued roughly the same policies, capital had options. Now that the Fed has broken away from the pack, capital has only one option: the U.S. The Federal Reserve should have begun normalizing rates etc. back in 2013, and if they’d been wise enough to do so then even baby steps over the past 5 years would have led to a fairly normalized financial environment. But Ben Bernanke and Janet Yellen blew it, so it’s been left to the current Fed leadership to do the heavy lifting over a much shorter timeline. Predictably, pulling away the punch bowl has spoiled the asset-bubble party, and now all the asset bubbles are increasingly at risk of deflating. But the yields and relative risk available in US-dollar denominated assets is starting to look a lot more attractive and lower risk than assets denominated in yen, yuan and euros. Capital flows tend to be self-reinforcing: as capital flows out of at-risk economies, it dampens investment, speculation and spending as the economy is drained of capital. Owners of assets notice this decay and so they decide to sell and move their capital to safer ground. Selling begets selling, and pretty soon nobody’s left to catch the falling knife, ie. buy assets that are rapidly losing value. The central bank “solution” to bidless markets is to become the buyer of last resort: when no sane investor will buy bonds, stocks or real estate, then the central bank starts buying everything in sight. |

Effective Federal Funds Rate 1960-2018 |

| We are already seeing this in action as Chinese governmental agencies have started quietly buying empty flats in ghost buildings to prop up the housing market. The idea here is to restore confidence with a relatively modest burst of quiet buying. But when markets turn and confidence is lost, sentiment can’t be restored so easily: sensing their last chance is at hand, sellers dump assets at a quickening pace, overwhelming the modest central bank buying.

This leaves the central bank with a stark and sobering choice: either let the asset bubble collapse and accept the immense destruction of “wealth,” or buy the whole darn market. This is the unintended consequence of employing unprecedented policies for a decade: like using antibiotics every day for years, eventually resistance develops and the “fix” no longer works. Now that central banks have inflated assets into the stratosphere, there’s $300 trillion in global financial assets sloshing around seeking higher yields and capital gains. How much of this $300 trillion can central banks buy before they destabilize currencies? How much can they buy before they run out of political goodwill? Isn’t it obvious that repeating the policies of 2009 won’t be enough to save the system from a long-delayed reset? |

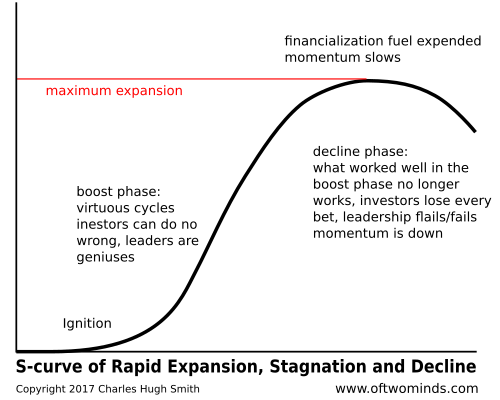

S-curve of Rapid Expansion, Stagnation and Decline |

Tags: Featured,newsletter