– Silver Futures Report, JP Morgan Record Silver Bullion Holding Is Extremely Bullish– JP Morgan Continues Adding To Massive Silver Bullion Holdings (see chart)– Silver Speculators Go Short – Which Is Extremely Bullish– Stunning Silver COT Report: One For the Ages (see chart) The silver futures Commitment of Traders (COT) report released last Friday was extremely positive and has most silver analysts calling for higher silver prices in the near term. The COT data signaled we are close to bottoming and suggest that both gold and silver should make gains in the coming weeks and months. The data showed that the hedge funds and “Managed Money traders,” the “dumb money” speculators now have record short positions in

Topics:

Jan Skoyles considers the following as important: Daily Market Update, Featured, GoldCore, newslettersent

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

– Silver Futures Report, JP Morgan Record Silver Bullion Holding Is Extremely Bullish

– JP Morgan Continues Adding To Massive Silver Bullion Holdings (see chart)

– Silver Speculators Go Short – Which Is Extremely Bullish

– Stunning Silver COT Report: One For the Ages (see chart)

| The silver futures Commitment of Traders (COT) report released last Friday was extremely positive and has most silver analysts calling for higher silver prices in the near term.

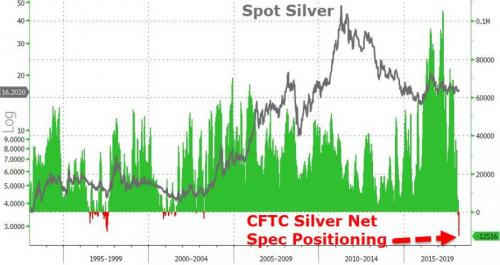

The COT data signaled we are close to bottoming and suggest that both gold and silver should make gains in the coming weeks and months. The data showed that the hedge funds and “Managed Money traders,” the “dumb money” speculators now have record short positions in silver. At the same time, the large commercials and including large bullion banks such as JP Morgan, the “smart money” and the “inside money” have reduced their shorts dramatically and are now long. The COT report shows ‘Managed money’ silver specs have their largest short position in at least 28 years and maybe ever. From a contrarian perspective this is very bullish. |

Silver Spot, 1995 - 2018 |

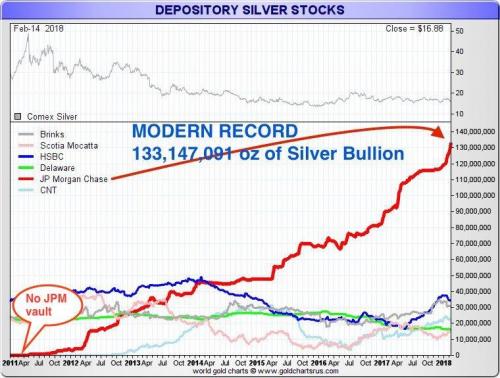

| Another less reported bullish factor is JP Morgan continuing to add to its massive silver bullion holdings. They rose to a new record high last week at 139.12 million troy ounces. Either JP Morgan themselves or their clients or both are acquiring physical silver bullion in a big way and are clearly bullish silver. |

Depository Silver Stocks, Apr 2011 - 2018 |

| The notes by Ed Steer and Jon Rubino about this are well worth a read and below are the key snippets:

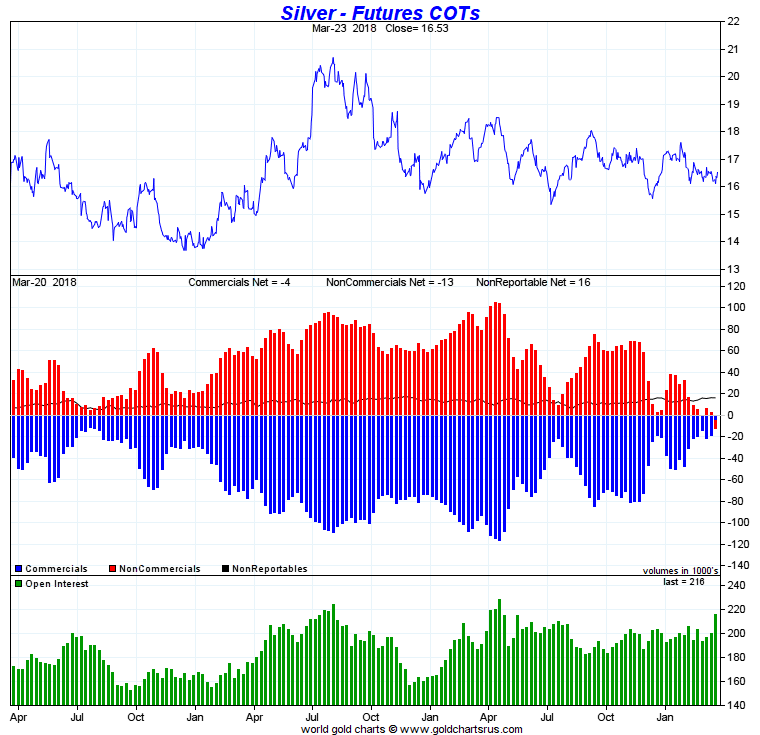

Ed Steer from EdSteerGoldSilver.com in Stunning Silver COT Report: One For the Ages put it this way The Commitment of Traders Report, for positions held at the close of COMEX trading on Tuesday was right on the money in gold as far as Ted estimates were concerned, but in silver the decline in the Commercial net short position exceeded even his most bullish expectations. Considering the very modest price decline in silver during the reporting week, I thought his “5,000 to 10,000 contract improvement” estimate to be wildly optimistic. How wrong I was! In silver, the Commercial net short position dropped by an eye-watering 15,564 contracts, or 77.8 million troy ounces of paper silver. Wow! |

Silver Futures COTs, Apr 2015 - Mar 2018 |

| Listen on SoundCloud , Blubrry & iTunes. Watch on YouTube above |

Jon Rubino from Dollar Collapse in Silver Speculators Go Short – Which Is Extremely Bullish put it this way:

Silver is a whole different story, with speculators going aggressively net short, something very seldom seen, and commercials almost in balance, which is also unusual. Looked at in a vacuum, this is hyper-bullish.

But of course the games futures traders play aren’t all that matters. Between trade wars, massive ongoing government deficits and spiking stock market volatility, the reasons for owning safe haven assets like gold and silver are both multiplying and gaining urgency.

Editors Note: Silver remains very undervalued in the short term and on a long term historical basis. It is also undervalued against gold as seen in the gold silver ratio at over 80:1.

Gold is beginning to receive some interest again from a small minority of retail investors but silver remains the preserve of relatively few contrarian investors. The media and financial press rarely, if ever, covers silver and almost never in a positive manner despite its strong fundamentals.

Yet silver is quite likely in the early stages of a new bull market that will rival or surpass that of the 1970s and thus merits an allocation in investment and pension portfolios.

Tags: Daily Market Update,Featured,newslettersent