Key Gold and Precious Metals News, Commentary and Charts This Week Gold and silver traded sideways this week as we saw stock markets take some heat and undo most of the recent recovery from the October sell off. Oil has sold off and is now at levels that we haven’t seen since 2017. While the US markets are quiet due to Thanksgiving all eyes are focused on Europe and the continuing debacle that is Brexit. With the expectation that a deal is going to be signed between the UK and the EU, this will mark the next step in the attempt for the UK to leave the world largest single market. Following the signing of the agreement, Theresa May next has the mammoth task of trying to get the British Parliament to agree to the deal.

Topics:

Mark O'Byrne considers the following as important: 7) Markets, Featured, newsletter, Weekly Market Update

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

| Key Gold and Precious Metals News, Commentary and Charts This Week

Gold and silver traded sideways this week as we saw stock markets take some heat and undo most of the recent recovery from the October sell off. Oil has sold off and is now at levels that we haven’t seen since 2017. While the US markets are quiet due to Thanksgiving all eyes are focused on Europe and the continuing debacle that is Brexit. With the expectation that a deal is going to be signed between the UK and the EU, this will mark the next step in the attempt for the UK to leave the world largest single market. Following the signing of the agreement, Theresa May next has the mammoth task of trying to get the British Parliament to agree to the deal. As it is highly unlikely that the House of Commons will co-operate, what next for Brexit? GoldCore CEO Stephen Flood discusses Brexit and its potential effect on globalisation in this week’s video. Given the continued uncertainty for the UK and the potential disastrous economic implications of the UK crashing out of the EU with no deal, cautious investors are starting to move their gold out of the UK. To facilitate this demand from clients, GoldCore has launched the first institutional-grade gold vault in Ireland. Irish, UK and international investors can for the first time store gold bullion bars and coins in professionally managed and secure, institutional grade vaults in Dublin. |

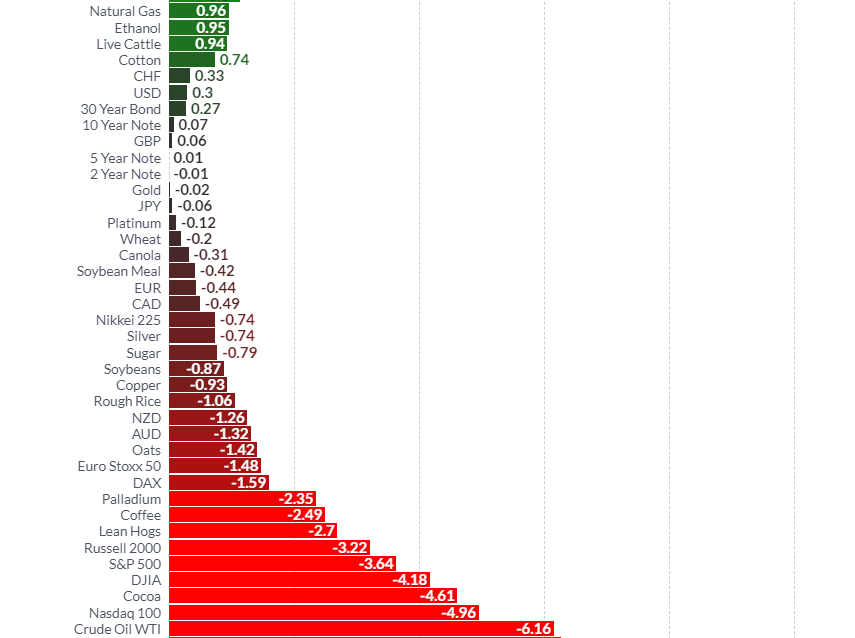

Relative Performance |

| This has been widely picked up in the media again this week with CNBC covering on Tuesday. You can check out the story here.

We also discussed the finer details and the thought process of our clients in a special episode of The Goldnomics Podcast which you can view here: |

Tags: Featured,newsletter,Weekly Market Update