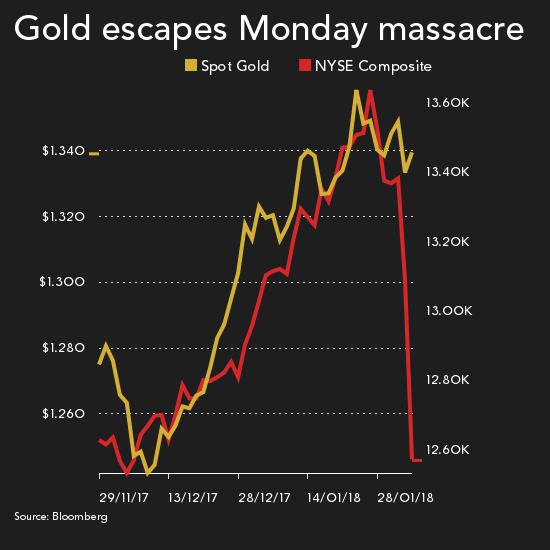

– Gold gains 0.6% in USD and surges 1.7% in euros and pounds – European stocks fall more than 3% at the open after sharp falls in Asia – DJIA falls 1,175 points, S&P 500 down 4.1% and Nikkei plummets 4.7%– Gold rises from ,330 to ,342, £942 to £960 and €1,067 to €1,085 /oz– Bitcoin crashes another 10% and has now plummeted by 70% to below ,000 – Increased risk aversion will drive safe haven demand for gold as its hedging properties are appreciated again Gold Spot and NYSE Composite, Nov 2017 - Jan 2018Source: Bloomberg via Mining.com - Click to enlarge Gold prices rose today in all major currencies as a rout in global equities prompted investors to seek shelter in safe haven gold. Spot gold prices were up

Topics:

Mark O'Byrne considers the following as important: Bitcoin, Daily Market Update, Featured, GoldCore, newslettersent

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

| – Gold gains 0.6% in USD and surges 1.7% in euros and pounds – European stocks fall more than 3% at the open after sharp falls in Asia – DJIA falls 1,175 points, S&P 500 down 4.1% and Nikkei plummets 4.7% – Gold rises from $1,330 to $1,342, £942 to £960 and €1,067 to €1,085 /oz – Bitcoin crashes another 10% and has now plummeted by 70% to below $6,000 – Increased risk aversion will drive safe haven demand for gold as its hedging properties are appreciated again |

Gold Spot and NYSE Composite, Nov 2017 - Jan 2018 |

| Gold prices rose today in all major currencies as a rout in global equities prompted investors to seek shelter in safe haven gold.

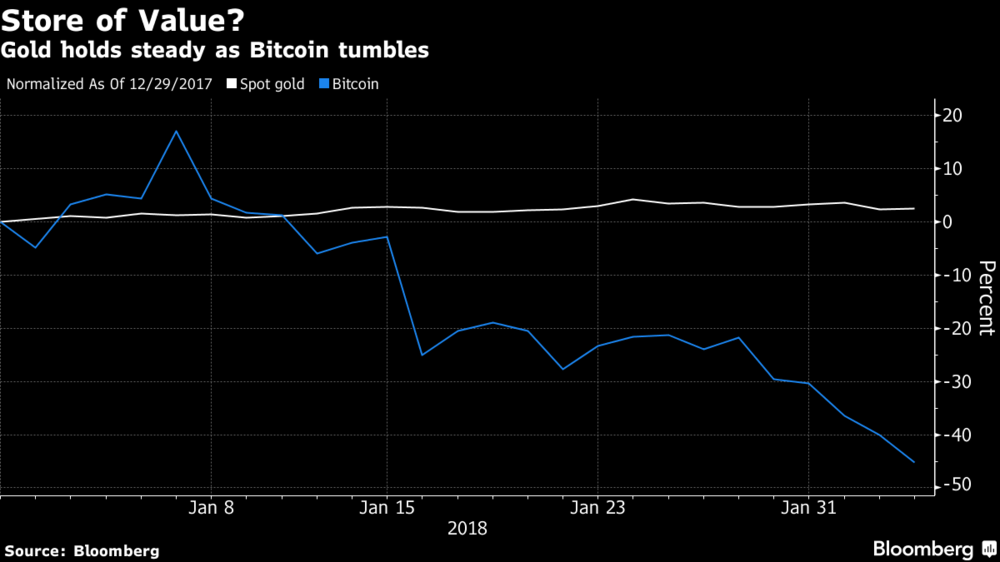

Spot gold prices were up 0.4 percent to $1,345.00 per ounce this morning in early European trading following Monday’s 0.6 percent gain in dollar terms. Gold saw larger gains in euros, sterling and other currencies as the dollar bounced back after a recent pronounced weakness. Bitcoin plummeted for a fifth day, dropping below $6,000 and leading other digital tokens lower. A backlash by banks and government regulators against cryptocurrencies is impacting already fragile sentiment due to recent sharp falls. Yesterday, bitcoin tumbled as much as 22 percent to $6,579. It has lost 70 percent of its value from a record high $19,511 in December. Other crypto currencies also fell sharply on Monday, with Ripple losing as much as 21 percent and Ethereum and Litecoin also weaker – down 16% and 13% respectively. |

Gold Spot and Bitcoin Price, Jan 2018(see more posts on Bitcoin, Gold, ) |

We believe gold prices may rise further as the global rout in stock markets should lead to a period of risk aversion and a new found appreciation for gold’s hedging and safe haven attributes.

However, as was seen during the ‘Lehman moment’ in 2008, gold could see short term weakness if stock markets continue to crash as speculators see margin calls and some liquidate all futures positions.

The fact that gold made good gains in all currencies yesterday, including the dollar, bodes well for gold and shows there is robust demand and the fundamentals of the gold market are sound. This is more than can be said than the fundamentals of the US economy and indeed of global stock and bond markets.

Tags: Bitcoin,Daily Market Update,Featured,newslettersent