Summary: The U.S. 2017 trade deficit was the largest since 2008. U.S. goods exports hit a record. There has been substantial improvement in the U.S. oil trade balance. The US trade deficit swelled in December, and the .1 bln shortfall was a bit larger than expected. It was the largest deficit since October 2008. For the 2017, the US recorded a trade deficit of goods and services of 6 bln, the largest since 2008. The deterioration of the trade balance may be worse than it appears. There has been significant improvement in the oil trade balance. In 2017, the real petroleum balance was just shy of bln, the smallest in 14 years. The non-oil goods deficit of almost 0.7 bln was a new record. U.S.

Topics:

Marc Chandler considers the following as important: Featured, FX Trends, newslettersent, trade, U.S. Trade Balance, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Summary:

The U.S. 2017 trade deficit was the largest since 2008.

U.S. goods exports hit a record.

There has been substantial improvement in the U.S. oil trade balance.

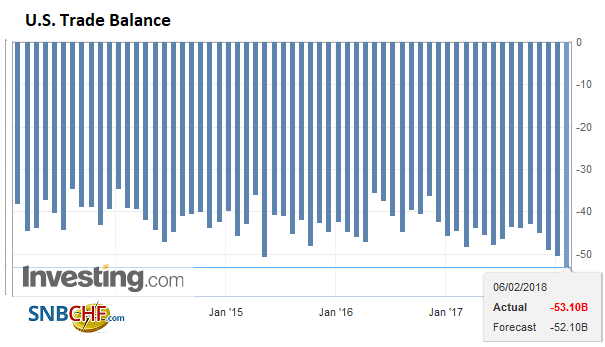

| The US trade deficit swelled in December, and the $53.1 bln shortfall was a bit larger than expected. It was the largest deficit since October 2008. For the 2017, the US recorded a trade deficit of goods and services of $566 bln, the largest since 2008.

The deterioration of the trade balance may be worse than it appears. There has been significant improvement in the oil trade balance. In 2017, the real petroleum balance was just shy of $96 bln, the smallest in 14 years. The non-oil goods deficit of almost $740.7 bln was a new record. |

U.S. Trade Balance, Dec 2017(see more posts on U.S. Trade Balance, ) Source: Investing.com - Click to enlarge |

Exports rose 1.8% in December to $203.35 bln. This is a record. There was a record shipment of capital goods, and increases in industrial supplies and materials. Exports rose 7.3% in 2017. Imports rose 2.5% in December to a record $256.5 bln. Imports rose 9.5% in 2017. There were record purchases of foreign produced consumer goods and capital goods.

Trade is a central issue for the Trump Administration. It argues that the chronic trade deficit is a function of bad trade deals and other countries taking advantage of the US. Tariffs and quotas were recently levied on solar panels and washing machines. Additional action may be pending on steel, aluminum and intellectual property rights.

The Trump Administration seems particularly sensitive to trade patterns with China and Mexico. The goods deficit with China widened 8.1% last year to a record $375.2 bln. The goods deficit with Mexico increased by 10% to $71.1 bln, the most in a decade. What the net figures conceal is that the US merchandise exports to both China and Mexico were records. Imports from Mexico and China were also records.

Net exports were estimated to have subtracted 1.1 percentage points from Q4 GDP, and the risk is that it was a slightly larger drag. When adjusted for inflation, the real goods deficit widened to $68.4 bln from $66.5 bln in November.

McKinsey Global Institute (MGI) published a report last year on manufacturing. The report noted that only 1% of US companies export, making a shallow base. Moreover, MGI argued that the US manufacturing sector has been starved for investment. Private sector investment in US manufacturing was estimated to be near 30-year lows. The average age of US factories is 25 years, while average age of equipment is around nine years.

MGI argued that it would cost $115 bln a year for a decade to fix the situation. The combination of tax cuts and liberalized depreciation rules are thought to help facilitate new private investment. However, companies did not lack for resources and the price and access to capital did not seem to be the main obstacle in the first place.

Tags: #USD,Featured,newslettersent,Trade,U.S. Trade Balance