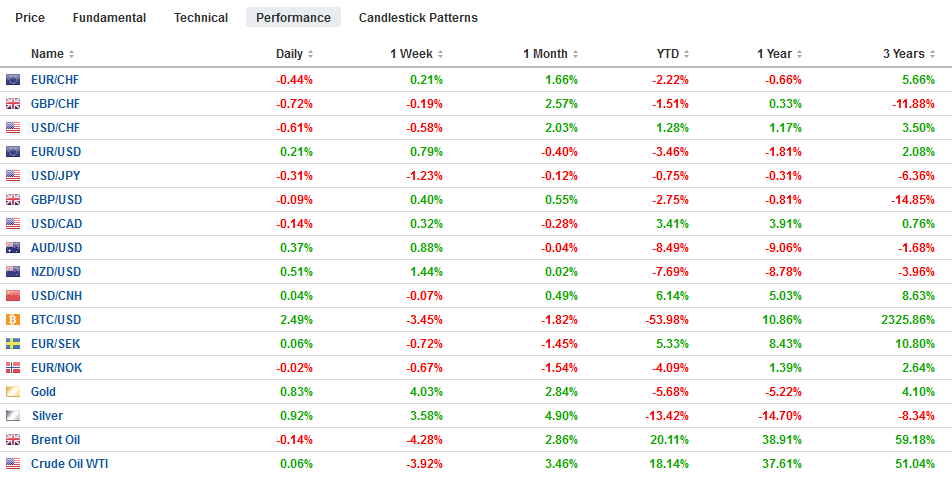

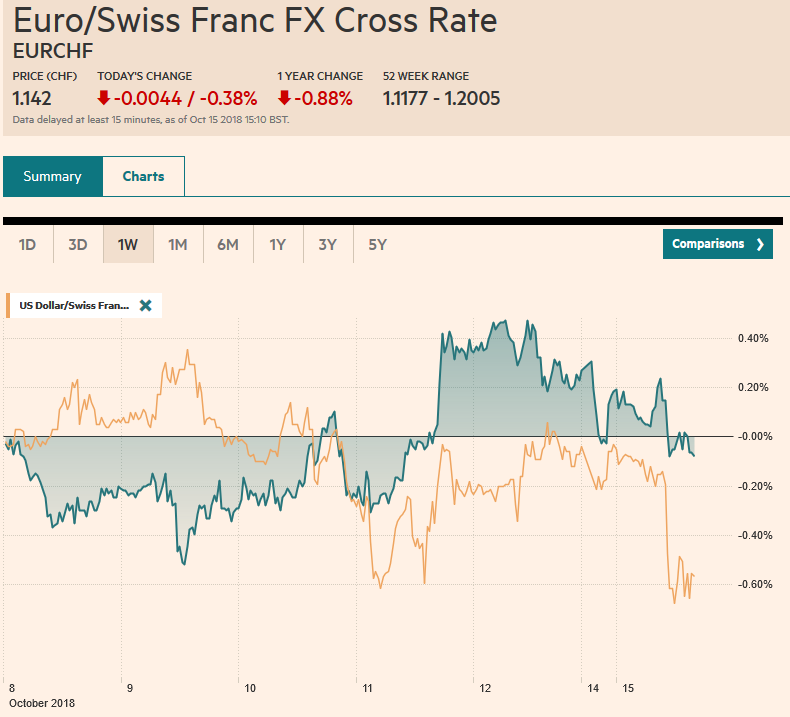

Swiss Franc The Euro has fallen by 0.38% at 1.142 EUR/CHF and USD/CHF, October 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Despite the pre-weekend gains that lifted the S&P 500 above its 200-day moving average, global equities are moving lower today. The main news over the weekend included the US renewing its threat to impose more tariffs on China and Saudi Arabia threatening retaliation for any sanctions relating to the disappearance of the journalist Khashoggi, and the lack of a breakthrough in UK-EU negotiations. Many large Asia equity markets (Japan, China, Hong Kong) were off around 1.5%. The Nikkei and Topix extended last week’s lows, but the

Topics:

Marc Chandler considers the following as important: 4) FX Trends, Brexit, EUR, EUR/CHF and USD/CHF, Featured, GBP, JPY, newsletter, Oil, SEK, SPX, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.38% at 1.142 |

EUR/CHF and USD/CHF, October 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Despite the pre-weekend gains that lifted the S&P 500 above its 200-day moving average, global equities are moving lower today. The main news over the weekend included the US renewing its threat to impose more tariffs on China and Saudi Arabia threatening retaliation for any sanctions relating to the disappearance of the journalist Khashoggi, and the lack of a breakthrough in UK-EU negotiations. Many large Asia equity markets (Japan, China, Hong Kong) were off around 1.5%. The Nikkei and Topix extended last week’s lows, but the Shanghai Composite and Hong Kong’s Hang Seng did not. European bourses are on the downside, with the Dow Jones Stoxx 600 off about 0.5% near midday on the Continent. It is extending the losing streak to a fourth session, and seven of the past eight, and is at its lowest level since late 2016. The equity weakness is giving the bonds a bit, and benchmark 10-year yields are off one-to-three basis points. Italians bonds are outperforming a little, and Portugal, which Moody’s upgraded ahead of the weekend, in a catchup move, is also doing better than most today. The dollar is mostly softer. The Swedish krona and sterling are exceptions. Political uncertainty in Sweden and Brexit concerns are the main weights, it appears. Brexit: Talks broke up over the weekend. The Irish border remains the pivotal issue, and the UK cannot agree to an open-ended transition period. A key meeting among EU government’s today to ostensibly prepare for the summit on Wednesday has been canceled. The summit that might have been called to finalize Brexit may now become a summit to prepare for a UK exit without an agreement. The UK cabinet meets tomorrow. May’s Chequers Plan has vocal critics in the cabinet and within the Tory Party, and, as the weekend developments illustrate, there is no agreement with the EU. We have suggested that May is in a trilemma and is unable to simultaneously appease, the EU, her cabinet, and Parliament. In her attempt to triangulate, May has succeeded in satisfying no one. Sterling came under downside pressure after posting an outside down day ahead of the weekend. It saw a high before the weekend of near $1.3260 and reached almost $1.3080 in early Asia. It has climbed back to test the $1.3050 area. There is a nearly GBP330 mln option struck at $1.3040 that expires today. The euro has bounced from a four-month low last week near GBP0.8720 to resurface above GBP0.8800 today, where there is an option for 1.6 bln euros that also will be cut today. |

FX Performance, October 15 |

Bavaria: The pre-election polls proved fairly accurate as the CSU lost its majority and drew less than 40% of the vote for the first time since 1954. The Social Democrats into oblivion, losing half their voters to poll less than 10%, below both the Greens, who is emerging as a centrist force, and the Afd, who saw no surge even though it managed to secure parliamentary representation for the first time. It is now in 15 of the 15 states parliaments. There could be national ramifications if the leadership challenge within the CSU leads to a break with Merkel’s CDU. Hesse holds state elections on October 28. The CDU and Greens are in a coalition there, and that is likely to continue and provides a precedent for a CSU-Green coalition in Bavaria. Separately, the Greens also did well in local elections in Belgium.

Euro: The euro opened lower in Asia (~$1.1535) and had steadily recovered to $1.1590 in late morning turnover in Europe. Last week’s high was set near $1.1610, and above there resistance is seen near $1.1630, which corresponds to the 100-day moving average and the 50% retracement of the leg down from late-September’ s high above $1.1800. There is a $1.16 option for roughly 940 mln euros that expires today.

Sweden: The four-party alliance has failed to cobble together a center-right government. The task returns to the Social Democrats and the incumbent Prime Minister Lofven. Mathematically, to reach a majority government either some cross-party alliance is needed or a deal must include the nationalist Swedish Democrats, which both the Social Democrats and Alliance disdain. The Riksbank meets on October 23-24. It has signaled its intention to raise rates in December or next February.

Oil: After falling more than 4% last week, oil prices are firmer today. The Saudi threat to respond vigorously to any threat against it over the disappearance of the journalist Khashoggi is given the market pause. The US appears to have ruled out cutting arm sales to Saudi Arabia but has not ruled out other actions depending on the outcome of the investigation. The rise of the Crown Prince Mohammed bin Salman has seen a more assertive Saudi government (Yemen, Qatar, kidnapping the Lebanese Prime Minister, house arrest of many royal family members, quick to anger at Canada’s criticism of its human rights). WTI for November delivery faces resistance $73-$74 area.

Yen: Softer yields and heavier stocks are underpinning the yen. The dollar has been pushed through the JPY111.85 area that provided support in the second half of last week. It fell to one-month lows near JPY111.65 in the European morning, which roughly corresponds to a retracement objective of the dollar’s rally from the late August low below JPY110. There is a $430 mln option at JPY111.55, expiring today, that may slow the greenback’s descent.

North America: The performance of the S&P 500 is key today. It is set to open lower, but if last week’s low holds (~2710) and if it closes above the 200-day moving average (~2766), positive sentiment can rebuild. The US data include an early look at October from the Empire State Fed survey and September retail sales. The strong labor market is underpinning consumption. Canada reports existing home sales and the central bank’s senior loan officer survey results will be published. Investors remain confident that overnight rate will be hiked at the next policy meeting on October 24.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$EUR,$JPY,Brexit,EUR/CHF and USD/CHF,Featured,newsletter,OIL,SEK,SPX