Summary Pakistani Prime Minister Nawaz Sharif may face trial on corruption charges. Turkey will reportedly pay .5 bln for a Russian missile defense system. Nigeria said it was willing to cap its oil production to support OPEC efforts to cut global supply. Former Brazilian President Lula was sentenced to nine and half years in prison on corruption charges. S&P downgraded Chile one notch to A+ with a stable outlook. A consortium of three private companies discovered 1.4-2.0 bln barrels of new oil in Mexico. S&P downgraded Venezuela by a notch to CCC- and kept the negative outlook. Stock Markets In the EM equity space as measured by MSCI, Brazil (+8.5%), Qatar (+6.6%), and Egypt (+5.8%) have outperformed this week,

Topics:

Win Thin considers the following as important: emerging markets, Featured, newslettersent

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Summary

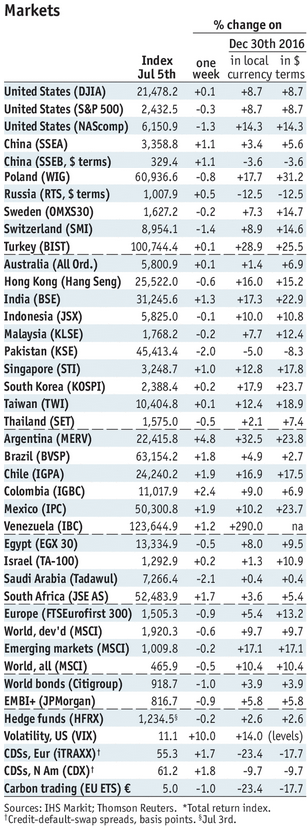

Stock MarketsIn the EM equity space as measured by MSCI, Brazil (+8.5%), Qatar (+6.6%), and Egypt (+5.8%) have outperformed this week, while the Philippines (-0.2%), Malaysia (-0.1%), and Indonesia (flat) have underperformed. To put this in better context, MSCI EM rose 4.4% this week while MSCI DM rose 1.6%. In the EM local currency bond space, Brazil (10-year yield -21 bp), South Africa (-19 bp), and Indonesia (-18 bp) have outperformed this week, while Mexico (10-year yield flat), India (-1 bp), and Malaysia (-1 bp) have underperformed. To put this in better context, the 10-year UST yield fell 7 bp to 2.31%. In the EM FX space, MXN (+2.9% vs. USD), BRL (+2.9% vs. USD), and ZAR (up 2.7% vs. USD) have outperformed this week, while EGP (-0.5% vs. USD), ILS (-0.4% vs. USD), and PHP (+0.1% vs. USD) have underperformed. |

Stock Markets Emerging Markets, July 05 Source: economist.com - Click to enlarge |

PakistanPakistani Prime Minister Nawaz Sharif may face trial on corruption charges. The investigation began after leaked documents showed that his family had offshore accounts in Panama, and the inquiry found that Sharif was unable to account for the disparity between his wealth and his known income. The Supreme Court will review the findings and convene a hearing on July 17. TurkeyTurkey will reportedly pay $2.5 bln for a Russian missile defense system. The move is certainly controversial given Turkey’s NATO membership. The agreement has Turkey receiving two S-400 missile batteries from Russia within the next year, followed by two more that will be produced within Turkey. NigeriaNigeria said it was willing to cap its oil production to support OPEC efforts to cut global supply. Oil Minister Emmanuel Kachikwu said that the output limit would come into effect when Nigeria can pump 1.8 mln barrels a day, which is about 100,000 barrels more than current production. Nigeria and Libya were exempted from the OPEC-led output cuts last year. BrazilFormer Brazilian President Lula was sentenced to nine and half years in prison on corruption charges. He has vowed to appeal, but the news came as a relief for investors fearful of a political comeback for Lula. Most polls show him as the leading candidate for the 2018 presidential election. S&P downgraded Chile one notch to A+ with a stable outlook. The agency said a prolonged period of slow growth is likely to hurt the fiscal outlook and debt burden. Our own sovereign rating model has Chile’s implied rating at A-/A3/A- and so actual ratings of A+/Aa3/A+ are still facing downgrade risks. MexicoA consortium of three private companies discovered 1.4-2.0 bln barrels of new oil in Mexico. This was the first discovery for Mexico by any company other than state-owned Pemex in 80 years, and comes two years after these companies won the exploration license. Under the profit-sharing agreement, the government will receive 69% of every barrel produced from these fields. S&P downgraded Venezuela by a notch to CCC- and kept the negative outlook. The agency cited continued deterioration in economic conditions, rising political tensions, and a worsening of the government’s liquidity position. S&P added that Venezuela will likely have difficulty paying debt service in H2 2017 and 2018 in the absence of significant new external funding. Our own model already has Venezuela at default levels. |

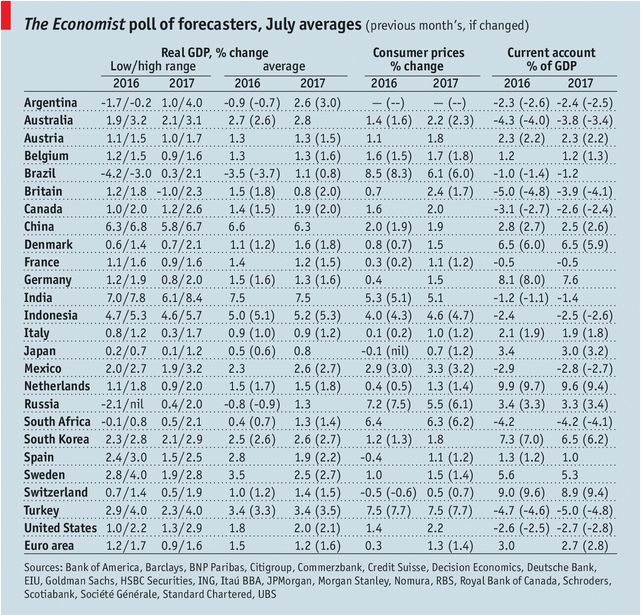

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, July 2017 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newslettersent