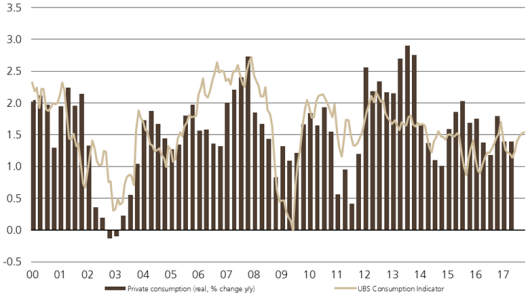

The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy. The UBS consumption indicator was quoted at 1.54 points in October, suggesting that private consumption is growing at a solid pace in the fourth quarter. A weaker Swiss franc and a drop in unemployment provide support for it, but rising inflation and the accompanying stagnation of real wages are likely to cap any growth in it. Zurich, 29 November 2017 – The UBS consumption indicator inched up to 1.54 points in October from a corrected September figure of 1.51. New registrations for passenger cars and

Topics:

UBS Switzerland AG considers the following as important: Featured, newsletter, Swiss Macro, Switzerland Private Consumption, Switzerland UBS Consumption Indicator, U.S. Consumer Spending

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy.

The UBS consumption indicator was quoted at 1.54 points in October, suggesting that private consumption is growing at a solid pace in the fourth quarter. A weaker Swiss franc and a drop in unemployment provide support for it, but rising inflation and the accompanying stagnation of real wages are likely to cap any growth in it.

Zurich, 29 November 2017 – The UBS consumption indicator inched up to 1.54 points in October from a corrected September figure of 1.51. New registrations for passenger cars and domestic tourism shored up the indicator. By contrast, the index of consumer confidence measured by the State Secretariat for Economic Affairs stagnated. In October it was -2 points, virtually unchanged from the previous quarter’s -3. Although consumers assess the labor market more positively, expectations with regard to the general economic situation have become slightly gloomier.

Private consumption vs. UBS Consumption IndicatorUBS projects growth in private consumption at 1.3% both for this year and for next, marginally below its long-term average. The weaker Swiss franc is benefiting Swiss retailers indirectly by making shopping outside the country more expensive for consumers. The economy is also likely to be buoyed in the coming year due by Europe’s strong economic showing. This could lower unemployment and further underpin consumption. But the recently published UBS Compensation Survey indicates stagnating real wages for this year and next, which should prevent a greater upturn in consumption. |

Switzerland Private Consumption and UBS Consumption Indicator, October 2017(see more posts on Switzerland Private Consumption, Switzerland UBS Consumption Indicator, ) Source: ubs.com - Click to enlarge |

How the UBS Consumption Indicator is calculated

The UBS Consumption Indicator signals private consumption trends in Switzerland with a lead time of one to three months on the official figures. At more than 50%, private consumption is by far the most important component of Swiss GDP. UBS calculates this leading indicator from six consumer-related parameters: new car registrations, business activity in the retail sector, the number of domestic overnight hotel stays by Swiss residents, the consumer sentiment index, employment figures and credit card transactions made via UBS at points of sale in Switzerland. With the exception of the consumer sentiment index and employment figures, all of this data is available monthly.

Tags: Featured,newsletter,Switzerland Private Consumption,Switzerland UBS Consumption Indicator,U.S. Consumer Spending