Black Friday was once the king of all shopping. A retailer could make its year up on that one day, often by gimmicking its way to insane single-day volume. Those days, however, are certainly over. Though the day after Thanksgiving still means a great deal, as the annual flood of viral consumer brawl videos demonstrate, it’s just not what it once was. The change has meant something in terms of economic commentary, too. Over the last several years, really going back to 2014, the internet has been given more of the central stage. Even the National Retailer Federation (NRF), the retail industry trade group tasked with promoting the retail industry as best as it can, has altered the way it will report Black Friday

Topics:

Jeffrey P. Snider considers the following as important: Black Friday, christmas shopping season, consumer spending, currencies, economy, Featured, Federal Reserve/Monetary Policy, Markets, newsletter, Retail sales, The United States, U.S. Retail Sales

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Black Friday was once the king of all shopping. A retailer could make its year up on that one day, often by gimmicking its way to insane single-day volume. Those days, however, are certainly over. Though the day after Thanksgiving still means a great deal, as the annual flood of viral consumer brawl videos demonstrate, it’s just not what it once was.

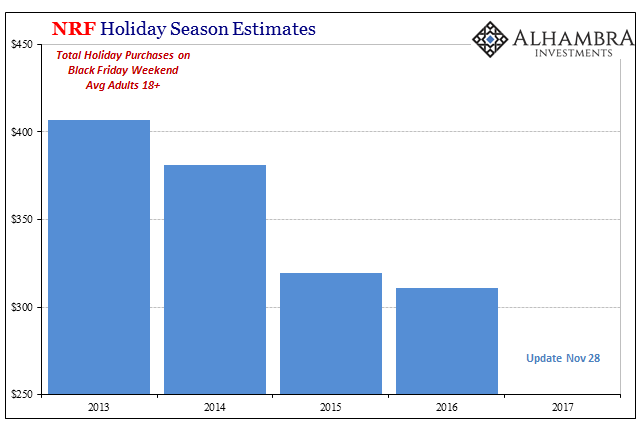

The change has meant something in terms of economic commentary, too. Over the last several years, really going back to 2014, the internet has been given more of the central stage. Even the National Retailer Federation (NRF), the retail industry trade group tasked with promoting the retail industry as best as it can, has altered the way it will report Black Friday estimates for 2017. It used to be that the closely watched NRF numbers would hit early on the Monday following all the hoopla. That particular day is now known as Cyber Monday, another big shopping day in the virtual retailer world. Stores and sellers aren’t as big on reporting only their traditional estimates because they have fallen off remarkably without this new addition to the commercial festivities. |

NRF Holiday Season Estimates, 2013 - 2017 |

From the NRF:

The focus on Black Friday wasn’t really what it seemed to be anyway. What’s truly important in the retail calendar is more than just the one day or weekend (extended). Analysts would often use Black Friday as a measuring stick for anticipating the Christmas shopping season as a whole. If consumers were highly engaged just after Thanksgiving, it was widely believed, the remaining weeks were as likely quite promising. The rise of internet shopping has complicated at least that formerly direct correlation. In recent years, spending at the margins has evened out with more sales and offers being held in December than strictly the end of November. Only part of that transformation, though, is really about changing consumer preferences. There remains a huge (largely unappreciated) macro story underneath. |

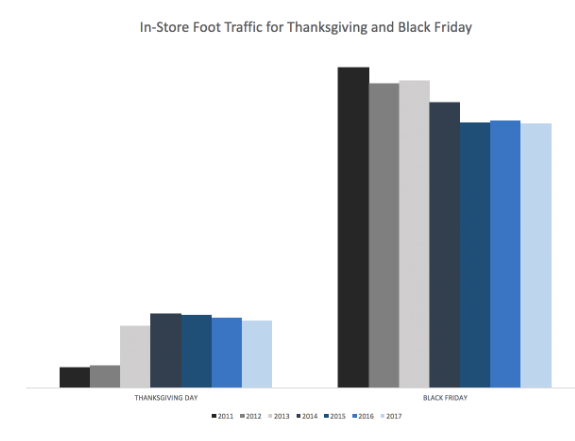

In-Store Foot Traffic for Thanksgiving and Black Friday, 2011 - 2017 |

While ShopperTrak reports that foot traffic was flat to down slightly for Black Friday 2017, that’s come to be expected. That’s why the focus is increasingly shifted to virtual outlets.

Unless holiday shopping actually contracts like it did in 2008, every year is a record high level. That doesn’t say anything apart from spin. We’ll know more tomorrow about this past weekend, and the inclusion of Cyber Monday within it, but until then there isn’t any indication whatsoever anything has changed about this economy – and consumers’ place in it. |

NRF Holiday Season Estimates, 2002 - 2017 |

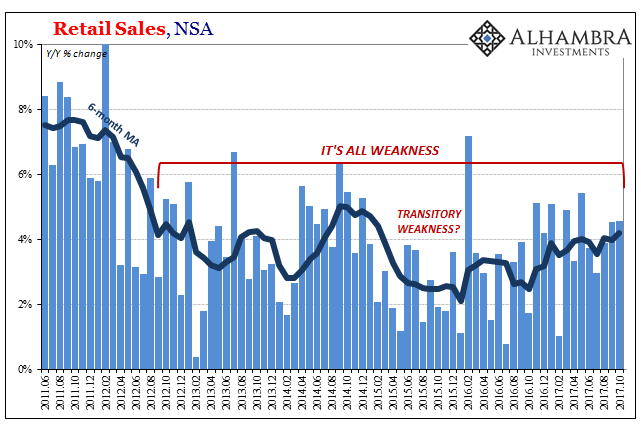

| The NRF expects that total Christmas retailing will gain 3.6% to 4.0% in 2017. That’s right in the same range as the continuing lackluster economy of the 2012 slowdown. And it’s far short of what used to count for consistent economic gains.

In 2005, for example, retail sales combined for November and December were 6.2% more than the same two months combined in 2004. Not only that, the economy added 684k temporary workers to deal with the seasonal burst of activity. The unemployment rate starting that year was 5.3%, ending at 4.9% (full employment). This year the NRF estimates that employers will add just 550k temporary workers. The trend has been clearly lower since 2013. The trade group tries to blame this on, ironically, the unemployment rate, claiming that it’s low calculation means, “With retail employment already up recently, retailers are seeing less of a need to hire seasonal workers for the holidays this year.” Yet, in October 2006, a month when the unemployment rate was 4.4% and thus comparable to today on that statistical basis, 688k holiday workers were brought on for the Christmas season. It seems instead as if retailers have become wise to the actual economic conditions of the season, which includes the relaxations of Black Friday and more.

That last one may be the most important, the part that leads to so much confusion about this (global) economy. It has become known as “residual seasonality” when in fact it’s really nothing more than consumer desperation/exhaustion. In other words, Americans shop as much as they can during the Christmas season, and still it gets to no more than lackluster growth at best, but to the point that unlike in prior years they have to then pause for several months afterward (when the credit card bills start rolling in). |

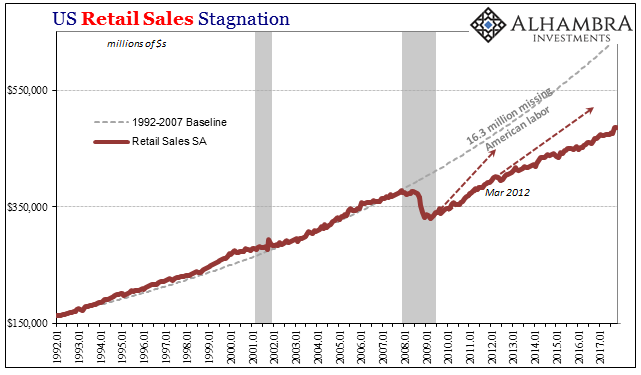

US Retail Sales, Jan 1992 - 2017(see more posts on U.S. Retail Sales, ) |

| It has left retailers with weak January’s (and beyond) sitting with inventory and prospective liquidation. It is so pronounced especially in second and third order effects that to mainstream economists (who have clung to “residual seasonality” defensively) it appears as if the economic statistics for each Q1 just have to be wrong (or, in the words of one prominent TV Economist, picturing another economy altogether).

The shifting consumer preferences surrounding Black Friday as well as the “residual seasonality” that follows from them are all re-normalizing economic and business patterns (reduced hiring and inventory) to this: |

US Retail Sales, Jun 2011 - Oct 2017(see more posts on U.S. Retail Sales, ) |

Economists talk (incessantly) about full employment and what that supposedly means, or should, but the economy itself has been seeing it much differently. It has taken several years of learning the hard way, but retailers are, it seems, finally zeroing in on the real baseline. Whatever spending happened this past weekend, it will be a record high for whatever category. What it won’t be is robust, though the word will surely find its way into heavy usage anyway.

Tags: Black Friday,christmas shopping season,consumer spending,currencies,economy,Featured,Federal Reserve/Monetary Policy,Markets,newsletter,Retail sales,U.S. Retail Sales