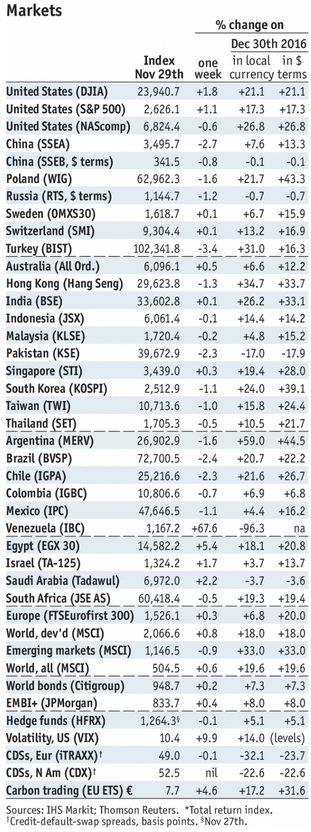

Stock Markets EM FX ended the week on a mixed note. US jobs data may refocus market attention on Fed tightening. Most EM inflation readings this week are expected to show easing price pressures, supporting a dovish EM central bank outlook. The major exceptions are Mexico and Turkey, whose central banks may be forced to tighten policy in the coming weeks. Stock Markets Emerging Markets, November 29 Source: economist.com - Click to enlarge Indonesia Indonesia reports November CPI Monday, which is expected to rise 3.4% y/y vs. 3.6% in October. If so, it would still be below the 4% target and in the bottom half of the 3-5% target range. Next policy meeting is December 14, no change is expected. Turkey Turkey

Topics:

Win Thin considers the following as important: emerging markets, Featured, newsletter, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Stock MarketsEM FX ended the week on a mixed note. US jobs data may refocus market attention on Fed tightening. Most EM inflation readings this week are expected to show easing price pressures, supporting a dovish EM central bank outlook. The major exceptions are Mexico and Turkey, whose central banks may be forced to tighten policy in the coming weeks. |

Stock Markets Emerging Markets, November 29 Source: economist.com - Click to enlarge |

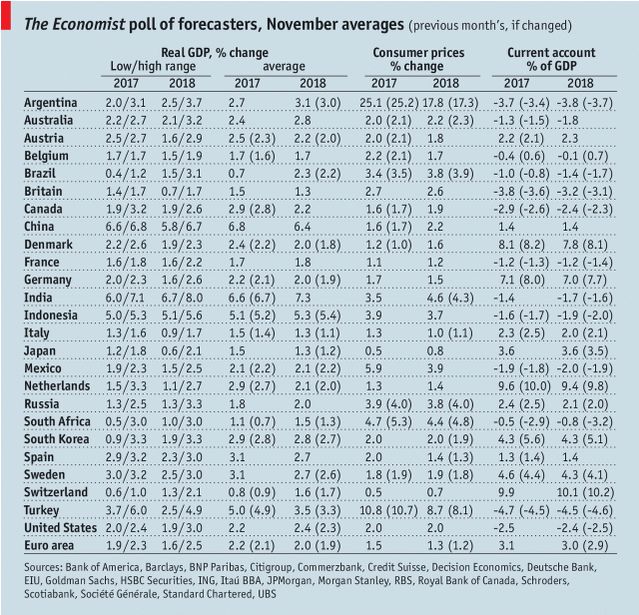

IndonesiaIndonesia reports November CPI Monday, which is expected to rise 3.4% y/y vs. 3.6% in October. If so, it would still be below the 4% target and in the bottom half of the 3-5% target range. Next policy meeting is December 14, no change is expected. TurkeyTurkey reports November CPI Monday, which is expected to rise 12.5% y/y vs. 11.9% in October. If so, it would still be above the 5% target as well as the 3-7% target range. If the lira comes under significant pressure again, we think the central bank will be forced to hike rates outright. Next policy meeting is December 14, no change is expected. October IP will be reported Friday, and is expected to rise 5.3% y/y vs. 10.4% in September. KoreaKorea reports October current account data Tuesday. The trade surplus narrowed that month, and so we expect the current account surplus to follow suit. Still, the overall external accounts remain strong and thus won-supportive. PhilippinesPhilippines reports November CPI Tuesday, which is expected to rise 3.2% y/y vs. 3.5% in October. If so, it would still be above the 3% target and in the top half of the 2-4% target range. Next policy meeting is December 14, no change is expected if disinflation continues. HungaryHungary reports October retail sales Tuesday, which are expected to remain steady at 6.2% y/y. It then reports October IP Wednesday, which is expected to rise 6.7% y/y WDA vs. 8.1% in September. Central bank minutes will also be released Wednesday. October trade and November CPI will be reported Friday, with inflation expected to rise 2.6% y/y vs. 2.2% in October. If so, it would still be below the 3% target and 2-4% target range. Next policy meeting is December 19 and further easing is possible via unconventional measures. TaiwanTaiwan reports November CPI Tuesday, which is expected to fall -0.2% y/y vs. -0.3% in October. The central bank does not have an explicit inflation target. However, lack of price pressures would allow it to ease again if the recovery were to falter. November trade will be reported Friday, with exports expected to rise 9.8% y/y and imports by 5.7% y/y. South AfricaSouth Africa reports Q3 GDP Tuesday, which is expected to grow 0.7% y/y vs. 1.1% in Q2. October manufacturing output will be reported Thursday, which is expected to rise 1.5% y/y vs. -1.6% in September. The economy remains sluggish, but the SARB cannot cut rates due to likely pressure on the rand. BrazilBrazil reports October IP Tuesday, which is expected to rise 5.2% y/y vs. 2.6% in September. COPOM meets Wednesday and is expected to cut rates 50 bp to 7.0%. November IPCA inflation will be reported Friday, and is expected to rise 2.88% y/y vs. 2.70% in October. If so, it would still be below the 4.5% target and in the bottom half of the 2.5-6.5% target range. However, inflation is rising and most believe this will be the end of the easing cycle. PolandNational Bank of Poland meets Tuesday and is expected to keep rates steady at 1.5%. CPI came in high at 2.5% y/y in November vs. 2.3% expected. This is the highest since November 2012 and is right at the target. Wage pressures are building as the labor market tightens, and so we believe that the NBP will be forced to hike in H1 2018. ColombiaColombia reports November CPI Tuesday, which is expected to remain steady at 4.1% y/y. If so, it would still be above the 3% target and above the 2-4% target range. Central bank minutes will be releasedThursday. At the November meeting, the bank delivered the second dovish surprise in a row and cut rates 25 bp to 4.75%. Next meeting is December 14 and another 25 bp cut to 4.5% is likely. MalaysiaMalaysia reports October trade Wednesday. The economy remains robust, while price pressures are starting to ease. CPI rose a lower than expected 3.7% y/y in October. While the central bank does not have an explicit inflation target, falling inflation should allow it to stay on hold for the time being. Next policy meeting is January 25, no change is expected. Czech RepublicCzech Republic reports October retail sales Wednesday, which are expected to rise 7.7% y/y vs. 3.6% in September. October industrial and construction output and trade will be reported Thursday. Next policy meeting is December 21, no change is expected. IndiaReserve Bank of India meets Wednesday and is expected to keep rates steady at 6.0%. However, a small handful of analysts look for a 25 bp cut. The economy picked up in Q3, while inflation is picking up as the RBI warned. As such, we see no more rate cuts ahead. ChileChile reports November CPI and trade Thursday. Inflation is expected to remain steady at 1.9% y/y. If so, it would still be below the 3% target as well as the 2-4% target range. Next policy meeting is December 14, no change is expected. MexicoMexico reports November CPI Thursday, which is expected to rise 6.61% y/y vs. 6.37% in October. If so, it would move further above the 3% target as well as the 2-4% target range. Next policy meeting is December 14 and markets are starting to price in risk of a 25 bp hike to 7.25%. ChinaChina reports November foreign reserves Thursday, which are expected to rise for the seventh straight month to $3.122 trln. November trade will be reported Friday. November CPI and PPI will be reported Saturday in Asia, with the former expected to rise 1.8% y/y and the latter by 5.8% y/y. |

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, November 2017 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newsletter,win-thin