Summary:

– Young Guns of Gold Podcast – ‘The Everything Bubble’– Precious Metal Roundtable discuss gold in 2017 and outlook– Gold +9.1% year to date; Performing well given Fed raising rates, lack of volatility and surge in stock markets – “People are expecting too much from gold”– Economy: Inflation indicators, recession on the horizon, global debt issues– Global demand: ETF inflows, Russia central bank purchases, Germany investment figures and international coin demand bode well for gold – “First monetary inflation, then asset inflation, next is price inflation …” – Gold bull market resumed; silver should outperform gold - Click to enlarge Indicators point to inflation, a recession is on the horizon and the

Topics:

Jan Skoyles considers the following as important: Daily Market Update, Featured, GoldCore, newslettersent

This could be interesting, too:

– Young Guns of Gold Podcast – ‘The Everything Bubble’– Precious Metal Roundtable discuss gold in 2017 and outlook– Gold +9.1% year to date; Performing well given Fed raising rates, lack of volatility and surge in stock markets – “People are expecting too much from gold”– Economy: Inflation indicators, recession on the horizon, global debt issues– Global demand: ETF inflows, Russia central bank purchases, Germany investment figures and international coin demand bode well for gold – “First monetary inflation, then asset inflation, next is price inflation …” – Gold bull market resumed; silver should outperform gold - Click to enlarge Indicators point to inflation, a recession is on the horizon and the

Topics:

Jan Skoyles considers the following as important: Daily Market Update, Featured, GoldCore, newslettersent

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

| – Young Guns of Gold Podcast – ‘The Everything Bubble’ – Precious Metal Roundtable discuss gold in 2017 and outlook – Gold +9.1% year to date; Performing well given Fed raising rates, lack of volatility and surge in stock markets – “People are expecting too much from gold” – Economy: Inflation indicators, recession on the horizon, global debt issues – Global demand: ETF inflows, Russia central bank purchases, Germany investment figures and international coin demand bode well for gold – “First monetary inflation, then asset inflation, next is price inflation …” – Gold bull market resumed; silver should outperform gold |

|

| Indicators point to inflation, a recession is on the horizon and the ‘Everything Bubble’ is the great threat to financial stability – these are the conclusions of the Young Guns of Gold who hosted a Precious Metal Roundtable, this week.

Jan Skoyles from GoldCore and Jordan Eliseo of Australia’s ABC Bullion were hosted by Ronald Stoeferle of Incrementum in a reboot of their Young Guns of Gold podcast. The Young Guns of Gold discussion was broken into three parts:

|

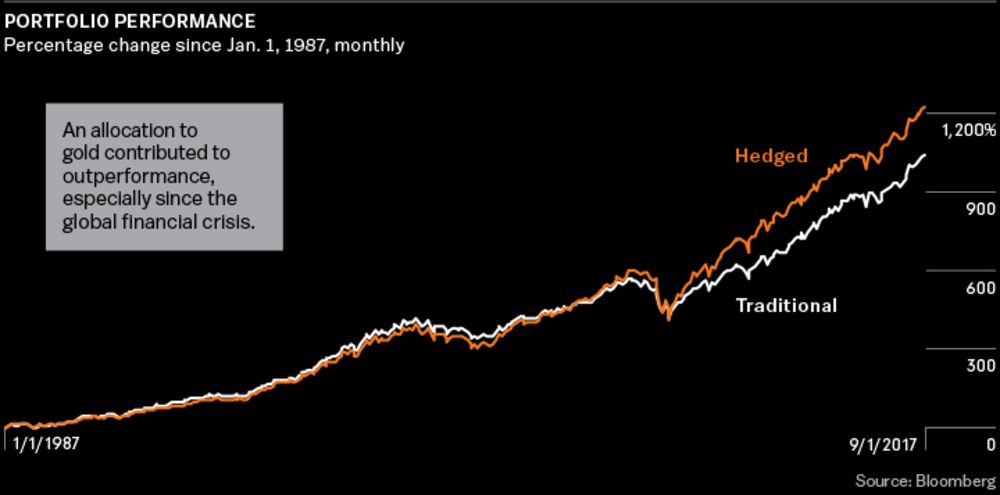

Portfolio performance, Jan 1987 - Sep 2017 |

Executive Summary

- High expectations of Trump’s reflationary growth policy dampened the gold price increase in 2016. However, Gold was still up 8.5% in 2016 and is up 10.6% since Jan. 2017.

- The further development of the normalization of monetary policy in the US is the litmus test for the US economy and it is decisive for how the gold price will develop.

- If the normalization of monetary policy does not succeed – which we expect so – gold will pick up momentum.

- Based on the premise that the bull market in gold has resumed, we expect the gold-silver ratio to decline.

Tags: Daily Market Update,Featured,newslettersent