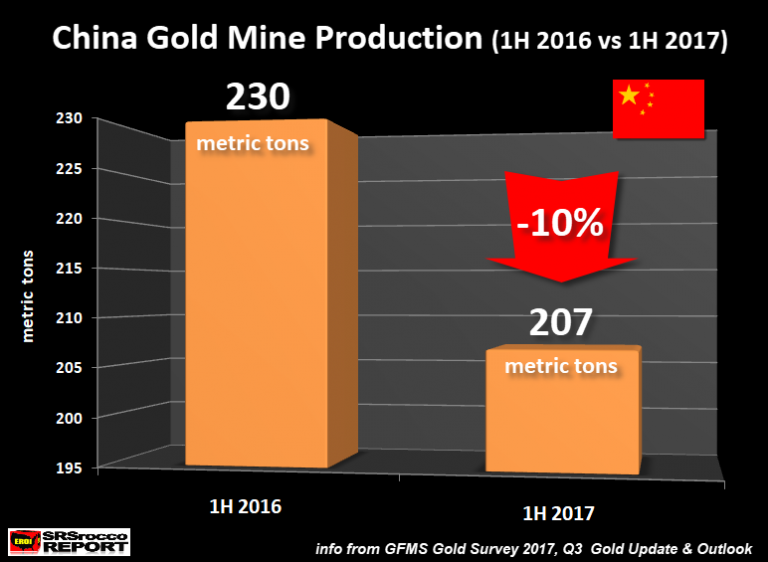

Gold mining production in China fell by 9.8% in H1 2017 Decreasing mine supply in world’s largest gold producer and across the globe GFMS World Gold Survey predicts mine production to contract year-on-year Peak gold production being seen in Australia, world’s no 2 producer Peak gold production globally while global gold demand remains robust China Gold Mine Production 1H 2016 vs 1H 2017 - Click to enlarge Gold production in the world’s largest gold producer and buyer fell by nearly 10% in the first half of 2017 in what may be another indication of peak gold. Chinese mine production registered the largest drop globally to total 207 tonnes in the first half of 2017, down 23 tonnes, or 9.8% year-on-year. In

Topics:

Jan Skoyles considers the following as important: Bitcoin, Daily Market Update, Featured, Gold, GoldCore, newslettersent

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

|

China Gold Mine Production 1H 2016 vs 1H 2017 |

| Gold production in the world’s largest gold producer and buyer fell by nearly 10% in the first half of 2017 in what may be another indication of peak gold.

Chinese mine production registered the largest drop globally to total 207 tonnes in the first half of 2017, down 23 tonnes, or 9.8% year-on-year. In the same period last year the country produced 230 metric tons. |

China Gold Production, 1970 - 2017 |

The issue of declining gold supply in China is not expected to improve. The GFMS World Gold Survey expects Chinese gold supply to fall by 14% this year from the 2014 peak. Their latest update explains:

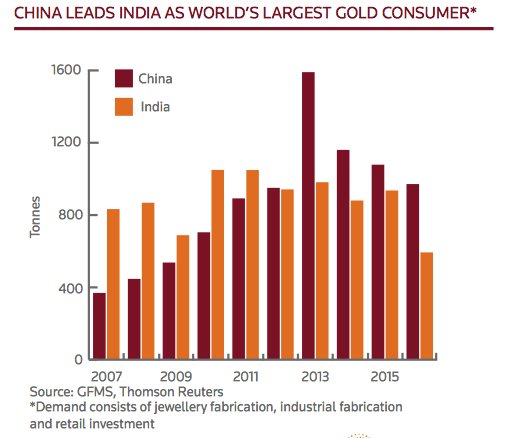

This fall in supply could have significant implications for global gold supply given the country’s leading role in the gold market. In 2016 the country produced 453t, 160t or 56% more than the second highest gold producing nation of Australia. It also leads global gold demand, beating India in the last five years. These numbers could be an indication that we are reaching peak gold, if we haven’t already. Given the country relies heavily on domestic gold supply – a shortage of gold supply at home will force the country to import more from abroad, putting pressure on global supply with a likely rise in prices. A situation made worse by the fact that many other gold producing nations are also suffering from falling production levels – including world’s no 2 gold producer Australia. |

World's Largest Gold Consumer, 2007 - 2017 |

Not just a crack in the ChinaIn the first quarter of the year the ten largest Chinese gold mining companies accounted for 41.4% of the country’s total production. China is very reliant on their domestic gold supply and points to problems further down the line of meeting its high levels of gold demand. At the beginning of the year China was the only major gold mining nation to have increased production in recent years, now it has joined its contemporaries in seeing falling production. The main reason for the fall in China’s gold supply isn’t on account of falling demand or prices:

Declining supply is not a problem unique to China. It is a common problem in gold producing nations. At the beginning of the year GFMS noted that global mine supply in the first quarter of the year reached a total of 756 tonnes, one tonne below the same period in 2016.

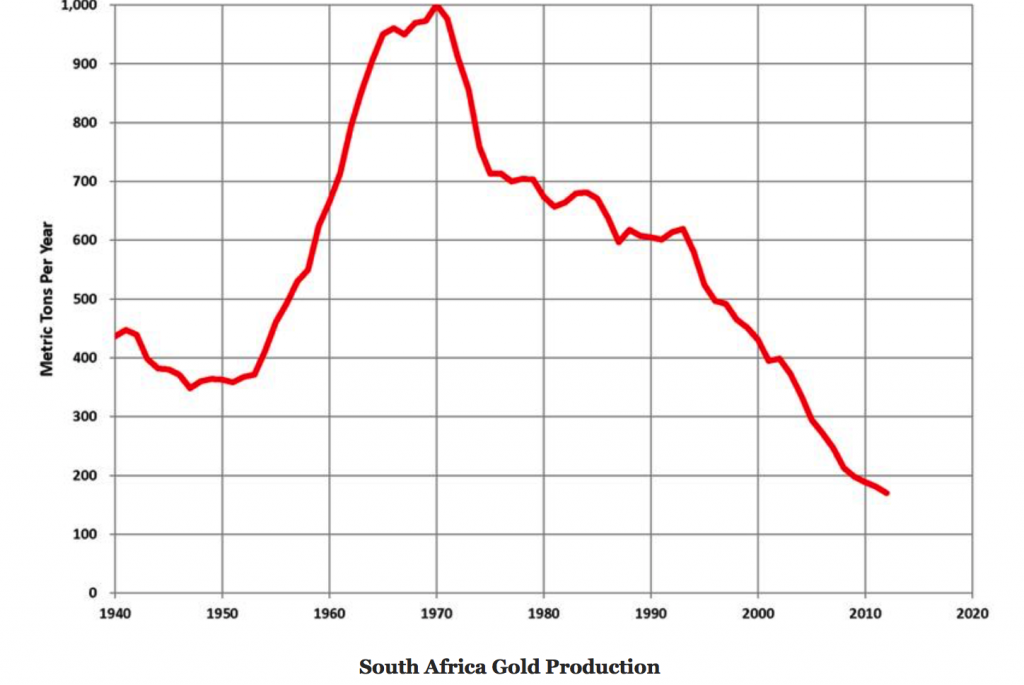

This is not a new problem. Just a quick glance at South Africa’s mining figures and one can see why it has has been a key point of concern for those monitoring global gold supply. It was once the leading producer, accounting for more than 40% of the total mined gold on earth. We have been warning that it is the ‘canary in the gold mine’ as its 80% plunge in production point to a future of gold shortages and peak gold. Earlier this quarter the Chairman of the World Gold Council Randall Oliphant expressed concern that the world might have already produced the most gold in a year that it ever will, on account of increasing gold demand and declining supply.

|

South Africa Gold Production, 1940 - 2017 |

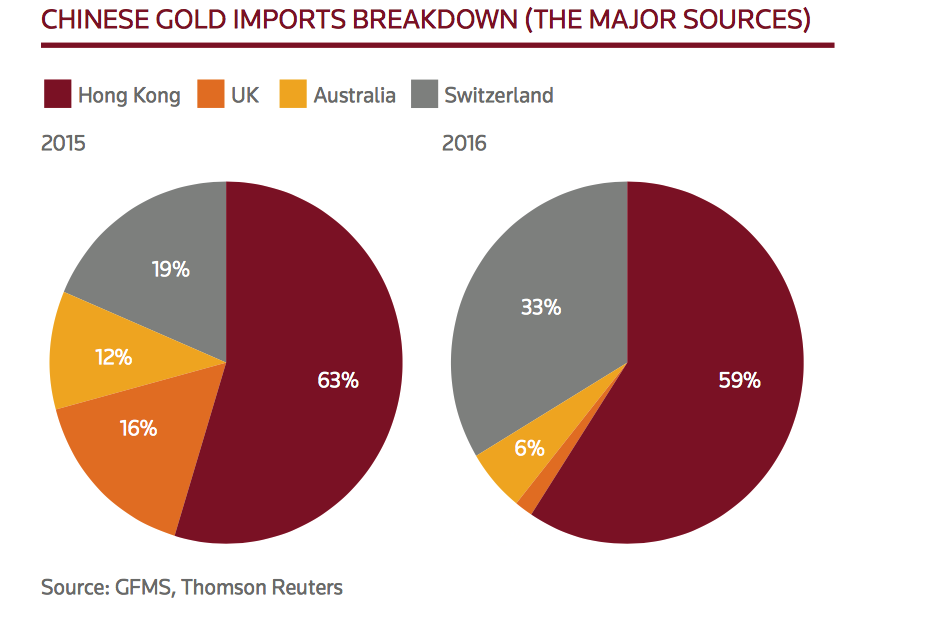

Peak gold here as uncertainties reach peak levelsChina does not export any of its domestically produced gold, but even this is not enough to satisfy demand from both investors and the official sector. Last year the country imported 1,281 tonnes of gold, from four key countries. In the short term, China may well be able to increase imports in order to satisfy domestic demand. It may struggle to increase its own production. However, in the long-term this is not a sustainable solution. Gold mines are finite and supply relies on an ever-growing number of new mines being discovered. Something which we can no longer rely on, as Pierre Lassonde recently explained:

Gold demand shows no sign of abating. As uncertainties increase across the world demand for physical gold increases. It is because of uncertainties that Oliphant believes that there will not be enough gold to satisfy demand. He sees risks in the political and economic system, combined with robust demand from India and China as the key drivers for increased gold demand and higher prices.

|

Chinese Gold Imports |

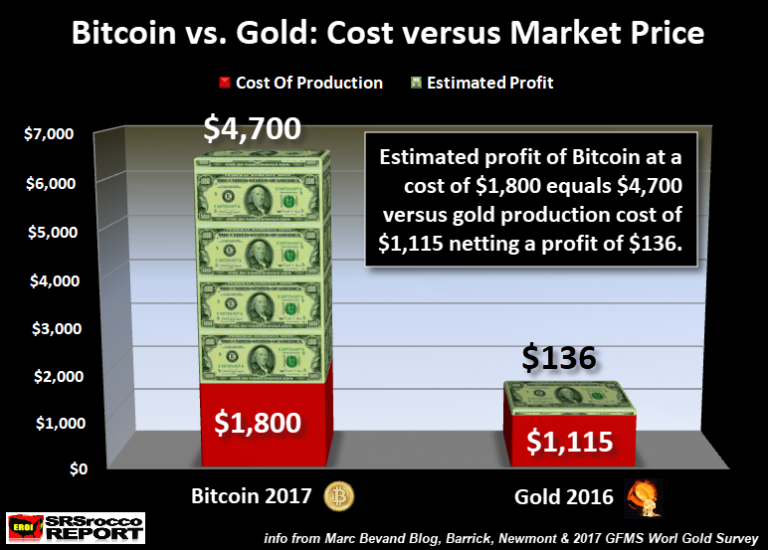

Diversify into actual physical gold before peak gold sees gold surge like bitcoinWe are at a key inflection point in gold history. There is an unstoppable force of global gold demand hurtling towards the inevitable and immovable object that is finite and diminishing gold supply. Who wins? Gold investors. Gold will always be in demand for as long as governments cause uncertainties both politically and economically. Short of alchemy there is nothing anyone can do to discover more gold as quickly as governments can destroy our confidence in the system and the value of our savings. Important developments such as these highlight the importance of not investing in paper, ETF or digital gold but buying actual gold bullion and ensuring that you own allocated and segregated physical gold bars and coins. If we have reached or are close to peak gold, investors do not want to find themselves on the wrong side of an ETF or digital gold redemption gone wrong. |

Bitcoin vs Gold(see more posts on Bitcoin, Gold, ) |

Tags: Bitcoin,Daily Market Update,Featured,Gold,newslettersent