It is largely irrelevant, but still the political theater is fascinating. As is now standard operating procedure, whatever comes out of the Trump administration immediately is conferred as the standard for awful. This is not my own determination, mind you, but that of the mainstream, whatever that is these days. And so it is with the first set of budget figures that include very robust growth projections, a point of contention and an obvious one regardless of the politics. In response, political opponents have seized upon these rosy figures as if that was something new from any president. It isn’t; the difference is that between Obama and Trump, Obama had the CBO, the Fed, and Economists on his side. That didn’t make the prior administration’s policies any more credible, as is being implied in today’s “analysis”, merely they were instead stamped with the imprimatur of the official economic models, the very same that had no idea there was a “recession” coming let alone a Great one. In the respect, given track records, it may actually be better that Trump’s don’t agree. Obama as well as the CBO forecast great things, eventually, and both were wrong. The reason for those mistakes was assumptions about “stimulus” that were based more so on assumption than evidence (circular reasoning).

Topics:

Jeffrey P. Snider considers the following as important: Ben Bernanke, cbo, currencies, depression, economy, EuroDollar, Featured, Federal Reserve/Monetary Policy, growth, Markets, newslettersent, Obama, Recession, The United States, Trump

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

It is largely irrelevant, but still the political theater is fascinating. As is now standard operating procedure, whatever comes out of the Trump administration immediately is conferred as the standard for awful. This is not my own determination, mind you, but that of the mainstream, whatever that is these days. And so it is with the first set of budget figures that include very robust growth projections, a point of contention and an obvious one regardless of the politics.

In response, political opponents have seized upon these rosy figures as if that was something new from any president. It isn’t; the difference is that between Obama and Trump, Obama had the CBO, the Fed, and Economists on his side. That didn’t make the prior administration’s policies any more credible, as is being implied in today’s “analysis”, merely they were instead stamped with the imprimatur of the official economic models, the very same that had no idea there was a “recession” coming let alone a Great one. In the respect, given track records, it may actually be better that Trump’s don’t agree.

Obama as well as the CBO forecast great things, eventually, and both were wrong. The reason for those mistakes was assumptions about “stimulus” that were based more so on assumption than evidence (circular reasoning). On January 8, 2009, several weeks before Obama would take the oath of office, the CBO attempted to claim that the economy wasn’t worse in the first half of 2008 because:

Those recessionary pressures were largely offset for a time by strong growth of exports and by government policies that included a significant easing of monetary policy and tax rebates during the spring and summer of 2008.

From that weirdly optimistic take, it was no surprise that both the CBO’s models as well as the Obama administration’s viewed very favorably the ARRA as well as the combination of QE and ZIRP. In January 2010, at the next annual budget update, the CBO well into the first year of “recovery” expected recovery:

Although the effects of those nontraditional policy actions [QE, ZIRP] are hard to quantify, CBO believes that they have provided a significant amount of stimulus—mitigating the impact of the financial crisis on the broader economy and moderating the depth of the recession.

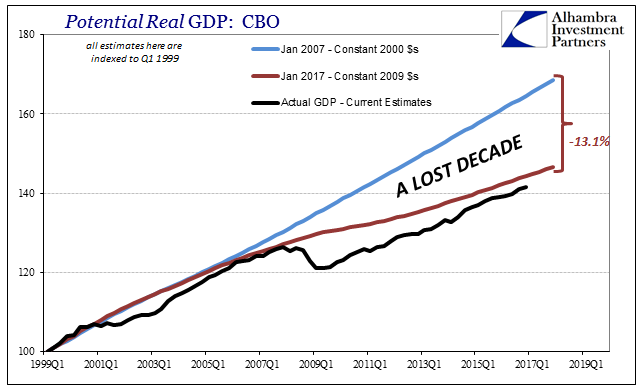

Again, that turned out not to be the case. The CBO’s own figures more recently show that the economy never recovered because nothing done or not done actually moderated “the depth of the recession.” The robust growth that was expected by the Obama administration as well as all the official econometric models never materialized, and in many more important ways the economy has only gotten worse. It was this last possibility that put Mr. Trump into the White House.

The fact that the CBO has been wrong, like almost all economists, does not immediately propose the Trump administration might be right. They are counting on several new policies with which to claim that increased growth. Many are exactly the same as those that were tried in 2009 and afterward; infrastructure, tax cuts, etc. As such, I find myself once more in an uncomfortable position, this time agreeing with of all people Paul Krugman (sans the political hyperbole).

As I said, belief that tax cuts and deregulation will reliably produce awesome growth isn’t unique to the Trump-Putin administration. We heard the same thing from Jeb Bush (who?); we hear it from congressional Republicans like Paul Ryan. The question is why. After all, there is nothing — nothing at all — in the historical record to justify this arrogance.

There really isn’t any case to make where tax cuts and deregulation are the difference between continued depression and recovery. I would vehemently disagree with Dr. Krugman as to whether both tax cuts and deregulation are helpful to the point of being needed, they are, but I am forced to concur in the limited sense that they are not likely to be the difference between the economy we have now and the economy that we desperately need. That means further that Krugman is right to criticize them as the basis for these higher projected growth rates regardless of where the CBO’s models or ferbus might stand.

It is unnecessary political theater where neither side is particularly credible about much of anything. Even when one or the other makes a salient point, they do so in such a way (Krugman in particular) so as to dissuade potentially impartial and highly interested parties from taking it seriously. One particularly basic reason is that nobody on either side seems to have any idea what happened and why. Thus, they are left to grope in the dark with various forms of old ideas repackaged, susceptible to even exaggerated political differences.

For my own analysis, political and otherwise, the answer is right there in between all of this. In that 2010 CBO analysis, the agency made what is really an inconsistent claim, but a mistake that is simply widely accepted without challenge:

During the recession, the Federal Reserve turned to nontraditional means to provide monetary stimulus. It lowered its target for the federal funds rate to nearly zero to stimulate economic activity, but because of the magnitude of the disruptions to the financial system, it also saw a need for additional actions.

Why did it take the “magnitude of disruptions to the financial system” for the Fed to finally see “a need for additional actions?” This is the same reasoning, loosely speaking, by which former Fed Chairman Ben Bernanke claims courage in action. True courage, then, would have been to act in a competent and effective manner such that there never was a financial crisis to begin with. The divorced, almost passive recalling of those events is quite illustrative to this hole in all their reasoning.

Why was there ever a global panic and Great “Recession” in the first place? It is just claimed that is the way it was and therefore everyone, especially the Fed, was helpless in stopping it. From that, what matters is supposed to be exclusively what everyone did afterward. It is just assumed now that the Great “Recession” was a foregone conclusion, and therefore there is no use in understanding what really happened so far as to figure out how to get away from it. And that is why we are stuck, on both sides, because nobody will go back to the ultimate source of all issues.

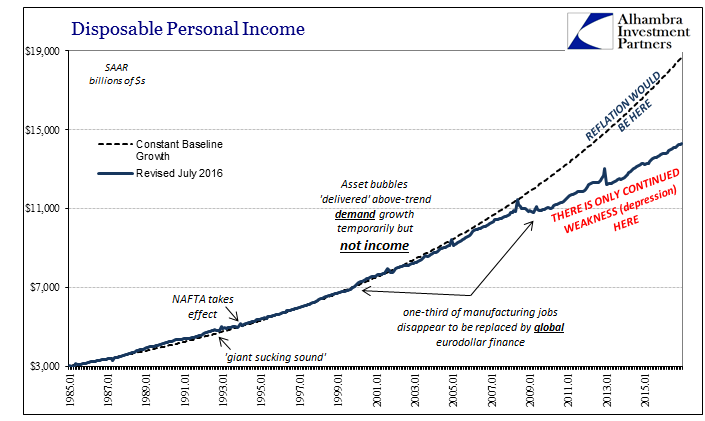

There will not be, cannot be in my judgment, any recovery until someone in position of authority finally reasons the events of 2007, 2008, and early 2009 beyond simply subprime mortgages or housing. Those, too, are but symptoms. Yet, it is all just taken as comprehensive gospel, even after ten years where official and unofficial expectations have all come to nothing. In every other discipline except economics, really Economics, there would be a determined re-examination going back to the source given the repeated and extreme failures of all efforts following from it.

| In other words, the issue isn’t ever Trump or the CBO, but rather understanding how we got here so as to understand how we get out of here. In that respect, all sides have failed and continue to do so in a way that just doesn’t make any sense apart from politics. Maybe we shouldn’t be surprised at this outcome, for Economics has exhibited this very blindness before. Almost all “stimulus” is predicated on the 1960’s view of the 1930’s, meaning that it is attuned exclusively to what comes after. Mainstream orthodox history is written as if it all started in October 1929.

Even that, however, makes little sense because it assumes that all future economic and financial events will look exactly like, or nearly exactly like, all past economic and financial events. In that respect, the CBO figures in particular should be a direct wakeup call; they show very clearly that this last decade has been unlike anything in history. That means all prior assumptions are invalid, just as they have so far proven to be. |

Potential Real Gross Domestic Products 1999Q1 - 2017Q1 |

| The problem for Trump is not that he is making a case for robust growth, it is that he is doing so without providing a credible explanation and reason for why it has been absent already for so long. If you don’t know what’s wrong, you can’t really claim to know what will be right. By not doing so, he damages the very attempt at doing so. The Fed and all other mainstream outlets have now given up on the very idea of robust growth in any situation. That now default view has to be overcome so as to avoid losing another decade.

Growth and recovery are actually possible, perhaps even likely, but it starts with a full accounting of 2008 rather than just repeating what has already been done after it. Nobody wants to do that, it seems, because neither side would come out of unscathed. |

Disposable Personal Income |

Tags: Ben Bernanke,cbo,currencies,depression,economy,EuroDollar,Featured,Federal Reserve/Monetary Policy,Growth,Markets,newslettersent,Obama,recession,Trump