Platinum Bullion ‘May Be One Of The Only Cheap Assets Out There’ Platinum “may be one of the cheap assets out there” and “is cheap when compared with stocks or bonds” according to Dominic Frisby writing in the UK’s best selling financial publication Money Week. Frisby writing in Money Week laments the total absence of value in today’s markets. He then identifies an asset that is both cheap (on a relative basis) and is valuable and the article is well worth a read: Platinum Price in USD, 2004 - 2016Platinum Bullion in USD (15 years) - Click to enlarge The value investor’s lament – where have all the cheap assets gone? Every week in MoneyWeek magazine there’s a small column devoted to great investors from the past.

Topics:

Mark O'Byrne considers the following as important: Daily Market Update, Featured, GoldCore, newslettersent

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

| Platinum Bullion ‘May Be One Of The Only Cheap Assets Out There’

Platinum “may be one of the cheap assets out there” and “is cheap when compared with stocks or bonds” according to Dominic Frisby writing in the UK’s best selling financial publication Money Week. Frisby writing in Money Week laments the total absence of value in today’s markets. He then identifies an asset that is both cheap (on a relative basis) and is valuable and the article is well worth a read: |

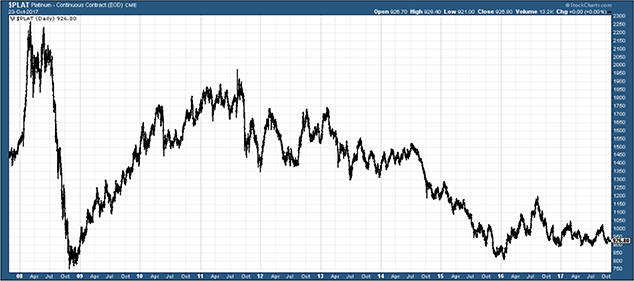

Platinum Price in USD, 2004 - 2016 |

| The value investor’s lament – where have all the cheap assets gone?

Every week in MoneyWeek magazine there’s a small column devoted to great investors from the past. You read a bit about who they were, what their circumstances were and what their methodologies were. Sometimes I’ve heard of them, sometimes I haven’t – but as often as not it seems that they were a value investor of some kind. Value investing is, I suppose, the most basic and instinctive of investing systems. You buy when you deem something to be cheap and you sell when it gets expensive. The principle has been applied for as long as humans have invested money. And yet it no longer seems to work. In this modern age of suppressed rates, quantitative easing, and easy (if you mix in the right circles) money, nothing is cheap – except money itself. Value investors have, mostly, been beaten by index trackers, and those who have simply gone long (ideally with as much leverage as possible), have wiped the floor with the prudent. Sensible, disciplined approaches have not worked. The stock market has flown and taken everything with it. As I went for my daily walk yesterday, I asked myself: “What out there is actually cheap at the moment?” |

|

| Finding value has become increasingly difficult

It depends on your valuation matrix, of course, but it’s hard to make the case that stocks are cheap. The Dow, the S&P 500, the Nasdaq – they are all at all-time highs, pretty much. I’m not saying they can’t go higher. But all-time highs is not cheap. The various FTSE indices are also in record territory, same too France and Germany. Japan is at 20-year-plus highs. On a country-by-country basis you might be able to argue somewhere is cheap – Greece (for a reason) – but it’s hard to say there is real value out there in stocks as an asset. The same goes for bonds. The yields on government bonds are, except for exceptional cases, minimal. As low as, 2016 excepted, they’ve ever been. Again, yields could fall – bonds could get even more expensive – but you can’t make the case that government bonds are cheap. The same goes for corporate and junk bonds. In the UK, the real estate market has two sides to it. In places like London, Brighton, Bristol, Oxford or Cambridge, prices bear little relation to local earnings. Then there are other regions where the 2007 highs were never recovered. You could find value in, say, parts of the Midlands or North Devon. But that’s not the same as being irresistibly cheap. Moreover, the future for UK real estate investing does not look good to me – it seems the government does not want to encourage it beyond owning your own home. You start looking at other assets: bitcoin and digital assets. Nope. Not cheap. Art. Nope. Not cheap either. The only asset class that’s cheap right now About the only assets I can find that are cheap are in the commodities sector. Oil looks reasonable value. I’m writing this piece from Texas, and I can tell you that oil consumption shows no signs of abating. But the real zinger for me is platinum. It’s as though the kid at school, who used to get straight As in all his grades and be captain of all the sports teams, has suddenly for no apparent reason, been relegated to the back of the class. He’s politely putting his hand up and saying, “Hey, remember me?” but nobody cares. They’re all ignoring him. John wrote about this the other week, but it really is striking. Back in the day, platinum was the star. It was a precious metal, so it would benefit from all the inflation of the 2000s. But it was an industrial metal too, so it would benefit from the industrial expansion. Rare, beautiful, hard to produce. What could possibly go wrong? The world blows up and gold and silver go to the moon – platinum goes there too. The global economy expands, everybody has more money – one thing they spend their new-found wealth on is platinum jewellery. It’s more precious than gold after all. People start driving more. More cars = more platinum. Instead, platinum has gone nowhere, and it’s been forgotten. The body blow seems to have been the Volkswagen scandal. Diesel emissions are greater than stated. The future for diesel cars (which use platinum in their catalytic converters), and thus the future for the precious metal, looks grim. Meanwhile, the whole “gold as money” narrative has upped sticks and and moved to bitcoin. Central banking works apparently, and so there is no need for precious metals. And the wealth created by the economic expansion of the past few years has not trickled down into platinum jewellery buying sufficiently to affect the price. The money must have all gone to rich folk who already own platinum! Any strike or mishap in South Africa that might affect platinum supply (something like 90% of platinum is mined there) has just been met with a global shrug. Platinum is simply too cheap Well, let me tell you a thing or two, Mr Market, who doesn’t care about platinum. You’re wrong! Gold (at around $1,290 per ounce) is now about 40% more expensive than platinum (around $925). That is not normal. Platinum is supposed to be more expensive than gold. Gold is typically 75% of the price of platinum. To redress that balance , platinum should be around $1,600. Platinum’s cheap little sister palladium (which is a law unto itself) is now more expensive than platinum. Again, that is not normal. It happens every now and then – well, once since 1970, in 2000-2001 – but it is the exception, not the rule. It’s like a BMW – nice, but not that nice – costing more than a Rolls Royce. Platinum is cheap when compared with stocks or bonds. It is sitting around or just below its cost of production, which is going to strain supply (in fact it already has). Who cares about platinum? Nobody really. It’s amazing that a metal this embedded in our collective psyche is meeting such apathy. The chart below shows the platinum price over the last ten years. |

Platinum Daily, Apr 2008 - Oct 2017 |

You can see the steady decline from 2011 through to 2016, the brief rebound rally, and then further declines. But those further declines have been with much more of sideways bias. In other words, although there aren’t many buyers, the hard selling seems to be done.

I get why nobody is buying platinum – there’s no compelling narrative for it at the moment. There’s no reason to buy it beyond that it’s cheap. But nor is there any real reason to sell it.

There’s often a cycle to bear markets. First you get the hard selling, then you get the forgotten phase – when an asset is simply overlooked. It seems we are in such a phase now.

Although we need not see a huge rise in the near-time, I would say the downside risk here is limited in a way that it isn’t in other asset classes – stocks, bonds, bitcoin – where the downside risk is fairly substantial.

It’s a case of accumulating and sitting patiently. Which is what value investors do.

Tags: Daily Market Update,Featured,newslettersent