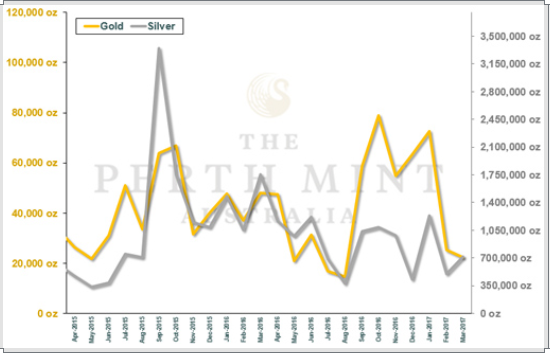

– Perth Mint’s silver bullion sales rise 43% in March.– Perth Mint’s monthly gold coin, bars sales fall 12%.– Gold silver ratio of 32 – 32 times more silver ounces sold.– Gold: 22,232 oz and Silver: 716,283 oz – bullion coins and minted bars sold. – Gold is 2.6% higher and silver surged 3.1% in the shortened week with markets closed for Good Friday tomorrow. Australian Kangaroo 2017, 1 oz 9999 Silver The Perth Mint’s silver bullion sales of coins and bars surged 43% in March. Silver sales climbed about 43 percent in March to 716,283 ounces from 502,353 ounces in February, according to a Perth Mint blog post.Gold bullion coins and minted bars fell in March to the lowest since August last year. Sales of gold coins and minted bars slipped about 12 percent in March to 22,232 ounces from 25,257 ounces a month earlier, the mint said on its website. Gold and Silver Compared Chart shows total monthly ounces of gold and silver shipped as minted products by The Perth Mint to wholesale and retail customers worldwide. It excludes sales of cast bars and other activities including sales of allocated/unallocated precious metal and Perth Mint Silver and Gold Certificates. - Click to enlarge The Perth Mint is the largest gold refinery in Australia, the world’s No. 2 gold producer after China.

Topics:

Mark O'Byrne considers the following as important: Featured, gold price, GoldCore, newsletter, silver prices, Weekly Market Update

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| – Perth Mint’s silver bullion sales rise 43% in March. – Perth Mint’s monthly gold coin, bars sales fall 12%. – Gold silver ratio of 32 – 32 times more silver ounces sold. – Gold: 22,232 oz and Silver: 716,283 oz – bullion coins and minted bars sold. – Gold is 2.6% higher and silver surged 3.1% in the shortened week with markets closed for Good Friday tomorrow. |

|

| The Perth Mint’s silver bullion sales of coins and bars surged 43% in March. Silver sales climbed about 43 percent in March to 716,283 ounces from 502,353 ounces in February, according to a Perth Mint blog post.Gold bullion coins and minted bars fell in March to the lowest since August last year. Sales of gold coins and minted bars slipped about 12 percent in March to 22,232 ounces from 25,257 ounces a month earlier, the mint said on its website. |

Gold and Silver Compared Chart shows total monthly ounces of gold and silver shipped as minted products by The Perth Mint to wholesale and retail customers worldwide. It excludes sales of cast bars and other activities including sales of allocated/unallocated precious metal and Perth Mint Silver and Gold Certificates. - Click to enlarge |

| The Perth Mint is the largest gold refinery in Australia, the world’s No. 2 gold producer after China. It is one of the largest gold and silver refineries in the world.

Gold and silver prices have surged this week on a weaker dollar and as appetite for risky assets such as equities waned due to geo-political concerns in the Middle East and Asia and deepening tensions between the U.S. and Russia. Gold is 2.6% higher and silver is 3.1% in the shortened Easter week with markets closed for Good Friday tomorrow. Geo-political risks that were dormant are becoming more active. This is leading to renewed risk aversion which should see further gains for gold. Perth Mint Bullion blog here |

|

Tags: Featured,gold price,newsletter,silver prices,Weekly Market Update