Gold set to shine as Washington stumbles “Bet on gold’s diversifying properties rather than political stability” World’s largest asset manager believes Trump and political drama in the U.S. means gold likely to rise Real rates flattening out and rising political instability – Blackrock’s Koesterich “For now my bias would be to stick with gold” – Blackrock U.S. debt ceiling issue to be fractious as bankrupt U.S. hits trillion debt Investors will again turn to gold in coming political strife - Click to enlarge “For now I would prefer to bet on gold’s diversifying properties rather than political stability” – Russ Koesterich, Blackrock. Not for the first time this year, Blackrock’s Koesterich has spoken

Topics:

Mark O'Byrne considers the following as important: Daily Market Update, Donald Trump, Featured, gold price, GoldCore, newslettersent

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

|

|

Not for the first time this year, Blackrock’s Koesterich has spoken about his faith in gold during times of both financial and political instability. Those times are now, the world’s largest money manager believes. Since the beginning of the year Koestrich has been adding to the gold position of the $39bn Global Allocation Fund. Gold is now the fund’s second-largest position.

|

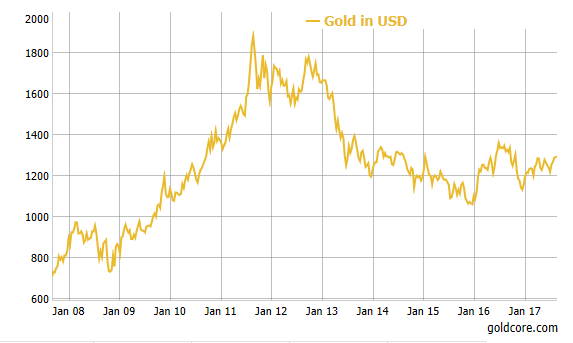

Gold Price in USD, Jan 2008-2017(see more posts on gold price, ) |

Real rates – plateauing and boosting gold

Heightened political uncertaintyKoesterich said earlier this month that “There has been a Pavlovian response by investors to disregard any piece of bad news or any spike in volatility, and that has been a very profitable strategy but we do think that there are risks in the world that are not being priced in.” Currently there is heightened geopolitical risk across the world, with a focus on how the US will manage. Investors will no doubt be looking to reduce their risk exposure as events unfold between the US and North Korea as well as Venezuela’s chaos which shows no sign of dissipating. The VIX index is often referred to as the ‘Fear Index’. Many believe this is a misnomer and does not portray what is really going on. The index has been trading at historically low levels. Apparently investors continue to bet that the index will remain low if money keeps pouring into markets and the global economy carries on improving. Koesterich doesn’t think this will be the case. For him political risk has not yet been reflected in the markets. |

Index Level, Jan 2014-Jul 2017 |

|

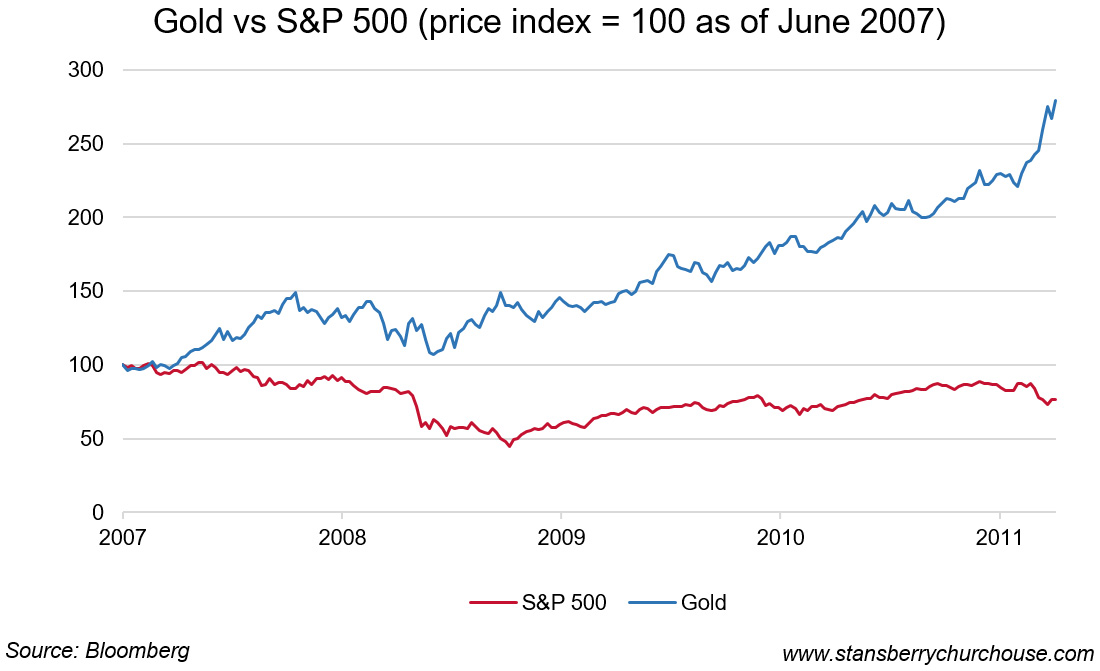

Gold vs S&P 500 Price index, 2007-2011 |

Conclusion – No crystal ball but stick with gold

Koesterich does not claim to ‘have any special insight into the Greek drama that is modern day Washington.’ But he is clear in his conviction that a ‘bet on gold’s diversifying properties rather than political stability’ is the way to trade right now.

Whilst Koesterich’s blog has made headlines and been featured on a range of sites, there should really be no surprise over his comments. All he is saying is that gold will continue to perform well thanks to a series of unknowns in the political and economic sphere.

It will act as a form of financial insurance and safe haven. This is no real news given history has demonstrated this as has the performance of gold in the last 10 years and as a hedge in the long term.

Most importantly the money manager is saying that he has little faith in the performance and abilities of the US government. In turn this means he is concerned for the strength of their currency and economy.

Individual savers and investors should take note – gold’s safe haven properties will be coming into their own as Washington continues to bicker and stumble.

Tags: Daily Market Update,Donald Trump,Featured,gold price,newslettersent