Summary:

Calculation Problem What is the real interest rate? It is the nominal rate minus the inflation rate. This is a problematic idea. Let’s drill deeper into what they mean by inflation. You can’t add apples and oranges, or so the old expression claims. However, economists insist that you can average the prices of apples, oranges, oil, rent, and a ski trip at St. Moritz. This is despite problems that prevent them from agreeing on what should be included. One problem is that we no longer need buggy whips. If buggy whips had been in the Consumer Price Index (CPI) before the advent of the car, what do you do when they go out of general use? Substitute driving gloves (which most people don’t use)? Another problem is that cars are vastly superior today than they were 50 years ago. Having had a chance to drive a classic 1965 Mustang with drum brakes, I can tell you it was scary to drive on the highway at 55 mph. What to include, and how can it even be added up? Illustration by alekup I didn’t dare drive it faster, as the stopping distance felt like it would probably be half a mile. But, of course, every car on the road was whizzing past me at +20mph. Cars today cost more.

Topics:

Keith Weiner considers the following as important: consumer price index, Featured, Gold and its price, newsletter, Nominal Interest Rates, On Economy, real interest rates, U.S. Consumer Price index, U.S. Dollar Purchasing Power

This could be interesting, too:

Calculation Problem What is the real interest rate? It is the nominal rate minus the inflation rate. This is a problematic idea. Let’s drill deeper into what they mean by inflation. You can’t add apples and oranges, or so the old expression claims. However, economists insist that you can average the prices of apples, oranges, oil, rent, and a ski trip at St. Moritz. This is despite problems that prevent them from agreeing on what should be included. One problem is that we no longer need buggy whips. If buggy whips had been in the Consumer Price Index (CPI) before the advent of the car, what do you do when they go out of general use? Substitute driving gloves (which most people don’t use)? Another problem is that cars are vastly superior today than they were 50 years ago. Having had a chance to drive a classic 1965 Mustang with drum brakes, I can tell you it was scary to drive on the highway at 55 mph. What to include, and how can it even be added up? Illustration by alekup I didn’t dare drive it faster, as the stopping distance felt like it would probably be half a mile. But, of course, every car on the road was whizzing past me at +20mph. Cars today cost more.

Topics:

Keith Weiner considers the following as important: consumer price index, Featured, Gold and its price, newsletter, Nominal Interest Rates, On Economy, real interest rates, U.S. Consumer Price index, U.S. Dollar Purchasing Power

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

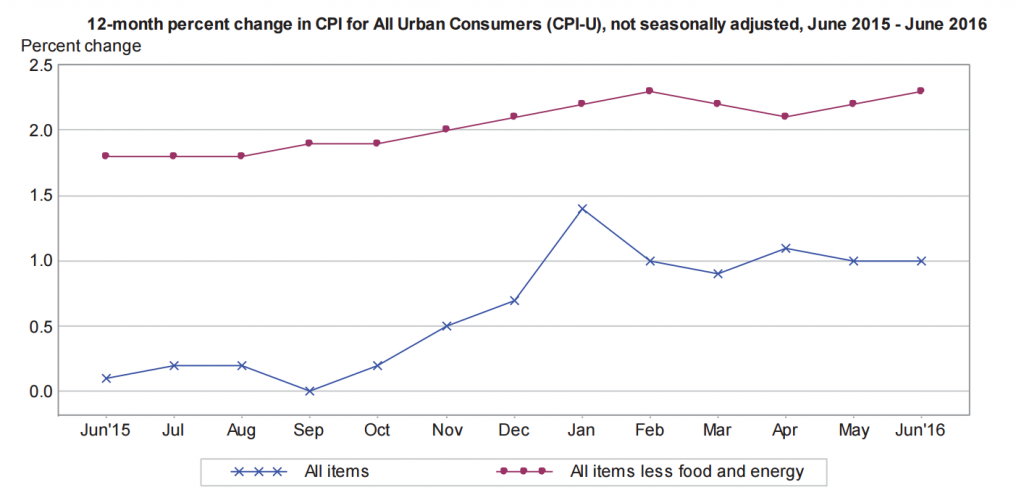

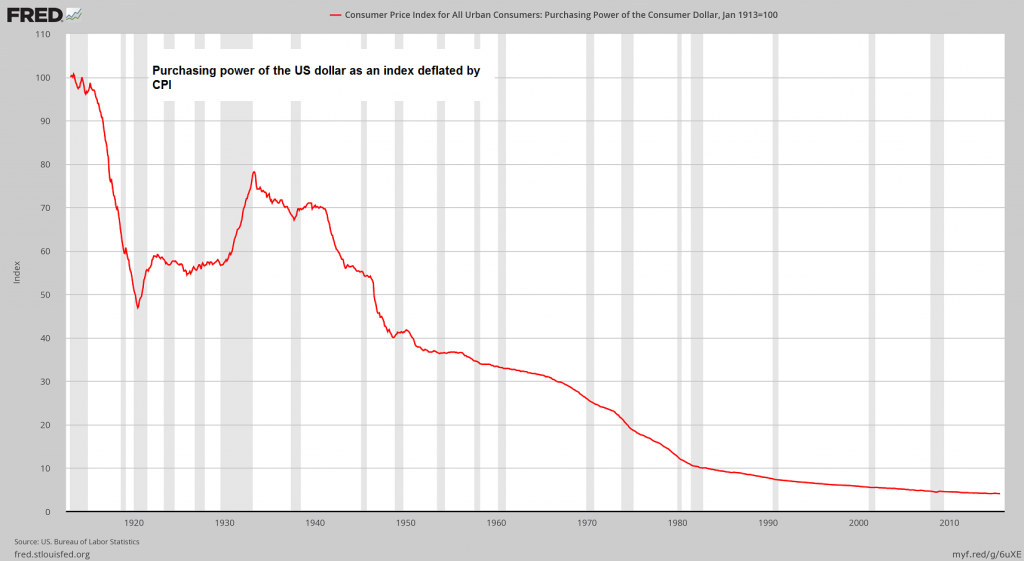

Charts by BLS, St. Louis Federal Reserve Research

Chart and image captions by PT