Chopper Pilot Descends on Nippon Readers are probably aware of recent events in Japan, the global laboratory for interventionist experiments. The theories of assorted fiscal and monetary cranks have been implemented in spades for more than a quarter of a century in the country, to appropriately catastrophic effect. Amid stubbornly stagnating economic output, Japan has amassed a debt pile so vast since the bursting of its 1980s asset bubble, it beggars the imagination. Here is a brief summary of what just happened: first, contrary to the global trend of incumbents falling from grace nearly everywhere, Shinzo Abe and the LDP achieved a resounding election victory. This victory inter alia allows Abe to proceed with his militaristic agenda unhindered and to keep promoting his economic program that is best described as a mad-cap flight forward. Secondly, an estimated five seconds after the votes were counted, Abe announced that he would indeed continue to follow the Keynesian playbook by doing even more of what hasn’t worked in over 25 years. His government plans to launch a major new “stimulus” program, rumored to cost 10 trillion yen (approx. 0 billion). Stimulus is the euphemism for shifting taxpayer funds to various favored political cronies.

Topics:

Pater Tenebrarum considers the following as important: Balloon Dog, Bank of Japan, Ben Bernanke, bridge to nowhere, Debt and the Fallacies of Paper Money, Etsuro Honda, Featured, Haruhiko Kuroda, Helicopter Money, Jeff Koons, Monte dei Paschi, newslettersent, On Economy, On Politics, Shinzo Abe, Weimar

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Chopper Pilot Descends on NipponReaders are probably aware of recent events in Japan, the global laboratory for interventionist experiments. The theories of assorted fiscal and monetary cranks have been implemented in spades for more than a quarter of a century in the country, to appropriately catastrophic effect. Amid stubbornly stagnating economic output, Japan has amassed a debt pile so vast since the bursting of its 1980s asset bubble, it beggars the imagination. Here is a brief summary of what just happened: first, contrary to the global trend of incumbents falling from grace nearly everywhere, Shinzo Abe and the LDP achieved a resounding election victory. This victory inter alia allows Abe to proceed with his militaristic agenda unhindered and to keep promoting his economic program that is best described as a mad-cap flight forward. Secondly, an estimated five seconds after the votes were counted, Abe announced that he would indeed continue to follow the Keynesian playbook by doing even more of what hasn’t worked in over 25 years. His government plans to launch a major new “stimulus” program, rumored to cost 10 trillion yen (approx. $100 billion). Stimulus is the euphemism for shifting taxpayer funds to various favored political cronies. In the process taxpayers will be left with even more bridges to nowhere, so they will at least get a few new eyesores out of it. |

A bridge to nowhere near Kyoto (there is a second, similar bridge nearby, which for differentiation reasons has been dubbed “the bridge from nowhere”). We hasten to stress that such monuments to bureaucratic insanity are by no means unique to Japan – they can be found all over the world (just not in a similar density). The one question etatistes always ask and which supporters of a free society have no satisfactory answer for is: “If there were no government, who would build the bridges to nowhere?” ? Photo credit: Jeffrey Friedl |

| Financial market participants immediately assumed that the central bank’s printing press would also be involved in this effort to create prosperity by bureaucratic fiat and consequently decided to lean on the yen (which was slightly overbought anyway). They also bought Japanese stocks, on the theory that they offer at least a small modicum of insurance against the monetary debauchery that is certain to be in train.

Thirdly, famous helicopter pilot, alleged “depression expert” and (as we think) certified monetary crank Ben Bernanke made landfall in Nippon shortly thereafter, reportedly to dispense his invaluable – and bound to be very costly – advice. A Bloomberg report on the event inter alia contains this little gem of unintended hilarity:

|

|

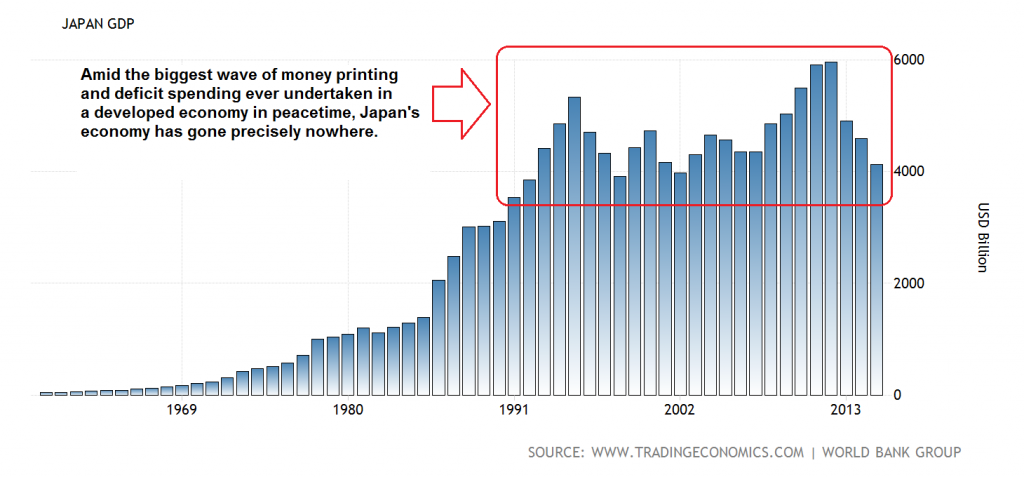

| Indeed, it has – and it has followed their advice to a T. The outcome is depicted below. This goes to show that it can sometimes take really long before a befuddled patient realizes his doctors are complete quacks. In this case it has taken 26 years and the patient’s befuddlement has yet to dissipate.

Chopper Ben has been invited to Tokyo by Etsuro Honda, a life-long bureaucrat and one of Shinzo Abe’s closest economic advisors. Bernanke’s task was to help persuade Mr. Abe to essentially go full retard on the Keynesian/ monetarist intervention cocktail. Honda has been conspicuous as a major importer of foreign economists to Japan in recent years. According to Bloomberg, they add “star power” to his own misguided policy prescriptions:

|

These are precisely the long term effects sound economic theory suggests one should expect as a result of the policies adopted in Japan over the years (we will happily concede that GDP isn’t a particularly useful measure of economic wealth, but it serves to show long term economic trends). The problem is that sound economic theory has never been put into practice in Japan. The main reason for this is that sound economic policy would make “policymakers” completely superfluous – click to enlarge. |

| In short, Honda has invited the most deluded enemies of civilization he could find in order to “help” Japan (again, this is just our opinion; others think more highly of said gentlemen).

So what did Bernanke’s advice consist of in detail? Bloomberg informs us that he recommended a specific variant of “helicopter money” to the Japanese, which would involve overt central bank financing of deficit spending by the government. Allegedly the topic didn’t come up this time, but it has definitely come up previously (it should be noted that very little of what was actually discussed was made public):

|

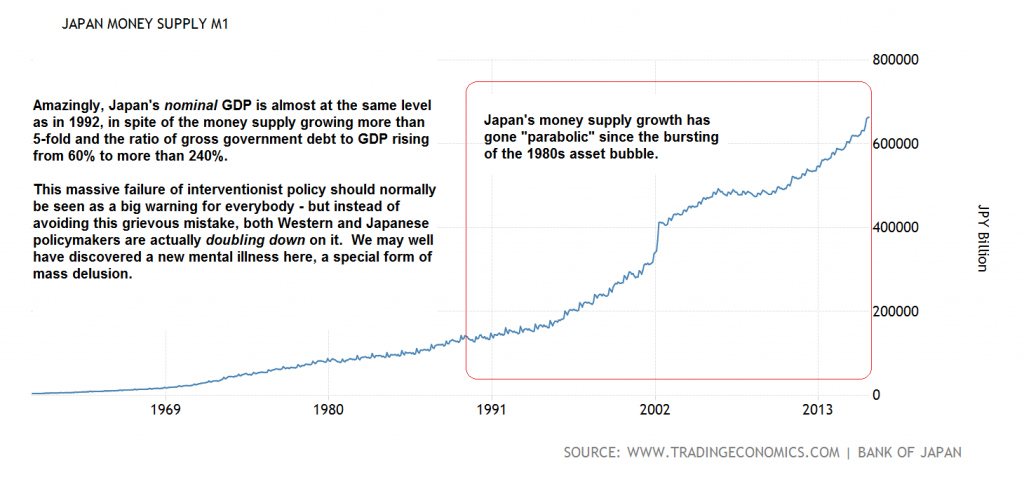

In spite of boosting the money supply by an astonishing multiple and burying the country up to its eyebrows in debt, Japan’s interventionists have not even been able to boost nominal GDP since 1992, which is quite a feat. It seems like a textbook example of what not to do – and yet, policymakers around the world insist on essentially doubling down on this madness. We believe this could be a new mental illness that is only waiting to be appropriately named. Keynes’ syndrome perhaps? Morbus grapheocraterum (bureaucrats’ disease)? We are open to suggestions – click to enlarge. |

| (emphasis added)

Reading between the lines, in spite of all the denials, helicopter money was what they discussed and what Japanese policymakers are now seriously considering. |

|

Weimar Bed Pans for Rich PeopleIt could well be argued (as Honda apparently did) that what the BoJ is doing now already constitutes a “helicopter money” policy – especially if one believes that the bonds bought by the BoJ will never be sold back into the market. Frankly, we doubt that they ever will be. It seems far more likely that proceeds from maturing bonds will be perpetually reinvested – a policy adopted by the Fed with respect to the assets it has amassed during its QE operations as well. In light of this, a friend of ours recently wondered whether it would actually make a difference what the BoJ did. Wouldn’t a “perpetual bond” purchased by the BoJ as proposed by Bernanke simply be an accounting operation of sorts that doesn’t really alter the already established facts on the ground? And wouldn’t the same apply to the theoretical case of “debt cancellation” by the central bank? If we agree that the government debt the BoJ has bought must already be regarded as permanently sequestered on its balance sheet, then it seems at least superficially that this is indeed little more than an accounting detail. And if/ when it is actually done, the initial market reaction may well be muted. However, underneath this simple accounting entry there is actually an intricate and complex web of interrelations. A few factors one needs to consider: Public confidence; the very nature of money; the difference between money and credit; and related to all of these: the connection between money (the medium of exchange) and the “real things” it can be exchanged for and the coordination of production, consumption and saving through time, as well as the distribution of wealth. We plan to discuss all these points in more detail over time (specifically, we plan to soon discuss the possibility of the emergence of “trust money” as a result of a consequent implementation of helicopter money policy. The topic was raised in this year’s “In Gold We Trust” report, which readers who haven’t done so yet should definitely check out). |

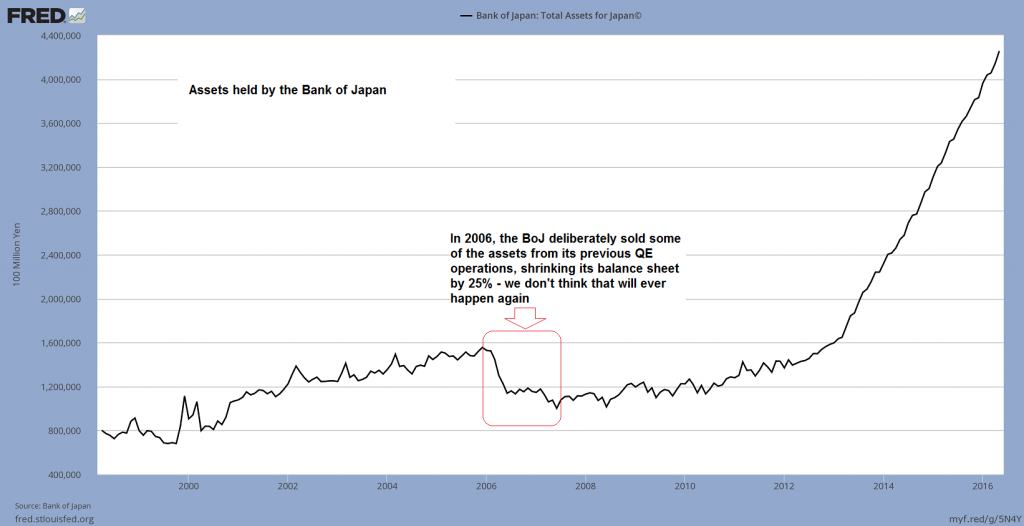

Assets held by the BoJ: in 2006 it actually did take some of its previous “QE” back, by decreasing the size of its balance sheet by roughly 25%. Other central banks were also tightening policy at the time, raising rates in baby steps. Not coincidentally, US house prices actually peaked in 2006. A global financial and economic crisis followed in short order, providing evidence that a mere slowdown in money supply growth is all it takes to bring the entire system to the brink of collapse – click to enlarge. |

| For now we want to focus on the question of confidence though, on which much of this ultimately rests. There are many reasons to believe that this confidence – as firmly established as it appears to be at the moment – is steadily undermined. At some point the authorities are likely to take “one step too many”, which will tip it over the edge.

So far, the most obvious sign that confidence in money itself is diminishing is the indiscriminate surge in asset prices (note that recently, stocks, gold and bonds have all risen in unison, a very rare sight). In other words, the confidence in the purchasing power of money appears to be increasingly doubted among those who are actually rich, or who manage large amounts of money for others. Their conscious awareness of this fact may vary, and fears over the health of the banking system may also be in play to some extent. After all, holding large amounts of electronic deposit money can be dangerous – the events in Cyprus and Greece serve as recent examples. And yet, whoever paid $58 million for Jeff Koons’ “Balloon Dog, orange” strikes us as a rich man’s version of the famed housewife during the Weimar era who exchanged her entire salary for bed pans right after she got paid, because she couldn’t get rid of the government’s scrip fast enough. |

Weimar bed pans for rich people… We actually think the balloon dog is not bad at all as an artwork – it undoubtedly has a certain je-ne-sais-quoi. We are only questioning its valuation, or rather, we are wondering whether the $58 million price tag is telling us something about inflation psychology of some of the main beneficiaries of monetary inflation. Photo credit: Noel Y. Calingasan |

The Unknown ThresholdOf course, as long as the general public’s confidence in government issued money remains firm, a great many crazy policy decisions will appear entirely reasonable, and will be rationalized ad nauseam in academe and the financial press. It is a bit like a mass hallucination and quite fascinating to watch. Central banks have had great leeway in pushing “inflationary experiments” – partly because the manufacturing sector’s productivity has for a long time increased at such a strong pace that it offset the price pressures of monetary inflation, and partly because the nature of the monetary system has created a deflationary undertow – most recently exemplified by the troubles of Italy’s banking system. For a retail depositor of Monte dei Paschi or a grandmother holding subordinated Monte dei Paschi bonds (which her bank advisor has talked her into buying – “perfectly safe, signora, the government will never allow our storied house to go under”), the foremost consideration is not the exchange value of the euro. Rather it is the question whether their share of the euro pie is about to disappear and go back to whence it came from – namely thin air. However, the public’s confidence in money is mainly based on the idea that these inflationary experiments are temporary in nature. They are seen as emergency measures that will eventually give way to “normalcy” again once the exigencies of the moment have been overcome. So a problem will arise if/ when an unknowable threshold is crossed – the point at which a critical mass of people begins to doubt that these measures are temporary and becomes convinced that the inflationary policy is deliberate and will never stop. This is the moment when the “genie gets out of the bottle”, as they say. |

Courtyard of the Monte dei Paschi di Siena bank HQ in the Toscana. Monte dei Paschi is the world’s oldest bank, founded in the 15th century, not long after the bankruptcy of the Medici Bank (which was found to hold only 5% in reserve against its deposit liabilities at the time it went under). Photo credit: Tango7174 |

And now consider what Ben Bernanke said on this particular point in his recent article on “helicopter money” at the Brookings Institute website:

(emphasis added) Convincing the public that increases in the money supply are “permanent” is quite risky. Emboldened by the Volcker experience, today’s central bankers seem absolutely certain they will be able to handle the problem of a sudden increase in inflation expectations with ease. There are numerous examples of the likes of Bernanke, Yellen, Draghi, et al. voicing this conviction. It seems to us they greatly underestimate the amount of “potential energy” already stored up in the system by what they have done so far. They don’t seem to fully grasp of the extent of the time lags involved (which can be very large). They are seemingly not fully aware that a possible loss of confidence will be a highly non-linear event, which may well prove intractable when it happens (and at the very least will give them extremely little time to react or ponder what to do). Lastly, they overestimate their own ability to withstand political pressures. So the question is really: which seemingly harmless accounting entry on a central bank balance sheet might end up shaking the public’s confidence? We cannot be certain, but the above mentioned “unknowable threshold” certainly does exist. |

|

| It is of course unlikely that while a deflationary mindset still permeates the “market mind” and official measures of price inflation remain low, people will suddenly lose confidence in the purchasing power of money just because a central bank implements yet another inflationary policy measure (as a friend recently pointed out to us in this context, one must also not forget that a great many people don’t fully understand these extraordinary central bank policy measures).

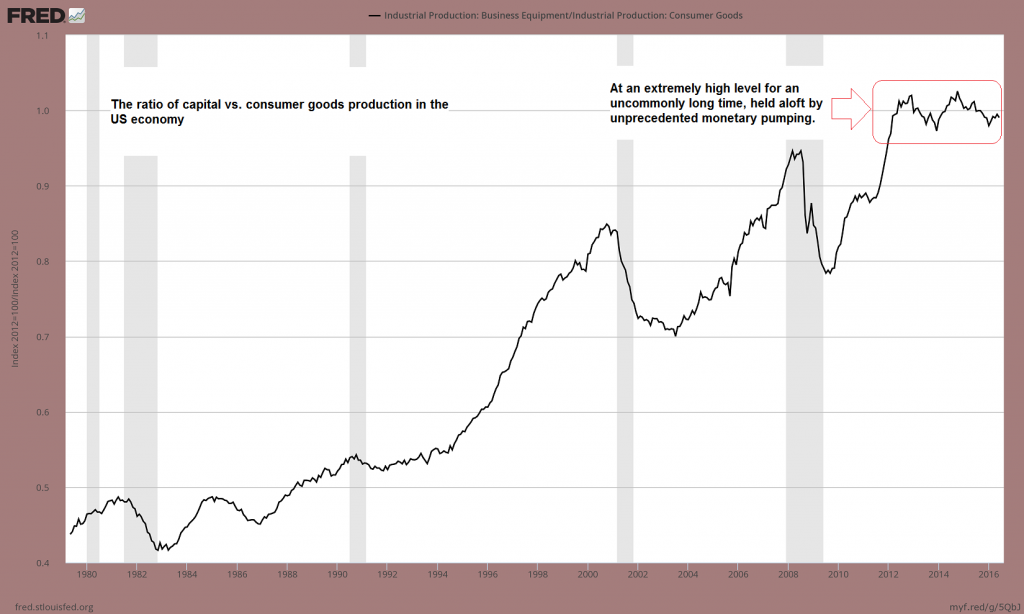

In terms of a possible sequence of events, we should expect price inflation to initially increase slowly. At present this is mainly due to base effects – the rise in oil prices since the beginning of the year is bound to affect headline inflation measures. We don’t want to dwell on these purely arithmetic effects though (although we do think traders need to be aware of them, as they are likely to affect bond yields in the near term, so it is something worth mentioning). We are more interested in the fact that logic dictates that when too many resources have been allocated to the higher stages and too few to the lower stages of the production structure (while concurrently nothing has actually changed in terms of time preferences and consumer demand), relative prices will eventually have to go the other way again, as the output of consumer goods is at some point no longer going to be adequate relative to actual demand. Neither money printing nor deficit spending can create any additional real capital. They merely distort prices and influence the allocation of already existing capital/ factors of production (inter-temporal in the case of monetary pumping, intra-temporal in the case of deficit spending). In short: the shift in relative prices caused by monetary pumping is not permanent. Consumers will then be faced with a kind of late stage “forced saving” situation (readers may want to check out our in-depth discussion of the concept for additional background information here: “Forced Saving”), as they will no longer be able to afford as many consumer goods as they would like to buy (particularly the types of consumer goods they want to buy, as capital has previously been malinvested, i.e., invested in the wrong lines). |

|

| This is when the so-called “impossible” may actually happen: economic weakness, combined with rising consumer prices, a.k.a. “stagflation”. In the beginning it will be mild. What happens then depends on how the monetary authorities react to such a development – will they ignore rising prices on the idea that economic weakness ensures they are a temporary phenomenon and adopt loose policies anyway? Or will they discover their inner Volcker? Given that central bankers have all become one-note Johnnies in recent years, it certainly seems to us that the former is more likely.

At that point, decisions by central banks to adopt extreme policies may well affect the inflationary expectations of the broader public far more strongly than before. The monetary inflation of the past is then likely to spill over rapidly from asset prices to consumer prices. This is also when the danger that a non-linear trend acceleration develops becomes acute. We have to interpose here that we acknowledge of course that one cannot rule out a deflationary outcome – e.g. a situation in which bankruptcies become so overwhelming that a part of the money supply is eventually wiped out due to banks going under. We will discuss this possibility in a follow-up post – let us just say that we currently believe this to be the more remote threat. However, it is clear that the eventual outcome is not predetermined. Ludwig von Mises addresses both of the above points in a passage in Human Action that discusses the price premium (a.k.a. the inflation premium) embedded in gross market interest rates:

(emphasis added) Mises also discusses the “crossing of the threshold” and the non-linear nature of a breakdown in the public’s confidence in state-issued money. The important point that has to be stressed here is that the money supply can be inflated for a very long time without causing an undue increase in all prices. As long as the public expects that inflationary policies are going to be reversed, its actions will in fact work against price increases (such as decisions to increase cash balances in order to wait for prices to decline). Only when the public’s expectations finally change will the trend get out of hand:

(emphasis added) |

|

ConclusionIt seems increasingly likely that some form of “helicopter money” (i.e., outright and explicitly permanent monetary financing of government spending) will be adopted by central banks as the next step in their misguided “fight against deflation” – or even simply in order to prevent a recession. Given that Japan is about a decade ahead of other developed countries in terms of monetary and fiscal experimentation, it is a likely candidate for going down this path first. Obviously, it doesn’t have to happen, and if it does, it may not happen in the near future just yet. However, Mr. Abe’s threat of more stimulus spending indicates that an opportunity presents itself here. Let us not forget, the markets expect Mr. Kuroda to “do something”, given that the BoJ keeps missing its absurd inflation target by miles. Almost no-one expects price inflation to become a problem. Does anyone still remember the late 1970s? At the time almost no-one believed that disinflation and potentially even deflation would ever again become an issue. Allowing for this possibility was the most contrarian stance one could take at the time. And yet, money supply growth had been slowing for a few years already and was about to go negative (this finally happened in 1981). Today the situation is the exact opposite. The money supply keeps growing by leaps and bounds in every major currency area, and “deflation” is the greatest fear. Not only is price inflation not considered a potential problem, policymakers are actually pining for it and are actively pursuing policies aimed at promoting it. This should certainly give everybody pause. Addendum: The Bridge From NowhereSince we mentioned it above: here is the bridge from nowhere, also near Kyoto. |

Charts by: BarChart, TradingEconomics, St. Louis Federal Reserve Research.