The 10th Anniversary Edition of the “In Gold We Trust” Report As every year at the end of June, our good friends Ronald Stoeferle and Mark Valek, the managers of the Incrementum funds, have released the In Gold We Trust report, one of the most comprehensive and most widely read gold reports in the world. The report can be downloaded further below. The report celebrates its 10th anniversary this year. As always, a wide variety of gold-related topics is discussed, providing readers with a wealth of valuable and intellectually stimulating information. This year’s report inter alia includes a detailed discussion of gold’s properties in terms of Nicholas Nassim Taleb’s “fragility/ robustness/ anti-fragility” matrix, as well as close look at the last resort of mad-cap central planners that goes by the moniker “helicopter money”. Gold, daily, over the past year Since falling to a new multi-year low amid growing despondency and a crescendo of bearishness late last year, gold has celebrated a rather noteworthy comeback. As our regular readers know, we pointed to many subtle signs that indicated to us that a trend change might soon be afoot as the low approached (particularly in gold stocks, see e.g.

Topics:

Pater Tenebrarum considers the following as important: Debt and the Fallacies of Paper Money, Featured, Helicopter Money, In Gold We Trust, Incrementum Inflation Signal, inflation-sensitive assets, inter alia, Mark Valek, newsletter, Nicholas Nassim Taleb, Precious Metals, Ronald Stoeferle

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The 10th Anniversary Edition of the “In Gold We Trust” ReportAs every year at the end of June, our good friends Ronald Stoeferle and Mark Valek, the managers of the Incrementum funds, have released the In Gold We Trust report, one of the most comprehensive and most widely read gold reports in the world. The report can be downloaded further below. The report celebrates its 10th anniversary this year. As always, a wide variety of gold-related topics is discussed, providing readers with a wealth of valuable and intellectually stimulating information. This year’s report inter alia includes a detailed discussion of gold’s properties in terms of Nicholas Nassim Taleb’s “fragility/ robustness/ anti-fragility” matrix, as well as close look at the last resort of mad-cap central planners that goes by the moniker “helicopter money”. Gold, daily, over the past yearSince falling to a new multi-year low amid growing despondency and a crescendo of bearishness late last year, gold has celebrated a rather noteworthy comeback. As our regular readers know, we pointed to many subtle signs that indicated to us that a trend change might soon be afoot as the low approached (particularly in gold stocks, see e.g. “Gold and Gold Stocks, it Gets Even More Interesting” or “The Canary in the Gold Mine” for some color on this). |

|

| Ronald and Mark are inter alia looking into the question whether gold’s recent comeback marks the resumption of the secular bull market, and which factors are likely to drive precious metals in coming years. As they correctly argue, the increasing desperation of central bankers and their willingness to boost inflation at all cost is going to lead to a plethora of unintended consequences, all of which are likely to boost the gold price.

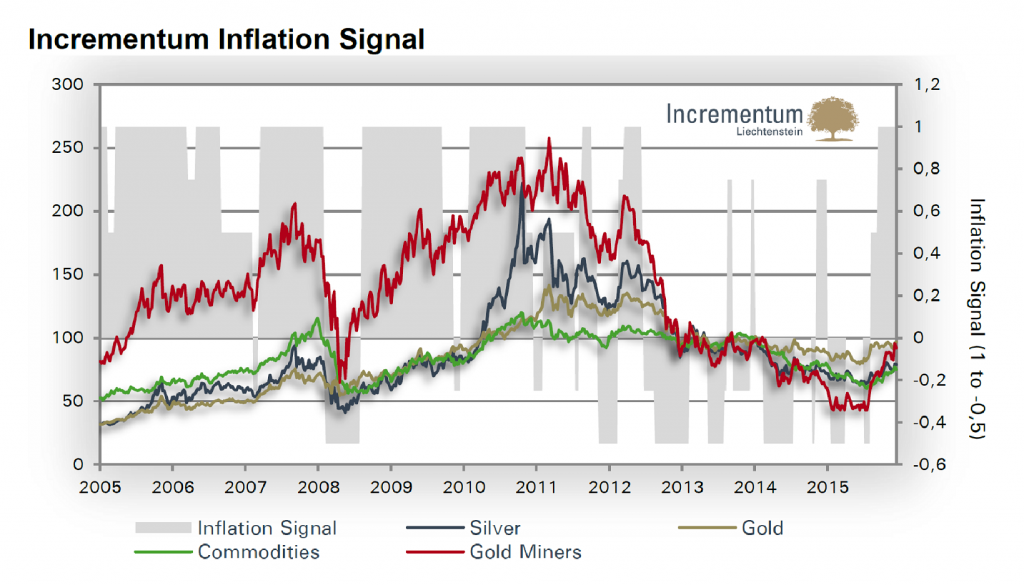

They also shed light on one issue that – apart from a handful of exceptions – is clearly not on anyone’s radar screen at the moment: namely the possibility that central banks might finally “succeed”. In other words, the possibility that gold’s recent rise is actually the harbinger of another event widely regarded as “impossible” – the return of price inflation. Incrementum Inflation SignalIn this context, we want to reproduce a chart from the report, which shows the proprietary Incrementum inflation signal vs. the gold price and a number of other inflation-sensitive assets. As can be seen, the signal has flipped rather forcefully toward inflation, after having been stuck for several years in “disinflation/ deflation” territory. This incidentally jibes with the ECRI Future Inflation Gauge, which has recently reached a new multi-year high as well. As can probably be imagined, if the message of these signals is actually borne out, central banks will be facing quite a quandary. It also has potentially far-reaching implications for investors of all stripes, which the report discusses extensively as well. |

Conclusion and Download Link

We are certain that our readers will find this year’s In Gold We Trust report just as interesting and entertaining as its predecessors. In fact, we believe the anniversary report is an especially well done issue. Enjoy!

The Report can be downloaded here (pdf): In Gold We Trust, 2016

Charts by: BarChart, Incrementum AG