Here’s a rough piece of calculation based on the last few years of news: When x happens, yields fall. An example of this post-GFC rule-of-thumb was Brexit and its fallout. The potential lesson from said rule is that yield hunting isn’t fun anymore, say Credit Suisse’s William Porter and team, with our emphasis: Negative (or very low) 10-year Bund yields have not been a boon for European credit markets, based on our...

Read More »What Drives Government Bond Yields?

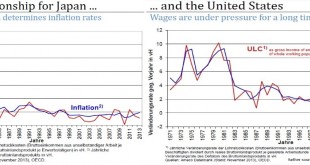

For us the five major drivers of government bond yields are: Inflation expectations and inflation: The by far most important criterion. High inflation expectations must be compensated via higher bond yields. The main driver behind inflation expectations is the wage development, this is the form of inflation that typically persists. Price inflation follows inflation expectations with a certain lag. Wealth: The higher the wealth of a country, the lower the bond yields. Wealth is typically...

Read More »What Drives Government Bond Yields?

For us the five major drivers of government bond yields are: Inflation expectations and inflation: The by far most important criterion. High inflation expectations must be compensated via higher bond yields. The main driver behind inflation expectations is the wage development, this is the form of inflation that typically persists. Price inflation follows inflation expectations with a certain lag. Wealth: The higher the wealth of a country, the lower the bond yields. Wealth is typically...

Read More »Is the Safe-Haven Government Bond Bubble Finally Bursting?

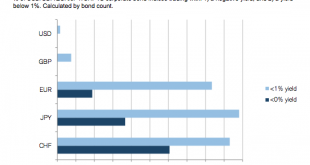

The Safe-haven government bond bubble did not pop, but Italy or Spain have become low yielders as well Government bond yields under 10 years for safe-havens are close to zero. In April 2013, even 20 year bond yields are less than 3%, What can explain this bubble of the century? Latest Data May 2015: A big Bond Sell-Off has started (from JGBs, over German Bunds to US Treasuries). Via Zerohedge: Having briefly tested above 3.00% on Thursday, for the first time since December 2nd, 2014, the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org