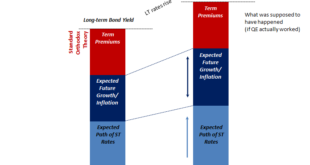

It should be as simple as it sounds. Lower LT UST yields, less growth and inflation. Thus, higher LT UST yields, more growth and inflation. Right? If nominal levels are all there is to it, then simplicity rules the interpretation. Visiting with George Gammon last week, he confessed to committing this sin of omission. Rates have gone up, he reasoned reasonably, therefore it would seem to follow how the market must be shifting expectations toward the more optimistic...

Read More »Deja Vu

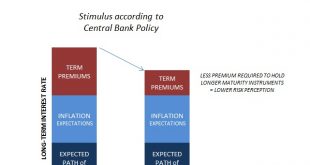

According to orthodox theory, if interest rates are falling because of term premiums then that equates to stimulus. Term premiums are what economists have invented so as to undertake Fisherian decomposition of interest rates (so that they can try to understand the bond market; as you might guess it doesn’t work any better). It is, they claim, the additional premium a bond investor demands so as to hold a security that...

Read More »Should we Be Concerned About the Fall in Money Velocity?

Alarmed Experts A fall in the US velocity of money M2 to 1.44 in June from 1.51 in June last year and 2.2 in May 1997 has alarmed many experts. Note that the June figure is the lowest since January 1959. Some commentators are of the view that this points to a severe liquidity crunch, which could culminate in a massive stock market collapse and an economic disaster in the months ahead. Money velocity is widely...

Read More »Visions of Tomorrow from the Permanently High Plateau

Mad as a Hatter Somewhere, someone first said “bull markets don’t die of old age.” We suppose this throwaway phrase was first uttered in a time and place much like today. That is, in the midst of a protracted bull market where stock prices had detached from the assets and earnings of companies their shares represent claim to. They may not die of old age… but they do occasionally die. Photo credit: Brett Cole...

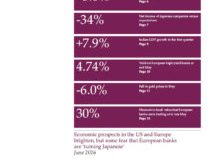

Read More »In the June 2016 issue of ‘Perspectives’

Published: 14th June 2016Download issue:Will Knut Wicksell be proved right? The Swede’s theories include the notion that there is a ‘natural’ level of interest rates, consistent with the economy operating at its full potential without overheating. But the actions of central banks have forced interest rates to artificially low levels in recent times, well below their ‘natural’ levels. If nature should reassert its predominance again, so the theory goes, then rates could shoot up, leading to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org