Better get out of the way… stampeding bisons Stampeding Animals The mass impulse of a cattle stampede can be triggered by something as innocuous as a blowing tumbleweed. A sudden startle, or a perceived threat, is all it takes to it set off. Once the herd collectively begins charging in one direction it will eliminate everything in its path. The only chance a rancher has is to fire off a pistol with the hope that the shot turns the herd onto itself. If the rancher is successful, it will stampede in a giant circle. If the rancher isn’t, it will run off a cliff. Today’s modern man, a complex species that ranges between homo sapiens and homo neanderthalensis, like bos taurus, is also predisposed to herd behavior. What’s more, the human animal will take just about anything and everything to the extreme. Religious pilgrimages, sporting events, music concerts, New Year’s Eve celebrations, and political rallies gone bad have all triggered deadly human stampedes. Just last year, for instance, over 2,400 people were trampled to death during the Hajj Stampede in Saudi Arabia. Photo credit: Watson Media, via flickr The Kaaba in Mecca – every year, several million Muslims gather in Mecca for the Hajj. Stampedes in which hundreds of people are trampled to death happen quite often.

Topics:

MN Gordon considers the following as important: Featured, Gold and its price, newsletter, Precious Metals, The Stock Market

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Stampeding Animals

The mass impulse of a cattle stampede can be triggered by something as innocuous as a blowing tumbleweed. A sudden startle, or a perceived threat, is all it takes to it set off. Once the herd collectively begins charging in one direction it will eliminate everything in its path.

The only chance a rancher has is to fire off a pistol with the hope that the shot turns the herd onto itself. If the rancher is successful, it will stampede in a giant circle. If the rancher isn’t, it will run off a cliff.

Today’s modern man, a complex species that ranges between homo sapiens and homo neanderthalensis, like bos taurus, is also predisposed to herd behavior. What’s more, the human animal will take just about anything and everything to the extreme.

Religious pilgrimages, sporting events, music concerts, New Year’s Eve celebrations, and political rallies gone bad have all triggered deadly human stampedes. Just last year, for instance, over 2,400 people were trampled to death during the Hajj Stampede in Saudi Arabia.

The Kaaba in Mecca – every year, several million Muslims gather in Mecca for the Hajj. Stampedes in which hundreds of people are trampled to death happen quite often. It is easy for such a big mass of people to panic – and there is nowhere one can turn if it happens.

Moreover, in today’s frenetic society, humans are granted a variety of avenues for a mob dynamic to express itself. Financial markets and the fear and greed prospects of economic scarcity provide a fertile landscape for remarkable human folly. Manias, panics, and crashes come to pass with unwavering regularity.

After an abundance of speculations have piled up on one side of a trade, they must eventually reverse course and charge elsewhere. The precise moment and duration are never clear. But, when the time comes, those at the back of the pack are often left holding worthless receipts.

Key Lessons from the Past

Social mood and mass collective movements cycle over and under in ways that are only really predictable in hindsight. The solution to high prices, of course, is high prices. Unfortunately, the lessons of the past are often the wrong instructions for the future.

For example, key lessons from the 1930s were that one should have no debt; one should keep large stashes of cash outside the banking system; and one should plant a vegetable garden and hoard scraps of aluminum and bags of flour and sugar…and whatever else one could store.

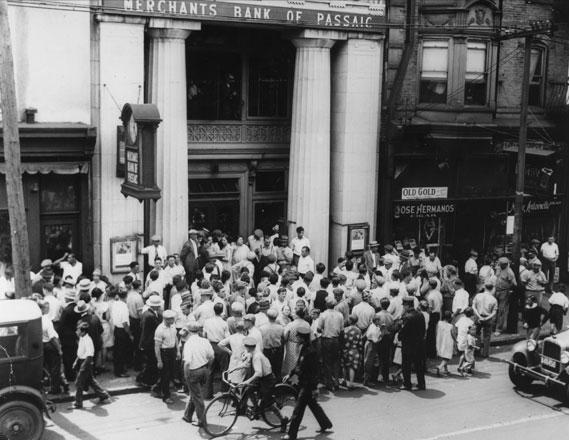

Bank run during the Great Depression – a lot of deposit money went to “money heaven” – it literally disappeared as thousands of fractionally reserved banks became insolvent. In spite of frantically pumping up its balance sheet, the Fed was unable to keep the money supply from contracting (contrary to the myth that the Fed “did nothing”, its holdings of securities grew by more than 400% from late 1929 to early 1933).

But those that heeded the lessons of the 1930s and held cash through the 1970s were rewarded with a significant loss of purchasing power. Their industry and thrift were covertly subtracted from their bank accounts. The landscape had shifted.

For the key lessons from the 1970s were that one should be borrowing large amounts of money; and that one should not hold a stash of cash. This was especially true if the borrowed money was used to buy a house. In no time at all, the debt burden was cut in half and house prices ballooned up.

For instance, the median unadjusted home value in 1960 was $11,900. By 1990, it was $79,100. Over the course of a 30-year loan, monthly payments on a home bought in 1960 were reduced to pocket change. At the same time, by 1990 it took $4.42 to purchase what $1 could buy in 1960. Home values increased at a rate exceeding the the dollar’s loss of value nearly by a factor of two.

The result is that one generation shuns credit like the black plague. The next laps it up like pigs eating slop. What are the correct lessons from yesterday to be applied to tomorrow?

“People still have a memory of what happened during the recession,” remarked IHS economist Chris Christopher, earlier this week. “Millennials, if they have money left after paying their student loans, do put money aside.”

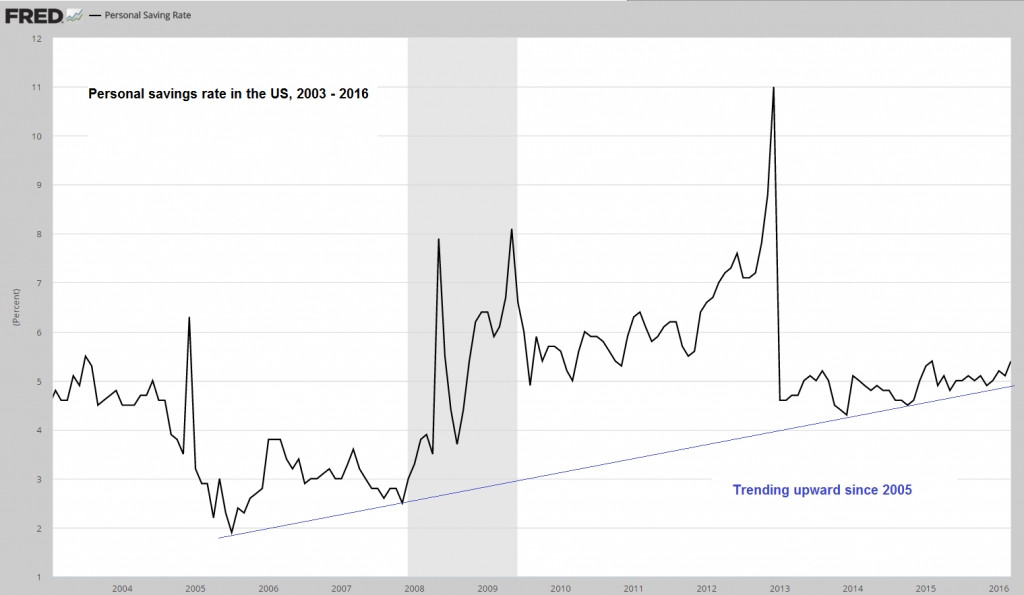

Christopher was commenting on the recent Gallup Poll that concluded that Americans are more likely in the post-2008 world to perceive saving money as more enjoyable than spending it. And, to a certain extent, their attitudes have reflected this, as the savings rate has increased from 1.9 percent in 2005 to 5.4 percent today.

Personal savings rate in the US, 2003 – 2016The personal savings rate. It should be noted that this is a highly problematic indicator – it certainly does not measure real savings. However, its trend does tell us something about the shift in consumer attitudes toward savings and debt. |

Gold Stampede Imminent?

Yet the lesson from 2008 may not be the correct lesson for tomorrow. On Wednesday the Fed announced their efforts to normalize rates have stalled out. Then, yesterday, first quarter GDP growth was reported at an abysmal 0.5 percent. What to make of it?

The Fed and other central bankers have executed radical policies of mass money debasement for nearly the last 8 years. This was supposed to “jumpstart” the economy and stimulate an economic boom. But the new boom has yet to come – instead the economy is flat lining. Meanwhile, the U.S. stock market is near its all-time high.

No doubt, this is a precarious situation…one that cannot last for much longer. When the stock market breaks, and the herd rushes out, where will they stampede to?

Yield of 10 year Treasury NoteBuying US treasuries and other developed market government bonds has been very profitable for 35 years running – that need not remain so. |

|

For the last 35 years, U.S. Treasuries have been a favorite safe haven destination for wealth. Many even referred to U.S. Treasuries as the ‘safest investment in the world.’ However, perceptions about government debt securities and the validity of monetary policy have dimmed since 2008. The next crisis, which may be just over the horizon, will likely be a major crisis of confidence.

Under this scenario, when the crisis comes it will come quick and without explicit warning. Wealth will exit financial markets like cattle stampeding from gunfire in the night. At the same time, people will quickly realize that stampeding into government bonds is like stampeding off a cliff. The preferred destination will likely be gold.

The Gold PriceAfter a cyclical bear market from 2011 – 2015, gold is waking up |

Hence, if you haven’t already, go get your hands on some physical gold; make it a small portion of your overall asset allocation. If you wait until the crisis arrives, it will be too late.

Plus acquiring physical gold is simple enough. In fact, it is as simple as buying a new pair of shoes. Save up some cash, take it to your local coin shop, and trade it in for bullion coins. Alternatively, if you’re short on cash, or have some ambivalence, try starting with silver bullion coins. See how you like it. You’ll probably be glad you did.

Charts by: St. Louis Federal Reserve Research, StockCharts, BarChart

Chart and image captions by PT

M N. Gordon is the editor and publisher of the Economic Prism.

Previous post