Interventions:The SNB intervenes for 6.3 bn francs in the week ending last Friday, the week one after Brexit. Already on Day One , the SNB intervened for an estimated 3-4 bn francs This is once again the a new weekly high since the end of the EUR/CHF peg in January 2015. Seven billion sight deposits come from Swiss banks, when fearful investors moved their money on Swiss bank accounts. FX: Unexpectedly for us, the SNB raised the intervention level to 1.0850. Apparently the central bank converted GBP->CHF flows into GBP->EUR flows – via EUR/CHF purchases. Speculators: are long CHF 10K contracts against USD versus 6.3K contracts last week. (CFTC data) Intervention levels are too high, in particular on dollar purchases The SNB converts a certain percentage of the inflows into USD to keep up the USD share at around 33%. Dollar purchases at 0.97 CHF are far too expensive in a historical (e.g. 0.75-0.80 CHF in 2011) and future perspective (when global inflation comes back). Similar to the EUR purchases at 1.40 in 2010, dollar purchases at elevated levels of 0.97 can pave the way for a SNB bankruptcy. Date of data (+ link to source) avg. EUR/CHF during period avg.

Topics:

George Dorgan considers the following as important: Featured, newslettersent, SNB, George Dorgan's opinion

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Interventions:

The SNB intervenes for 6.3 bn francs in the week ending last Friday, the week one after Brexit. Already on Day One , the SNB intervened for an estimated 3-4 bn francs

This is once again the a new weekly high since the end of the EUR/CHF peg in January 2015. Seven billion sight deposits come from Swiss banks, when fearful investors moved their money on Swiss bank accounts.

FX: Unexpectedly for us, the SNB raised the intervention level to 1.0850. Apparently the central bank converted GBP->CHF flows into GBP->EUR flows – via EUR/CHF purchases.

Speculators: are long CHF 10K contracts against USD versus 6.3K contracts last week. (CFTC data)

Intervention levels are too high, in particular on dollar purchases

The SNB converts a certain percentage of the inflows into USD to keep up the USD share at around 33%. Dollar purchases at 0.97 CHF are far too expensive in a historical (e.g. 0.75-0.80 CHF in 2011) and future perspective (when global inflation comes back). Similar to the EUR purchases at 1.40 in 2010, dollar purchases at elevated levels of 0.97 can pave the way for a SNB bankruptcy.

| Date of data (+ link to source) | avg. EUR/CHF during period | avg. EUR/USD during period | Events | Net Speculative CFTC Position CHF against USD | Delta sight deposits if >0 then SNB intervention | Total Sight Deposits | Sight Deposits @SNB from Swiss banks | “Other Sight Deposits” @SNB (other than Swiss banks) |

|---|---|---|---|---|---|---|---|---|

| 01 July, 2016 | 1.0865 | 1.1228 | Brexit: SNB intervenes for 6.3 bln. CHF | +10867x125K | +6.3 bn per week | 507.5 bn | 430.3 bn | 77.2 bn |

| 24 June, 2016 | 1.0854 | 1.1272 | Brexit: SNB Intervenes for 4.9 bln. | +6381x125K | +4.9 bn per week | 501.2 bn | 423.5 bn | 77.8 bn |

| 17 June, 2016 | 1.0834 | 1.1252 | Speculators and sight deposits switch to long CHF vs. USD | +7130x125K | +2.6 bn per week | 496.3 bn | 416.5 bn | 79.8 bn |

| 10 June, 2016 | 1.0936 | 1.1335 | Speculators short CHF, when USD/CHF was fallen by 3%. | -9645x125K | -0.3 bn per week | 493.7 bn | 415.5 bn | 78.1 bn |

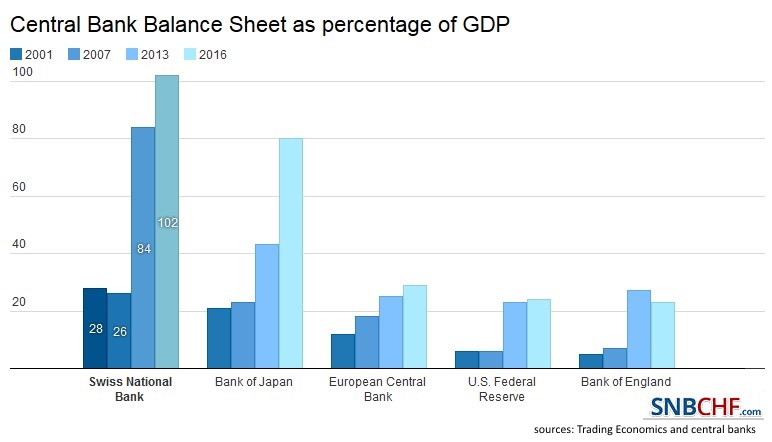

SNB balance sheet now over 100% of GDPIt should be remarked that the SNB assets are volatile FX investments. FX investments are less than 3% of the BoJ, ECB, Fed and BoE balance sheet. Central banks from Emerging Markets typically buy foreign bonds. But these countries have far higher inflation and therefore – over time – a weaker local currency. But the Swiss Franc is a currency that by tendency appreciates. |

|