The papers from the Reserve Bank of New Zealand describes in easy words where central banks should intervene based on economic history and experience. It avoids the often used econometric considerations. For FX rates those often do not incorporate sufficient long-term data. Details1 Via Forexlive:It is very interesting, but what perhaps makes it more useful for a wider FX trader audience is its reference the triggers for a central bank intervention. The RBNZ specifies the ‘opportune-ness’ of intervention as one of the ‘traffic lights’ it considers when intervening. The more ‘opportune’ the moment, the more likely intervention will be effective. Read about what made RBNZ intervention opportune at the article … such information could come in handy in future. Also, from Westpac: A primer on the RBNZ’s FX intervention policy In brief: The exchange rate must be at an exceptionally high or low point in the cycle; The level must be unjustified based on a range of economic fundamentals; Intervention must be consistent with the Policy Targets Agreement (PTA); and Market conditions must be opportune, so that intervention has a reasonable chance of success Use the viewer to scroll down inside the full PDF file. Direct file access here.

Topics:

George Dorgan considers the following as important: Currency intervention, Featured, FX rate, Milton Friedman, Monetary Policy, RBNZ

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

The papers from the Reserve Bank of New Zealand describes in easy words where central banks should intervene based on economic history and experience. It avoids the often used econometric considerations. For FX rates those often do not incorporate sufficient long-term data.

Details1

Via Forexlive:

It is very interesting, but what perhaps makes it more useful for a wider FX trader audience is its reference the triggers for a central bank intervention.

- The RBNZ specifies the ‘opportune-ness’ of intervention as one of the ‘traffic lights’ it considers when intervening. The more ‘opportune’ the moment, the more likely intervention will be effective.

Read about what made RBNZ intervention opportune at the article … such information could come in handy in future.

Also, from Westpac: A primer on the RBNZ’s FX intervention policy

In brief:

- The exchange rate must be at an exceptionally high or low point in the cycle;

- The level must be unjustified based on a range of economic fundamentals;

- Intervention must be consistent with the Policy Targets Agreement (PTA);

- and Market conditions must be opportune, so that intervention has a reasonable chance of success

Use the viewer to scroll down inside the full PDF file.

Direct file access here.

The following is another paper that represents the same subject and makes things even more simple.

Buy Low and Sell High enforces Central Bank Profitability and Stabilizes the Currency

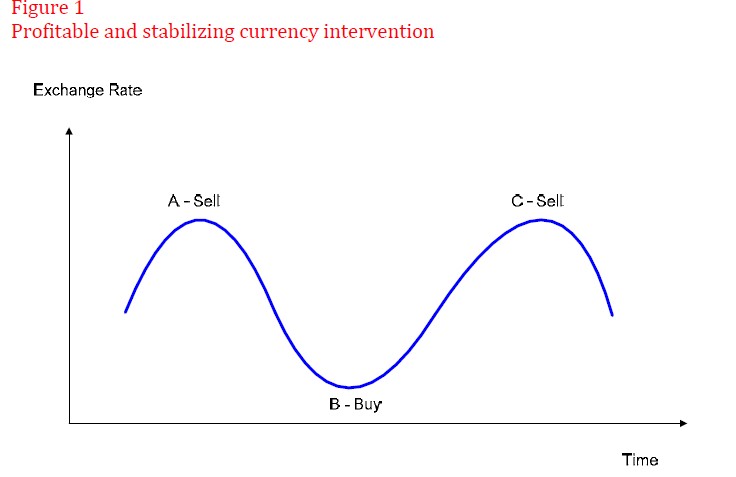

An early contribution to the debate was Friedman’s ‘Profits Test’2 , which assumed central banks that were trying to minimise fluctuations in the exchange rate behaved like speculators when intervening. As a result, they tend to buy local currency / sell foreign currency the when exchange rate is low, to support the local currency, and sell local currency / buy foreign when the exchange rate is high to depreciate the local currency.

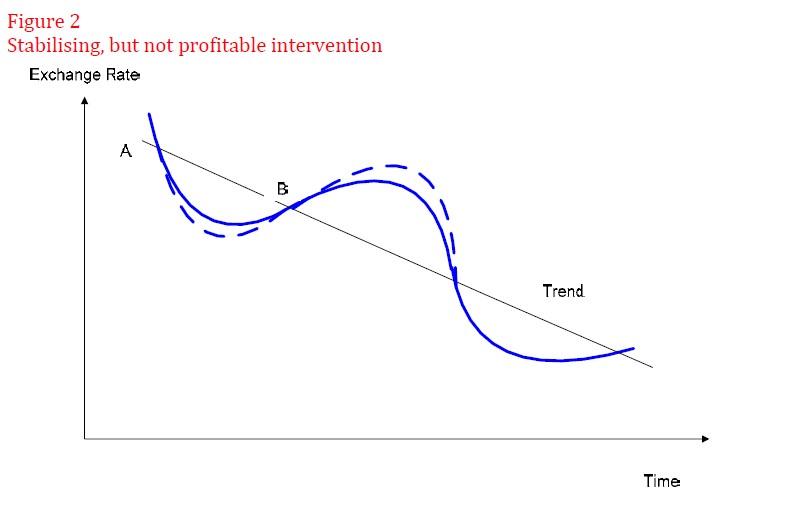

In some circumstances, intervention may succeed in stabilising the exchange rate, but not be profitable for the central bank. An example of this is if the exchange rate is on a consistent upward or downward trend (Figure 2). The central bank may be able to reduce the volatility of the exchange rate around the trend (buying at point A and selling at point B), but the intervention would not be profitable because the central bank would be selling at a loss.

This represents the FX interventions executed by the Swiss National Bank between 2009 and 2010/2011 when the EUR/CHF fell from 1.60 to 1.20. It ended in a big central bank loss in the year 2010.

Use the viewer to scroll down inside the full PDF file.

The full file can be downloaded here.

References- Econometric data often may be void because they incorporate only a limited historic series of data but not a longer history. For example, fifteen years of economic data, used in the CHF Real Effective Exchange Rate is only a part of history. It is based on the idea that in 1999 all currencies were fairly valued, which is clearly not the case. [↩]

- Friedman, M (1953) “The Case for Flexible Exchange Rates”, Essays on Positive Economics, University of Chicago Press [↩]