A shake-up in interest-rate policy in China promises to cut lending rates and should benefit the broad Chinese economy over time.Over the weekend, the People’s Bank of China (PBoC) announced a major change in its benchmark lending interest rate, establishing a closer linkage between banks’ funding costs and their lending rates.Given the notable decline in short-term market interest rates since last year due to the PBoC’s liquidity injections, this likely will lead to a decline in commercial...

Read More »China: strong credit growth in March again

Chinese credit data surprised on the upside in March, following a surge in January and a sharp fall in February, but stimulus to the real economy may not be as strong.Chinese credit data surprised on the upside in March, following a surge in January and a sharp fall in February. Monthly total social financing (TSF) came in at Rmb2.86 trillion, much stronger than the market consensus forecast of Rmb1.85 trillion. New bank loans also surprised on the upside at Rmb1.69 trillion, compared with...

Read More »PBOC aims to stave off potential liquidity shock

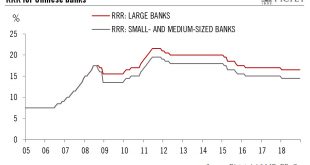

The decision to lower reserve requirements for some lending does not represent a policy shift by the PBoC, still intent on reining in excessive financial leverage.The People’s Bank of China (PBoC) announced on 30 September that it would lower the required reserve ratio (RRR) for selected banks by 50-150 basis points (bps) from the beginning of next January.Specifically, banks eligible for a 50 bps cut to their RRR will include those that have at least 1.5% of their existing loans or of their...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org