Just ahead of Sunday’s general election, there is little sign of appetite among the leading parties to tackle the significant challenges that Italy faces.According to the last polls published before the blackout period, no single party or coalition is projected to win an outright majority in the Italian general election next Sunday. Given cyclical growth, near-term economic risks seem to be contained, but Italy’s potential growth rate is low, and youth unemployment is among the highest in Europe. The country has the second-highest debt load in the euro area after Greece (132% of GDP). Over the past few years, Italy has endeavoured to address certain structural issues, but more steps need to be taken to lift the Italian growth rate to a sustainably higher level.Whatever Italy’s next

Topics:

Nadia Gharbi considers the following as important: Italian coalition, Italian economic challenges, Italian elections, Italian political uncertainty, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Just ahead of Sunday’s general election, there is little sign of appetite among the leading parties to tackle the significant challenges that Italy faces.

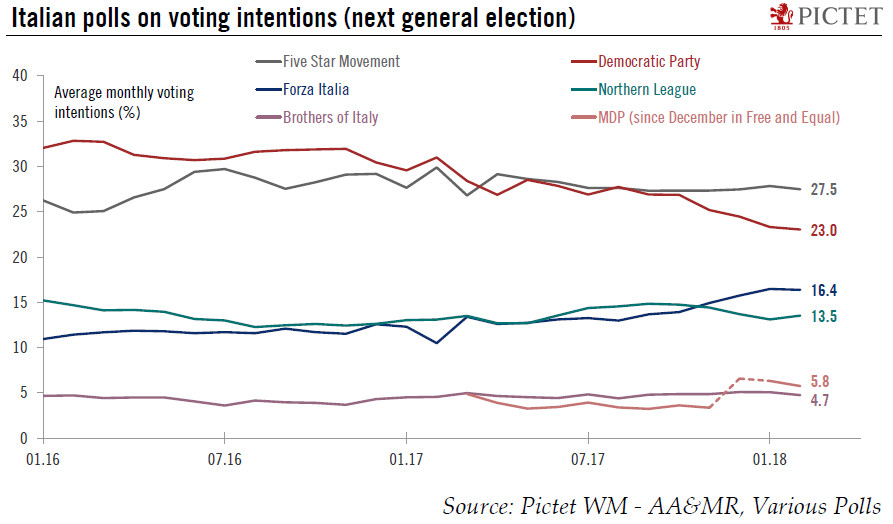

According to the last polls published before the blackout period, no single party or coalition is projected to win an outright majority in the Italian general election next Sunday.

Given cyclical growth, near-term economic risks seem to be contained, but Italy’s potential growth rate is low, and youth unemployment is among the highest in Europe. The country has the second-highest debt load in the euro area after Greece (132% of GDP). Over the past few years, Italy has endeavoured to address certain structural issues, but more steps need to be taken to lift the Italian growth rate to a sustainably higher level.

Whatever Italy’s next government looks like, the chances that it will push through long-term structural reforms to improve economic performance or to tackle the country’s public debt appear low. Based on election promises, the situation could even worsen. All parties are pledging significant expansionary policies and cutting tax is an important part of the programmes of the centre-right parties in particular. Repealing the 2011 Fornero pension reform features prominently in both the centre-right and Cinque Stelle manifestos. Such policies would likely put Italy on course for a confrontation with the European Commission over fiscal consolidation and deficit reduction targets at some point. Already, Italy is not in compliance with EU fiscal rules. Barring compromise (likely), the Commission could be forced to open a procedure against Italy (which is to present an update on its fiscal situation in April-May). Rising tension with the EU and fiscal slippage could further heighten market concerns about Italy’s debt sustainability.

Bottom line: while this general election is among the most uncertain in Italian history, whoever manages to form a government is unlikely to show any eagerness to tackle the root problems that Italy faces. Thus, while near-term risks may be contained, investors are likely to become less sanguine about the medium-term outlook as monetary and external tailwinds are likely to wane gradually.