In spite of rate differentials, the dynamics driving US Treasuries and possible changes in global growth may limit yen and franc decline.The start of the year has seen the Japanese yen and Swiss franc appreciate strongly against the US dollar (they rose by 5.6% and 4.4% respectively between 1 January and 22 February) despite higher US yields. However, this rise in US yields came with heightened market volatility, favouring safe haven currencies such as the yen and franc.Indeed, both currencies are characterised by structurally large domestic current account surpluses and positive net international investment positions. At a time of low global risk appetite, the lack of recycling outflows (investors normally seek higher yields elsewhere when global risk appetite is high) to counter the

Topics:

Luc Luyet considers the following as important: Macroview, Swiss franc depreciation, yen depreciation

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

In spite of rate differentials, the dynamics driving US Treasuries and possible changes in global growth may limit yen and franc decline.

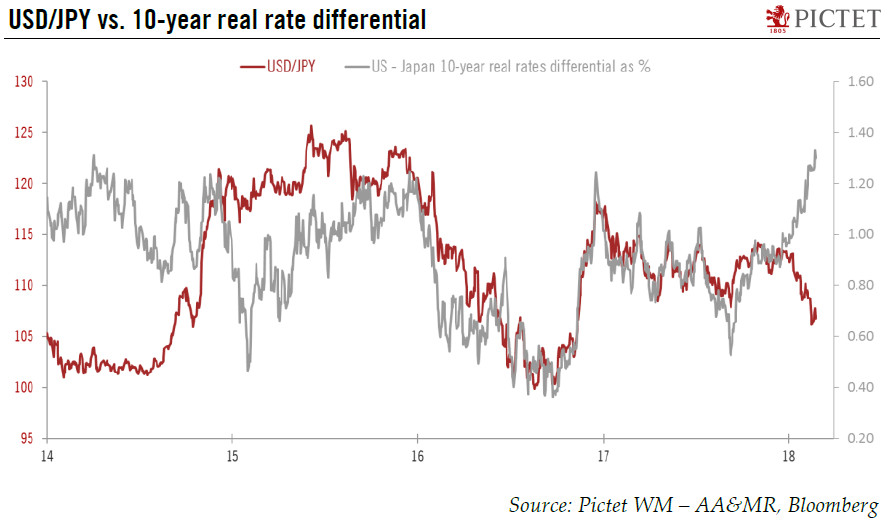

The start of the year has seen the Japanese yen and Swiss franc appreciate strongly against the US dollar (they rose by 5.6% and 4.4% respectively between 1 January and 22 February) despite higher US yields. However, this rise in US yields came with heightened market volatility, favouring safe haven currencies such as the yen and franc.

Indeed, both currencies are characterised by structurally large domestic current account surpluses and positive net international investment positions. At a time of low global risk appetite, the lack of recycling outflows (investors normally seek higher yields elsewhere when global risk appetite is high) to counter the upward pressure stemming from current account surpluses and the potential repatriation of foreign investments tend to support the yen and franc, despite their low yields.

Although we continue to believe global risk appetite will remain healthy during 2018, the risk of additional spikes in market volatility has increased given the recent dynamics in US Treasuries and potential changes in the global growth regime. Consequently, while we still believe the yen and franc will depreciate, we are lowering our forecast for the magnitude of the depreciation of these defensive currencies in 2018. We now see a move towards JPY115 and CHF0.98 per USD in 2018, compared to current spot prices of JPY107 and CHF0.93 per USD.

Although we have decided to lower our expectations for yen and franc decline, we believe the environment remains rather negative for defensive currencies. Indeed, our scenario of strong US growth together with a gradual rise in inflation should support capital flows into US assets, supporting the US dollar in 2018. Indeed, the attractiveness of US equities has significantly improved thanks to the US tax cuts, while US fixed income, with its current elevated carry, offers a decent cushion against a potential decline in bond prices.