Although highly uncertain, any truce between the US and China at the G20 meeting could delay new tariffs.A new low point in trade tensions between the US and China was reached in September 2018 when the US placed an additional 10% duty on roughly USD200 billion of Chinese imports. However, since then, hints at a potential ‘détente’ have focused on the G20 summit in Buenos Aires at the end of November, with hopes that progress there could delay the setting of tariffs on all Chinese imports into the US by several months. This said, the risk that across-the-board tariffs are introduced next January are not completely off the table, in our view, and could resurface if talks break down.Indeed, it remains uncertain whether US President Donald Trump will strike a ‘deal’ with Chinese president Xi

Topics:

Thomas Costerg and Dong Chen considers the following as important: G20 meeting, Macroview, US China negociations, US China trade tension

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Although highly uncertain, any truce between the US and China at the G20 meeting could delay new tariffs.

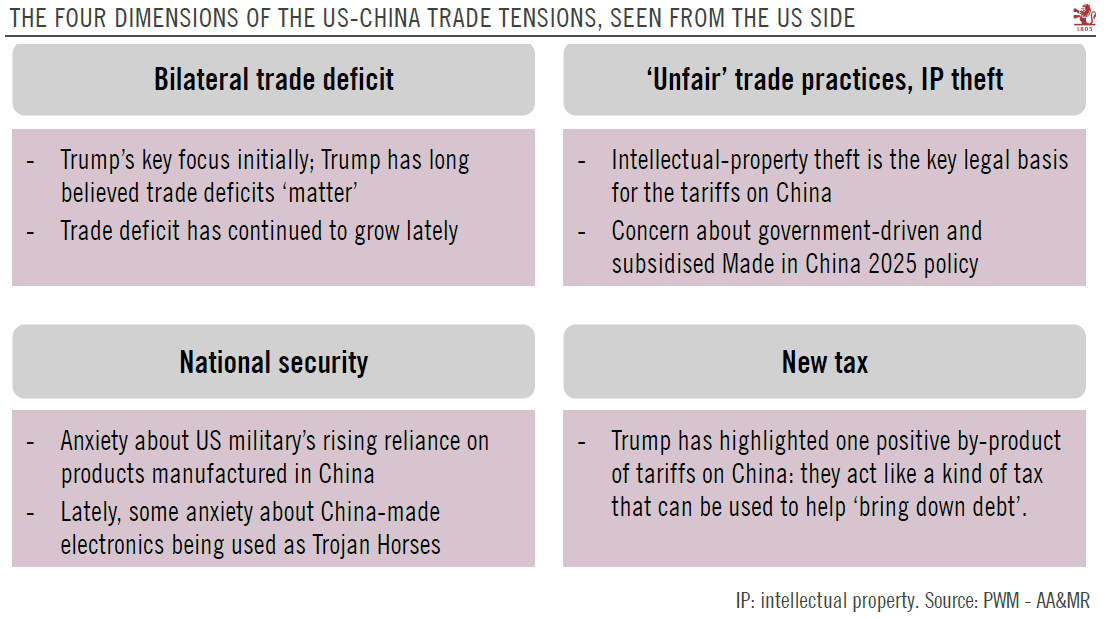

A new low point in trade tensions between the US and China was reached in September 2018 when the US placed an additional 10% duty on roughly USD200 billion of Chinese imports. However, since then, hints at a potential ‘détente’ have focused on the G20 summit in Buenos Aires at the end of November, with hopes that progress there could delay the setting of tariffs on all Chinese imports into the US by several months. This said, the risk that across-the-board tariffs are introduced next January are not completely off the table, in our view, and could resurface if talks break down.

Indeed, it remains uncertain whether US President Donald Trump will strike a ‘deal’ with Chinese president Xi Jinping at the G20 meeting. Trump seems to be under pressure from policy hawks like US Trade Representative Robert Lighthizer and even Vice President Mike Pence, who adopted quite an aggressive tone on his recent tour of Asia. Still, Trump seems guided by a willingness to do business with Xi, so a positive signal of an intent to pursue negotiations, however fragile, is not to be excluded. A true trade deal at this G20 summit, however, remains quite unlikely.

For its part, China has been holding out low hopes for a deal. While the government is still eager to reach a trade agreement with the US, it seems it is also prepared for the ‘trade war’ to drag on for years.

All in all, our base case remains that bilateral issues remain deep seated and that the US will end up extending tariffs to all Chinese imports in 2019. A delay of the 25% tariffs on half of Chinese imports that are scheduled to enter into force in January (up from the current 10%), seems remote at this stage, as Trump seeks a way to pressure China into further talks. The macro impact of the tariffs remains limited—but it is worth watching how financial and market conditions evolve if confrontation escalates.