Moderate rise in core inflation should not divert Fed from its current policy path.February core PCE inflation rose 0.23% m-o-m, in line with expectations. The y-o-y reading was up to 1.6% from 1.5% in January.The improvement in US core inflation remains quite unspectacular when taking into account full employment and solid underlying growth (likely to reach 3% this year).Core inflation should rise to 2% y-o-y in Q2-2018, but it is then likely to be broadly stagnant for several months.Rising inflation is unlikely to steer the Fed off its current routine of one quarter-point rate hike per quarter. It would take core inflation to rise above 2.5% y-o-y (and GDP to rise above 3%) for the Fed to consider accelerating tightening, we think. That remains quite unlikely in the near future.Read

Topics:

Thomas Costerg considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Moderate rise in core inflation should not divert Fed from its current policy path.

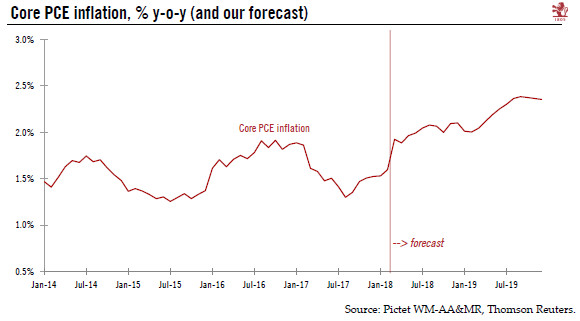

February core PCE inflation rose 0.23% m-o-m, in line with expectations. The y-o-y reading was up to 1.6% from 1.5% in January.

The improvement in US core inflation remains quite unspectacular when taking into account full employment and solid underlying growth (likely to reach 3% this year).

Core inflation should rise to 2% y-o-y in Q2-2018, but it is then likely to be broadly stagnant for several months.

Rising inflation is unlikely to steer the Fed off its current routine of one quarter-point rate hike per quarter. It would take core inflation to rise above 2.5% y-o-y (and GDP to rise above 3%) for the Fed to consider accelerating tightening, we think. That remains quite unlikely in the near future.