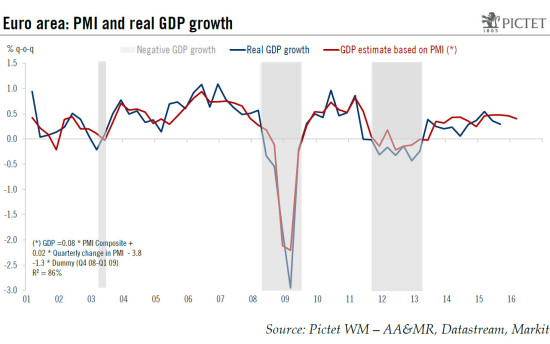

Despite a drop in January, the composite PMI remains resilient in terms of real activity. We continue to expect the pace of euro area growth to speed up from 1.5% in 2015 to 1.8% in 2016. Euro area business surveys (PMIs and IFO) disappointed in January, partly as a reflection of global uncertainty related to EM growth and market volatility so far this year. PMIs survey: easing, but still at a high level According to Markit’s preliminary estimates, the euro area composite PMI eased from 54.3 in December to 53.5 in January, below consensus expectations (54.1). January’s decline was due to a drop in both sectors: services (-0.6 point to 53.6) and manufacturing (-0.9 point to 52.3). The breakdown by components highlighted the external risk to growth and inflation. In the manufacturing sector, the output (-1.3 point to 53.2), new orders (-1.1 point to 53.1) and new exports orders (-0.9 point to 52.3) indices declined in January, but they still remain in expansion territory. Positive surprises came from the services business expectations index (+1.9 point to 65.2) which increased sharply, reaching its highest level since April 2011. As for price dynamics, the input prices index fell to its lowest level since early 2015, whereas the output price index remained in contraction territory.

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: euro area, Ifo, Macroview, PMI

This could be interesting, too:

Marc Chandler writes Busy Wednesday: French Confidence Vote, Fed’s Powell Speaks, ADP Jobs Estimate, and Beige Book

Marc Chandler writes French Government on Precipice, Presses Euro Lower

Marc Chandler writes Yen Jumps on Rate Hike Speculation

investrends.ch writes Deutschland: Auftragsmangel steigt auf höchsten Wert seit 15 Jahren

Despite a drop in January, the composite PMI remains resilient in terms of real activity. We continue to expect the pace of euro area growth to speed up from 1.5% in 2015 to 1.8% in 2016.

Euro area business surveys (PMIs and IFO) disappointed in January, partly as a reflection of global uncertainty related to EM growth and market volatility so far this year.

PMIs survey: easing, but still at a high level

According to Markit’s preliminary estimates, the euro area composite PMI eased from 54.3 in December to 53.5 in January, below consensus expectations (54.1). January’s decline was due to a drop in both sectors: services (-0.6 point to 53.6) and manufacturing (-0.9 point to 52.3). The breakdown by components highlighted the external risk to growth and inflation. In the manufacturing sector, the output (-1.3 point to 53.2), new orders (-1.1 point to 53.1) and new exports orders (-0.9 point to 52.3) indices declined in January, but they still remain in expansion territory. Positive surprises came from the services business expectations index (+1.9 point to 65.2) which increased sharply, reaching its highest level since April 2011. As for price dynamics, the input prices index fell to its lowest level since early 2015, whereas the output price index remained in contraction territory.

Overall, despite January’s drop, the composite PMI remains resilient in terms of real activity and is consistent with a real GDP rising at a quarterly rate of around 0.4% q-o-q in Q1, in line with our forecast. Thus, we continue to forecast an increase in GDP growth from an estimated 1.5% in 2015 to 1.8% in 2016, mainly domestically driven, with some downside risks from the external side. As a result, the February sentiment data will have to be watched very carefully.

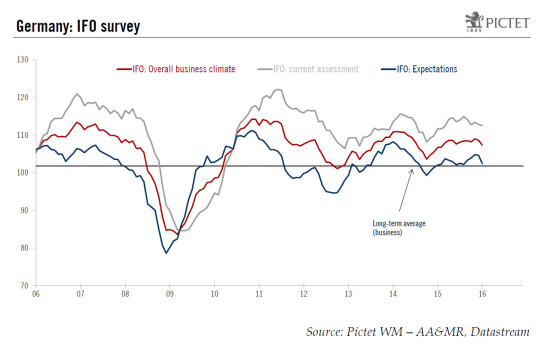

In Germany, sentiment among German businesses weakened at the start of the year. The flash composite PMI fell by 1.0 point to 54.5 in January, below consensus expectations (55.1). The IFO business survey mirrored the downside surprise in the PMI. Indeed, the IFO headline business climate index fell from 108.6 in December to 107.3 in January, worse than consensus expectations (108.4). January’s decrease was driven by a drop in both components. While the current assessment index dropped moderately (-0.3 point to 112.5), the expectations index (-2.2 points to 102.4) marked its largest one-month decline since June 2012. This fall was concentrated in the manufacturing sector, in line with the message given by German PMI, and presumably reflects concerns about global demand. As mentioned in the IFO’s press release, “business expectations in manufacturing sector were substantially revised downwards. Sentiment weakened in several branches mainly due to the poorer export outlook”. Thus, if such concerns ease, expectations might rebound.

While the weakness was mainly concentrated in the manufacturing sector, the other sectors posted mixed signals. The retail IFO improved, whereas both services PMI and services IFO fell in January, with the latter falling from its record high to a five-month low.

Overall, German IFO and PMI surveys are consistent with GDP growth of around 0.4% q-o-q for Q1, mainly domestically driven.

In France, the flash composite PMI increased to 50.5 in January from 50.1 in December, slightly above consensus expectations (50.3). The increase was essentially due to a rise in flash services PMI (+0.8 point to 50.6). This came after two monthly declines in services activity following the Paris attacks. In contrast, the negative surprise came from the flash manufacturing PMI, which decreased by 1.4 point to 50.0 in January on the back of sharp drops in new orders (-3.0 points to 48.7), new exports orders (-2.0 points to 48.7) and output indexes (-1.2 point to 50.0). In contrast, the employment component remained broadly stable at 50.0.

Overall, the composite PMI for Q1 suggests that French real GDP growth is likely to remain modest.

In other euro area countries where no flash estimates are provided, Markit indicated that “countries also continued to enjoy strong output and employment growth, though at a slightly slower rates of expansion than peaks seen late last year”.

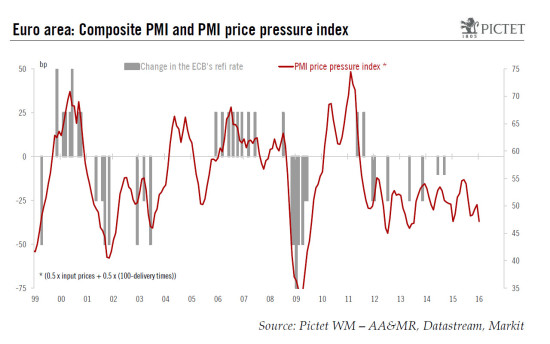

Weak price developments put pressure on the ECB

Although the latest euro area business climate indicators can be described as resilient overall in terms of activity and jobs prospects, the same cannot be said of developments of price pressures, or the lack thereof. Our simple gauge of (dis)inflationary pressures points to a marked deterioration in the January PMIs (see the chart below). Other indicators reflected new evidence of lower input prices while output prices have remained broadly stable over the past few months. Moreover, as Draghi pointed out last week, any upside from stronger (nominal) wage growth should remain very much contained for now.

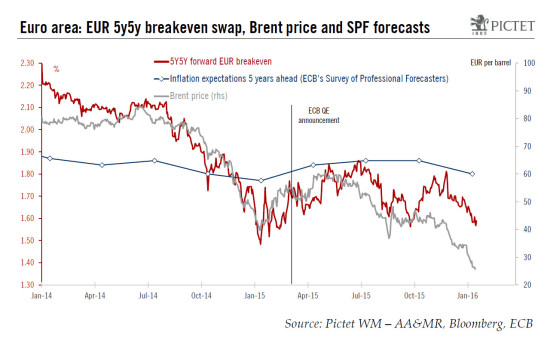

The most important factor therefore remains inflation expectations. The longer oil and inflation remains at depressed levels, the higher the risks that business surveys, not only market-based inflation expectations, reflect those concerns over price stability. Last week, the Survey of Professional Forecasters showed long-term inflation expectations falling from 1.86% to 1.80%, not far away from their lowest level on record, while the distribution of expectations further shifted to the downside.

In all, we expect the ECB to act as a risk manager and to deliver a new easing package at its 10 March meeting, including another 10bp deposit cut and a EUR20bn increase in the pace of monthly purchases, to EUR80bn a month.