Macroview September Flash PMIs were a mixed bag, but a closer look provides grounds for optimism. Markit’s euro area flash PMI indices for September were mixed, with France outperforming but business confidence declining in the German services sector as well as in the rest of the currency union. However, details of the PMI readings were generally better than the headlines. New orders rose in September and labour market dynamics remained supportive. Perhaps the best news from the Markit PMIs was that price pressures continued to build for the seventh straight month, albeit from very low levels. We are keeping our euro area GDP forecast unchanged at 1.5% in 2016 and 1.3% in 2017, with small upside risks.The flash PMI number for Germany fell in September, and average PMI for the third quarter is looking weaker than it was in the second. However, forward-looking services indices were much more encouraging and Markit suggested the current slowdown “may only be a temporary spot”. The flash composite PMI index for France reached a 15-month high in September. While a closer look at some underlying components of the index provide grounds for caution, French GDP growth looks on track to rebound to around 0.4% q-o-q from -0.1% in the second quarter.Today’s PMIs are unlikely to materially alter the outlook for the European Central Bank.

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: Composite PMI, euro area business activity, Flash PMI, Macroview

This could be interesting, too:

Jeffrey P. Snider writes As The Fed Seeks To Justify Raising Rates, Global Growth Rates Have Been Falling Off Uniformly Around The World

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

September Flash PMIs were a mixed bag, but a closer look provides grounds for optimism.

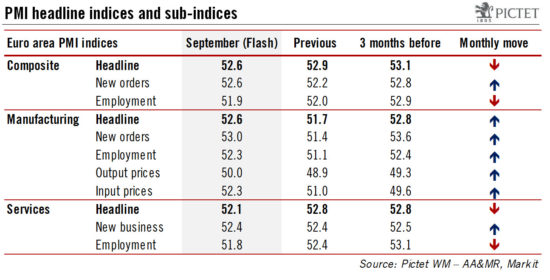

Markit’s euro area flash PMI indices for September were mixed, with France outperforming but business confidence declining in the German services sector as well as in the rest of the currency union. However, details of the PMI readings were generally better than the headlines. New orders rose in September and labour market dynamics remained supportive. Perhaps the best news from the Markit PMIs was that price pressures continued to build for the seventh straight month, albeit from very low levels. We are keeping our euro area GDP forecast unchanged at 1.5% in 2016 and 1.3% in 2017, with small upside risks.

The flash PMI number for Germany fell in September, and average PMI for the third quarter is looking weaker than it was in the second. However, forward-looking services indices were much more encouraging and Markit suggested the current slowdown “may only be a temporary spot”. The flash composite PMI index for France reached a 15-month high in September. While a closer look at some underlying components of the index provide grounds for caution, French GDP growth looks on track to rebound to around 0.4% q-o-q from -0.1% in the second quarter.

Today’s PMIs are unlikely to materially alter the outlook for the European Central Bank. We continue to expect its quantitative easing (QE) programme to be extended by at least six months beyond March 2017 along with technical changes to address the scarcity of bonds for QE purchase. At the margin, lower disinflationary pressures are likely to make the ECB more confident that QE is working, with the hope that better policy transmission will eventually help achieve price stability.