European financial stocks have sold off sharply in recent weeks, raising concerns about a new banking crisis. European banks have been underperforming the European equity market to much the same degree as US banks have been underperforming the US market, suggesting that there is no specific issue with European banks. However, the banking sector is vulnerable to pressure on earnings expectations from wider concerns about the global economy, which will continue to weigh on bank stocks. Three new sources of earnings downgrades for European and US banks have emerged in recent weeks. First, on the back of losses arising from low oil and commodities prices, a realisation that the global corporate credit cycle is turning, having previously been on a positive trend since the end of the 2007-08 financial crisis. Some losses on loans to the energy sector were taken in Q4, mostly by US banks and in some cases (such as UBS) by European banks, with banks guiding that there is more to come if commodity prices stay low. How high will losses be? That will depend on how low commodity prices go, and for how long they stay there. However, loan losses will be gradual, spread over several quarters—very different from 2007-08, where the marking-to-market of securities in banks' trading books required them to book losses immediately.

Topics:

Yann Goffinet considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

European financial stocks have sold off sharply in recent weeks, raising concerns about a new banking crisis.

European banks have been underperforming the European equity market to much the same degree as US banks have been underperforming the US market, suggesting that there is no specific issue with European banks. However, the banking sector is vulnerable to pressure on earnings expectations from wider concerns about the global economy, which will continue to weigh on bank stocks.

Three new sources of earnings downgrades for European and US banks have emerged in recent weeks.

- First, on the back of losses arising from low oil and commodities prices, a realisation that the global corporate credit cycle is turning, having previously been on a positive trend since the end of the 2007-08 financial crisis. Some losses on loans to the energy sector were taken in Q4, mostly by US banks and in some cases (such as UBS) by European banks, with banks guiding that there is more to come if commodity prices stay low. How high will losses be? That will depend on how low commodity prices go, and for how long they stay there. However, loan losses will be gradual, spread over several quarters—very different from 2007-08, where the marking-to-market of securities in banks' trading books required them to book losses immediately.

- Second, lower/negative interest rates, which are generally bad for banks’ net interest margins and profits. In the euro area, we expect the European Central Bank (ECB) to cut its deposit rate (applicable to banks' deposits at the ECB) further into negative territory, probably by 10 bps to -0.4%, in early March. It has been estimated that a 20bps drop in the deposit rate penalises European banks' earnings by about 5%. In the US, until a few weeks ago investors expected four interest rate hikes this year to lift banks' net interest margins. Now markets think that US monetary tightening will be slower, which means lower bank earnings than expected. In addition, following the decision by the Bank of Japan (BoJ) in late January to introduce negative rates, investors are concerned that negative rates may become more widespread and stay negative for longer than expected, and are questioning what the lower bound for interest rates really is—which is all negative for European and US banks.

- Third, on the back of lower credit and equity markets, trading revenues in these areas will be lower, which impacts investment banks and global banks on both sides of the Atlantic. In the asset management business, lower AuM also leads to lower earnings.

Banks therefore face a profitability issue, on several counts. However, there is no issue with liquidity or solvency—at least not yet—nor is this a systemic issue (unlike in 2007-08). European banks’ solvency ratios actually rose by 20 bps in Q4 (based on those banks that have reported so far), to 12.2%, well above their levels before the 2007-08 financial crisis. Bank liquidity is abundant, and banks have access to liquidity in EUR—targeted longer-term refinancing operations (TLTROs) in unlimited quantity—while USD liquidity is also available. It is only for HKD (Hong Kong dollar) that bank interest rates have shown upside pressure in the past weeks.

Market liquidity is a problem, especially on the credit side and may explain why yields on some Additional Tier 1 (AT1) bank issues have spiked and why bank Credit Default Swaps (CDS) spreads have widened considerably. Indeed, there is evidence of hedging of AT1 exposure through buying CDS protection, as AT1 liquidity for the holders of this kind of debt has dried up.

There have been particular concerns about Italian banks (notably over Non-Performing Loans — NPLs) and about Deutsche Bank. However, Italian banks do not face solvency issues (with the possible exception of Banca Monte dei Paschi di Siena) and nor does Deutsche Bank (although it does face severe pressure on its profitability).

Bank stocks therefore appear to be suffering more as a result of the turmoil on global equity markets and wider fears about the global economy than because of issues of a systemic nature specific to the banks themselves. Equity markets have sold off on concerns over the slump in the oil prices, China’s slowing growth and financial mismanagement, and central banks’ waning ability to prop up growth. Combined with a stronger dollar until very recently, this has increased fears that the Fed may have tightened too soon and that the US economy could fall into recession.

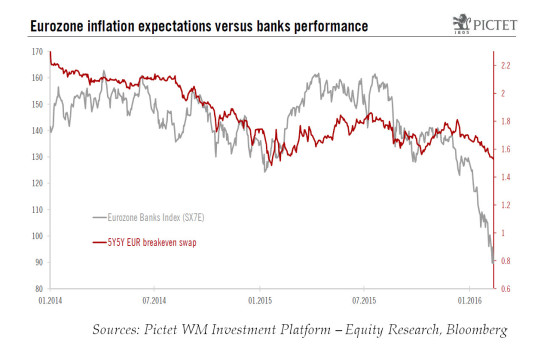

Deflationary risks are a particular concern for banks, given that the real value of debt increases when inflation turns negative. As risks of deflation are seen to increase, so do the perceived risks to the banking sector, on both sides of the Atlantic (see chart below). In addition, the banking sector is usually high beta in times of turmoil, a consequence of banks being highly leveraged entities (equity/total assets is often below 5% in Europe, slightly higher in the US) and having broad exposure across sectors and geographies—notably, in the current environment, to oil and gas, commodities and emerging markets.

The chart above illustrates some correlations between Eurozone inflation expectations and the performance of Eurozone banks.

For bank stocks to recover significantly, concerns about these risks will have to abate—especially concerns about the global deflationary effects that could arise from a sharp weakening of the Chinese yuan. Until then, the sector may find it difficult to perform sustainably.

Within the financial sector, current conditions are likely to favour non-banks with low balance sheet risk that are not too vulnerable to lower revenues. Among banks, domestic retail banks with little market exposure may well be better placed. Insurers present generally less risk than banks, with typically strong balance sheets and good dividend-paying capacity. Within insurance, investors now favour non-life insurance, as market risks are lower than for life insurers.