(Disclosure: Some of the links below may be affiliate links) Everybody will tell you that raising children is very expensive. In fact, in the United States, it is supposed to cost a quarter of a million dollars. And, in Switzerland, statistics say that it will cost you over 200’000 CHF!But is raising a baby really that expensive? And is there something we can do to raise a baby frugally and reduce our expenses? Yes, there is!Today, I talk with Mama Bear Finance, who is a first-time mom. During these ten months, she managed to spend less than 4000 CHF! And she kept track of all her baby expenses!And now, she is sharing her experience with us! Keep on reading to learn how you can raise a baby frugally in Switzerland!1. Tell us about yourselfHello, I’m a fellow personal finance blogger like

Topics:

Mr. The Poor Swiss considers the following as important: Frugality

This could be interesting, too:

Mr. The Poor Swiss writes What is The Best Credit card in Switzerland for 2020?

Mr. The Poor Swiss writes What is The Best Credit card in Switzerland for 2020?

Mr. The Poor Swiss writes 7 Things To do in Lockdown To Improve Your Finances

Mr. The Poor Swiss writes Cheap International Transfers with Neon

(Disclosure: Some of the links below may be affiliate links)

Everybody will tell you that raising children is very expensive. In fact, in the United States, it is supposed to cost a quarter of a million dollars. And, in Switzerland, statistics say that it will cost you over 200’000 CHF!

But is raising a baby really that expensive? And is there something we can do to raise a baby frugally and reduce our expenses? Yes, there is!

Today, I talk with Mama Bear Finance, who is a first-time mom. During these ten months, she managed to spend less than 4000 CHF! And she kept track of all her baby expenses!

And now, she is sharing her experience with us! Keep on reading to learn how you can raise a baby frugally in Switzerland!

1. Tell us about yourself

Hello, I’m a fellow personal finance blogger like The Poor Swiss, and I live in Lausanne, Switzerland, as an American expatriate.

I’m in my early 30s, and I want to achieve financial independence.

My hobby is to achieve financial independence ASAP. Just kidding, just kidding. I love ice skating, skiing, and snowboarding – basically winter sports! I developed this liking since moving to Switzerland six years ago.

I also love to draw, read finance blogs, and travel!

Lastly and most importantly, I’m a wife and a mom to a little cutie pie whom I called, Baby Bear, in my blog.

2. Tell us about your baby

Baby Bear is now one year old! Time really flies.

She’s a baby full of energy and curiosity about the world around her. I often take her on my back when we travel.

Baby Bear loves to go out, and I think she’s quite adventurous. Whenever we go out, she would be fascinated by anything and everything!

It’s really incredible to see how a little baby can appreciate the smallest things like the birds chirping or the leaves falling from a tree. She actually made me stop to smell the roses, literally!

She is also my main source of inspiration that motivated me to create my blog, Mama Bear Finance.

3. What is most expensive in raising a baby?

The most expensive expense is, no doubt, the healthcare cost.

We have the basic insurance plan with Helsana, and it cost 120 CHF per month in health insurance premium.

We also have out-of-pocket healthcare costs for miscellaneous stuff such as baby skin cream, eye drop, compress for babies, vitamin D (although I later found out that the insurance can cover this with a doctor’s prescription), etc.

4. Can you detail the expenses in raising your baby?

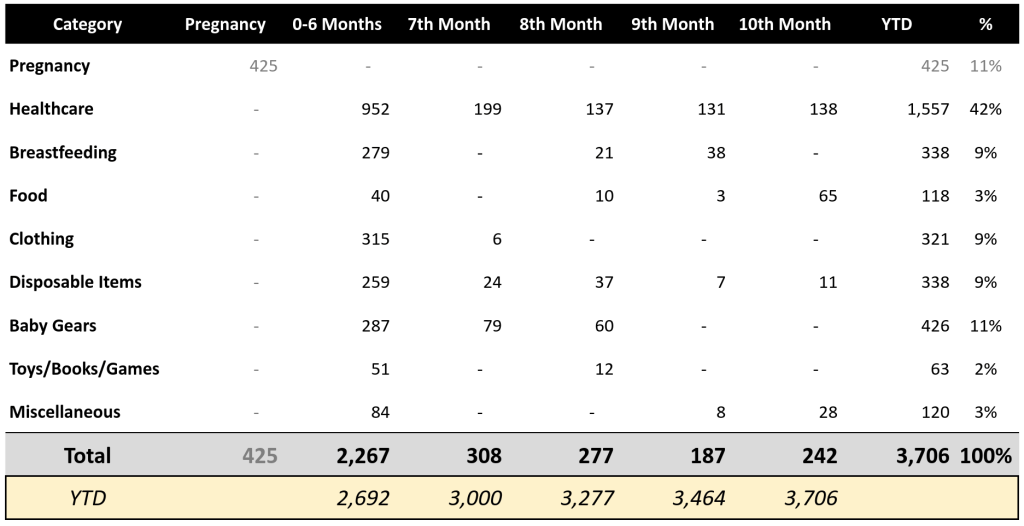

Here is a table of the total cost of raising a baby till the 10th month, including prenatal costs. The expenses ares categorized by pregnancy, healthcare, breastfeeding, food, clothing, disposable items, baby gears, toys/books/games, and miscellaneous items.

I planned to keep tracking this expense for the full 12 months because I was curious to find out my total expenditures comparing to the national average household in the U.S.

(Please note that I consider CHF/USD at 1:1 parity to make it simple and because the exchange rate has been fluctuating around this level for the past five years. As I have mostly American readers, I use the US$ sign instead of CHF in my blog.)

As you can see, healthcare amounts to a whopping 42% or $1,557 of the full cost!

Then, the next expensive category is baby gears, which comprised 9% or $426 of the total cost. This category consists of the strollers (one used Bugaboo and one new travel stroller), baby carriers, carpets, blankets, a high chair, and a secondhand crib that we bought, among other things.

Coming up tied for third place are breastfeeding and disposable items at 9% or $338 of the total cost. Surprisingly, breastfeeding is not free. I actually spent quite a lot on Lecithin supplements and lactation consultant fees.

Meanwhile, the disposable items are made of mostly disposable diapers and wipes, which, as many parents know, we use a lot! This is because we also use cloth diapers interchangeably, so without this aspect, the disposable costs will be even higher!

According to the U.S. Department of Agriculture, the cost estimated to raise a child from birth to 17 years old is about $233,610 (or $13,742 per year). This excludes higher education costs and prenatal costs.

I’m quite amazed that our spending of $3.3k (excluding prenatal cost) is significantly below the U.S. national average of $13.7k.

However, this is because I was a stay-at-home-mom, so we didn’t have to shell out for childcare costs.

Also, I haven’t allocated the cost of grocery and housing since we buy food in bulk, and our housing situation didn’t change. The food cost in this chart shows the ready-to-eat baby food we bought from the supermarket during our travel or when we go out.

If I include childcare (which is about 2,000 – 3,000 CHF in Switzerland in our area) and grocery cost, we would be way above the national average of American households.

5. Is there something that people should not buy second-hand?

Luckily, I have not had any bad experience with buying secondhand baby items in Switzerland. In fact, all of the stuff we bought used were in very good shape.

But if there is one thing that I would recommend NOT buying secondhand would be cloth diapers.

I’m a proponent of using cloth diapers since they offer many benefits such as eco-friendliness, cost efficiency, no chemicals added, and they actually help with potty training earlier!

We bought 15 cloth diapers brand new for $225 total, and it’s the best “investment” we’ve made.

I did a full comparison cost of this on my blog about using exclusively cloth diapers vs. disposable diapers, and the difference is over $1,600 in savings.

Therefore, I highly recommend parents to try using cloth diapers, but not buy them used since these touches the sensitive body part of the baby.

Also, seeing how my baby pees and poops, it’s best if no one buys them off of us, haha.

6. Is there anything in Switzerland that is more expensive for raising a baby?

Perhaps food! I don’t mean processed baby food because the price of that is quite standard internationally, especially for well-known brands.

But I’m talking about grocery cost, and we all know that Switzerland has one of the highest standards of living in the world, so grocery definitely costs way more compared to other parts of the world.

Since I’ve been making fresh, healthy baby food at home using ingredients bought in the supermarket, I can see that this cost adds up in our grocery bill compared to before we had a child.

It’s hard to account for how much exactly, but I think I can estimate that it may have added about 100 – 150 CHF per month. That’s 1,200 – 1,800 CHF per year, which is in par with healthcare cost!

7. What is your best tip for raising a baby frugally?

My best tip that I got from experienced parents is not to splurge or overspend on buying frivolous things for the baby.

This is because a baby grows SO QUICKLY, and those cute clothes, shoes, and toys will only be used for a short period. Therefore, it doesn’t make sense to buy overly expensive items at a baby’s early stage.

I’ve heard over and over again that many parents regretted buying expensive stuff for their firstborn, and when it came to their second, they were much more relaxed and opened to buying secondhand or using hand-me-downs. They also no longer buy the most expensive brands.

This is because, as new parents, we get very excited about having our first baby, so we are more inclined to buy the best baby stuff. That’s why many baby brands target FIRST TIME parent.

I, of course, felt compelled to buy things as well because they are just so darn cute! But then since I’m pursuing financial independence and I wanted to save money to travel with the baby in the future (knowing fully that it’ll cost more to travel later), I prioritized these financial goals over instant gratification.

So far, I don’t feel like we missed out on not spending enough for her because she seems to have everything she needs! Besides, I know that what she truly needs is our love, our presence, and our care, which supersedes any material things.

Also, as expatriates, we do have the plan to move back to the U.S. someday, so not overbuying means fewer things to worry about the day we leave Switzerland!

8. What is your best tip for raising a baby?

I think food is very fundamental to the health of a baby, so I would recommend breastfeeding and making homemade baby food.

Now, I understand that this is much easier said than done as I can imagine it’d be difficult if I have to work full-time.

But since I did a research project for one of the largest infant formula companies during my MBA, I learned the unbeatable benefits of breastfeeding (ironically). Breast milk is known to provide an infant with the best start in life, and it also provides antibodies for breastfeeding moms.

Not to mention the cost savings of breastfeeding vs. buying infant formula, but that’s beside the point really. The health benefit is truly the most fundamental part.

In terms of making baby food, I try to make a batch so that it’s enough for a few days, and it’ll still be fresh in the fridge.

But all-in-all, I do know that there is no one-size-fits-all to raising a baby, so my BEST tip is just to trust your instincts as parents and that everything will be okay!

10. Do you foresee any big expense coming?

I foresee childcare to be the next big item. As we do not have any families in Switzerland, we will have to put Baby Bear in childcare, and that is very expensive here.

But if we do decide to move back to the U.S., then I believe my parents can take care of her, so the next big item will be healthcare and education if we decide to put her in private school.

11. Anything you would like to add?

I just have a quick comment on the notion of raising a baby frugally. In fact, we didn’t plan to be frugal parents, but we did aim to be minimalists.

Since we do have plans to move back to the U.S. one day, we are very mindful of what we accumulate in our apartment. While keeping this minimalist approach, we also developed an appreciation for keeping our apartment free of clutter.

This is especially true during my “nesting period” when I developed an urge as a new mom to get rid of A LOT of stuff to make room for the baby. It was an eye-opening exercise to know how much junk we have in our apartment and how getting rid of them felt so refreshing.

I think the difference between being frugal and minimal is that frugalism focuses more on the savings aspect, while minimalism focuses more on having less to live more mindfully.

Although I’m frugal by nature, I don’t want to limit my spending on the baby because she really is one of the most important people in my life. I would trade any savings and delay in reaching financial independence just to ensure the optimal care for her.

However, by being minimalists, we actually also achieved tremendous savings by not overbuying things. And the funny part was that even though we don’t try to buy new things, her wardrobe, toys, and everything else just naturally accumulate! So, it was really good that we became more mindful about not accumulating more stuff.

I think there is certainly an overlap between frugalism and minimalism, and I think we are pretty much in that overlap.

So, by aiming to have fewer things, we also saved a bunch. By tracking our expenses, I can already see a change in my mindset by knowing what is necessary vs. what is frivolous.

What started as a curiosity to find out how much it costs to raise our baby compared to the national average turned out to be quite an insightful lesson about mindful living and spending.

Thanks a lot to Mama Bear Finance for answering all my questions and sharing with us this wealth of information!

I am amazed to see that she was able to spend so little during the first ten months of her baby’s life. And she did all that without lowering the quality of life for her baby and while making her baby as a priority.

I think this is inspirational! And I will review that and contact her once we will have children to try to reduce our expenses as well. But I am not sure I could bear the cloth diapers though!

To learn more about her, you can follow her on Mama Bear Finance. She blogs about personal finance, financial independence, and raising a baby. I would especially recommend her posts about child expenses.

What about you? What are your tips for raising a baby frugally?