(Disclosure: Some of the links below may be affiliate links) You may have read that I am using DEGIRO has my broker. I chose DEGIRO mainly because of its very low fees. I am very satisfied with my experience with DEGIRO. I have not had a big problem since I started using it about a year ago.Interactive Brokers is also a very popular broker. It has been there for much longer than DEGIRO, who is a very young broker. And it also has very low fees. When I chose DEGIRO over Interactive Brokers, I did it because I thought it was cheaper. But I did not thoroughly research the subject.In this post, we are going to compare once again DEGIRO and Interactive Brokers. I am going to make the comparison in detail, including the two different account types of DEGIRO. In the default account of DEGIRO

Topics:

Mr. The Poor Swiss considers the following as important: Investing, Switzerland

This could be interesting, too:

Lance Roberts writes CAPE-5: A Different Measure Of Valuation

Lance Roberts writes CAPE-5: A Different Measure Of Valuation

Lance Roberts writes Estimates By Analysts Have Gone Parabolic

Fintechnews Switzerland writes Top 12 Fintech Courses and Certifications in Switzerland in 2025

(Disclosure: Some of the links below may be affiliate links)

You may have read that I am using DEGIRO has my broker. I chose DEGIRO mainly because of its very low fees. I am very satisfied with my experience with DEGIRO. I have not had a big problem since I started using it about a year ago.

Interactive Brokers is also a very popular broker. It has been there for much longer than DEGIRO, who is a very young broker. And it also has very low fees. When I chose DEGIRO over Interactive Brokers, I did it because I thought it was cheaper. But I did not thoroughly research the subject.

In this post, we are going to compare once again DEGIRO and Interactive Brokers. I am going to make the comparison in detail, including the two different account types of DEGIRO. In the default account of DEGIRO (Basic), DEGIRO can lend your shares to other investors. It is not something that is done by default with Interactive Brokers. Therefore, my previous comparison was not very fair! This time, I am going to try to make it better.

Investing involves risks of losses. Make sure you are aware of that before you start investing.

DEGIRO

As a reminder, DEGIRO is a Dutch brokerage company. It is a quite new company. They only started in 2008 and only opened to the public in 2013. Even though DEGIRO is a Dutch broker, it is now available to many countries, including Switzerland. It is probably the cheapest broker in Europe, if not in the world. And they are growing fast. If you want more information, you can take a look at my review of DEGIRO.

As mentioned several times on this blog, DEGIRO is my broker of choice. The reason is simple: it is the cheapest broker. Period.

We are going to compare the fees of the two brokers for an ETF investor. I will not make the comparison for other cases. Here are the fees of DEGIRO:

- Buy a Swiss ETF: 2 EUR (2.3 CHF) + 0.038%

- Buy a US ETF : 0 CHF

You are probably surprised by the 0 CHF fee for US ETF. It is because DEGIRO is offering a large free list, including the Vanguard funds that I am using. For instance, you have the Vanguard S&P 500 and the Vanguard Total World (VT). If you do not use one of the free ETFs, you will pay exactly the same fee as for Swiss ETFs.

There is also a 2.5 EUR fee per year for each exchange on which you have positions. This fee is called the connectivity fee.

Now, there is something fundamental to take into consideration. There are two kinds of accounts: Basic or Custody. If you opt with the Basic account, you will not get any other fees. But DEGIRO will be able to lend your shares to other people. If you choose for the Custody account, DEGIRO cannot lend your shares. They are yours only. However, the Custody account has some extra fee. You will have to pay fees on dividends. You will pay 1 EUR + 3% of the dividend, with a maximum of 10% of the dividend.

Since I do not want DEGIRO to lend my shares to anyone, I opted for the Custody account. At that time, I did not pay too much attention to this fee because I considered it, wrongly, negligible. In this post, I am are going to compare both account types.

Interactive Brokers

Interactive Brokers is a broker from the United States. It was established forty years ago. And it is now the biggest online broker in the United States. It is used a lot in the personal finance community. It is a great broker, also with very low fees. I do not have anything against Interactive Brokers. When I chose my broker, I almost went with IB but decided to go to DEGIRO to save on fees.

Here are the fees on IB:

- Buy a Swiss ETF: 0.1% of the value with a minimum of 10 CHF

- Buy a US ETF: 0.005 USD per share, with a minimum of 1 USD (1 CHF) and a maximum of 1% of the value.

It can easily be simplified to 10 CHF for a Swiss ETF and 1 CHF for a US ETF. For simple investors like us, we will hit the minimum in most cases.

But there is one more fee that we have to take into account. Indeed, Interactive Brokers has a custody fee of 10 USD (10 CHF) per month. If you do not spend 10 CHF in trade fees, you will pay 10 CHF this month minus the fees you already paid. This is a big deal for small investors like us. However, as soon as you reach 100’000 USD value, they waive this fee!

Something is essential for our comparison: By default, Interactive Brokers does not lend your shares to anyone.

Now, we have all the information we need to compare both brokers!

Starting investor

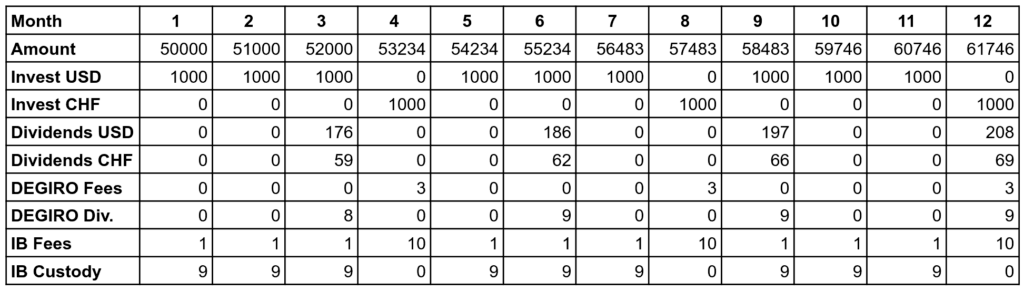

I am going to compare both brokers with several different scenarios. The first scenario is for a starting investor like me. Starting with 50’000 CHF (or USD, the same thing at the time of this writing) and investing 1000 per month. 1000 is invested in Swiss ETF every four months and the other months, invested in US ETF.

The entire portfolio has around 25% Swiss stocks and 75% US stocks. It has a dividend yield of 1.8%, which is around the average on world stocks. And dividends are paid at the end of every quarter. These are reasonable assumptions for a starting investor. And for the sake of math, we are going to ignore that your portfolio can go up and down because of market valuations.

This gives us the following final fees:

- DEGIRO Basic fees: 14 CHF

- DEGIRO Custody Fees: 49 CHF

- Interactive Brokers: 120 CHF

DEGIRO is the clear winner here, as expected. But what this is also showing is that DEGIRO custody fees are not negligible. I thought it was not so expensive as that. I thought that 3% of the dividends was not a lot. But it is a lot more than I thought. And this is for a very small portfolio!

Let’s see what happens if you invest 3000 CHF per month:

We arrive at the following fees:

- DEGIRO Basic fees: 16 CHF

- DEGIRO Custody Fees: 59 CHF

- Interactive Brokers: 120 CHF

Interestingly, DEGIRO fees went up 2 CHF while DEGIRO Custody Fees went up by 10 CHF! And Interactive Brokers fees did not move, which is logical since the custody fees act as a minimum fee.

For a starting investor, with less than 100’000 CHF in his account, DEGIRO is much cheaper than Interactive Brokers. Even DEGIRO Custody is less expensive than IB.

Standard Investor

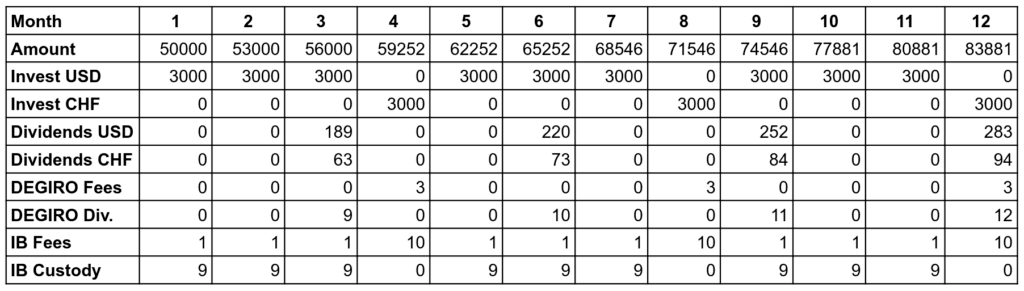

Let’s now explore the case with a bit more money. We still have the same pattern of investment. But the invested value starts at 100’000 CHF, and 2000 CHF are invested each month.

If we do the calculation one more time, we find the following fees:

- DEGIRO Basic fees: 15 CHF

- DEGIRO Custody Fees: 81 CHF

- Interactive Brokers: 39 CHF

This is very interesting! Interactive Brokers become much cheaper now that you do not have to pay custody fees! And it is less expensive than DEGIRO Custody. About twice less expensive! DEGIRO Basic remains very cheap, more than twice cheaper than IB.

Let’s see what happens with 5000 invested each month.

We find this time the following fees:

- DEGIRO Basic fees: 19 CHF

- DEGIRO Custody Fees: 95 CHF

- Interactive Brokers: 39 CHF

Only DEGIRO fees changed. This is because we are still hitting the minimum fees for a transaction from Interactive Brokers.

For a standard investor with about 100’000 CHF of value invested, it is better to either go with DEGIRO Basic or Interactive Brokers. It depends if you want to take the risk of lending your shares.

Advanced Investor

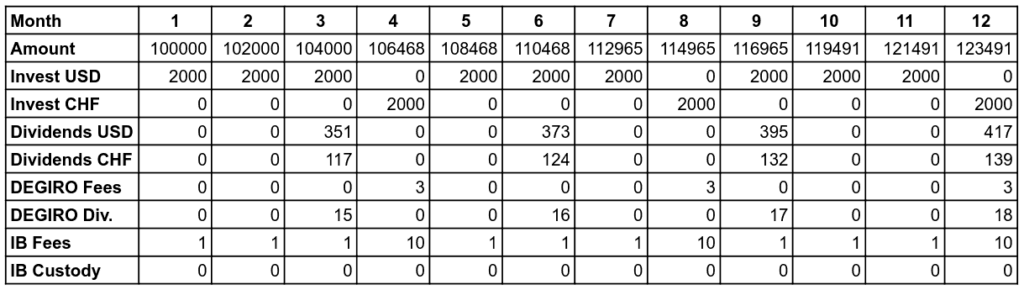

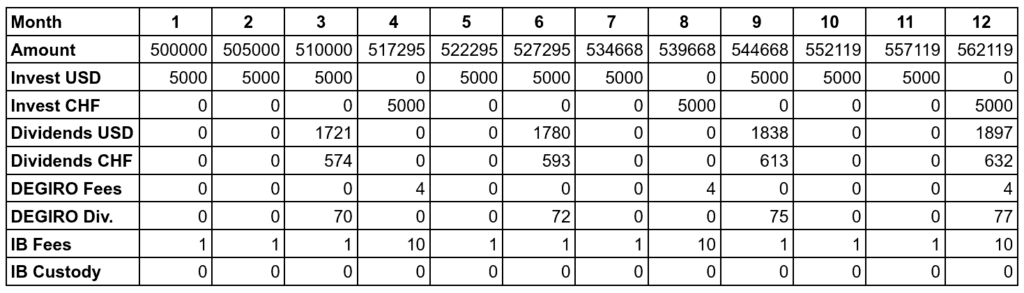

We can now see what happens for an investor on the road the Financial Independence (FI). This investor has 500’000 CHF and is investing 5000 CHF each month.

The advanced investor must pay the following fees:

- DEGIRO Basic fees: 19 CHF

- DEGIRO Custody Fees: 313 CHF

- Interactive Brokers: 39 CHF

DEGIRO Basic and Interactive Brokers fees did not change. But DEGIRO Custody fees have grown very high! With a high net worth, it is a very bad idea to use DEGIRO Custody.

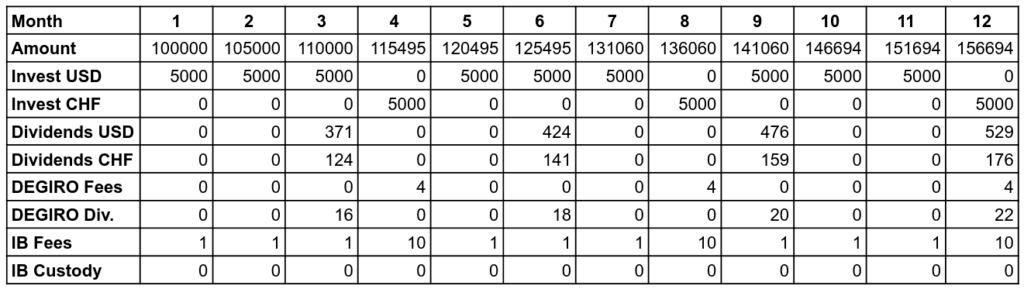

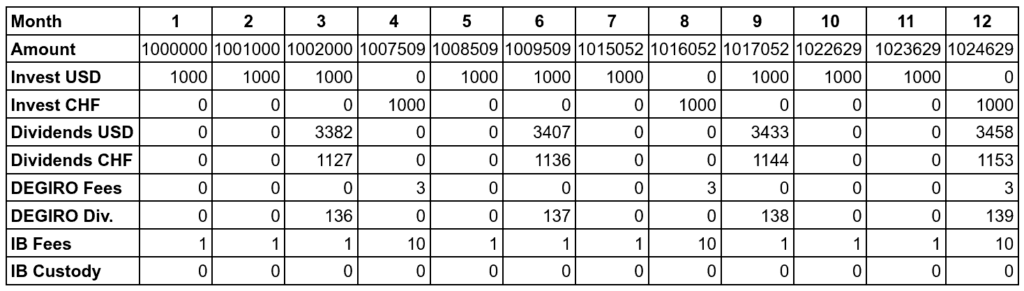

Financially-Independent Investor

Let’s see the last example: An investor that reached FI at one million CHF. Let’s say that he can still invest 1000 CHF per month via a side hustle or some passive income.

The financially independent investor must pay the following fees each year:

- DEGIRO Basic fees: 14 CHF

- DEGIRO Custody Fees: 566 CHF

- Interactive Brokers: 39 CHF

The results are pretty clear! The financially-independent investor will lose 561 CHF each year because of DEGIRO custody fees! Once again, DEGIRO Custody is a very bad choice with a large net worth. This is not an acceptable fee for someone who is financially independent. And taking the risk of your shares being lent when you are entirely dependent on these shares is probably not very reasonable either. So Interactive Brokers is probably the best option here.

Having two brokers?

We have seen that Interactive Brokers is really bad for a value of less than 100’000 CHF. And we have also seen that DEGIRO Custody is really bad for a large portfolio value. But DEGIRO Basic is really cheap.

Nothing prevents you from having two different brokers. You could have an Interactive Brokers account and a DEGIRO account (either Basic or Custody). Since IB is cheap for US positions but expensive for Swiss positions, the idea is to use DEGIRO for CH positions and IB for US positions. Obviously, this is not interesting if you have less than 100’000 CHF. In that case, any DEGIRO account will do better than IB

I have done the computation for all the cases of the article:

- Standard Investor (2000): 18 CHF with IB/Basic and 38 CHF with IB/Custody

- Standard Investor (5000): 22 CHF with IB/Basic and 44 CHF with IB/Custody

- Advanced Investor: 22 CHF with IB/Basic and 99 CHF with IB/Custody

- Financially-Independent Investor: 17 with IB/Basic and 158 with IB/Custody

First of all, we see that using Custody account for CH positions is quickly becoming too expensive. However, if you are willing to risk the share lending of DEGIRO for your CH positions, this could be worth it to have a DEGIRO Basic account for your Swiss positions and an IB account for your US positions.

I think this is a really interesting solution. It is also one layer of protection if one of the two brokers goes bankrupt. In most cases, you will get back your money. But it can take a long time. So if you have two brokers, you can still access the money from one while the other is in jeopardy.

For now, I am far from having 100’000 CHF on my portfolio. So I do not have that problem yet. But I am really thinking of moving my US portfolio to Interactive Brokers once it reaches 100’000 CHF. And I am also thinking of moving my CH portfolio to DEGIRO Basic account. I do not have to take the decision now. But I will think about it and make a decision before I reach that point.

Conclusion

There are a few essential things about these two brokers. DEGIRO Custody is not as cheap as it seems and can easily end up being way more expensive than Interactive Brokers. As expected, Interactive Brokers is too costly for small net worth because of its safe custody fees below 100K CHF. DEGIRO Basic is indeed the cheapest. But you take the risk of lending your shares.

The cheapest broker for you will depend on a few things:

- If you do not care that your shares can be lent to others. The answer is easy. You should use DEGIRO Basic

- If you do not want your shares to be lent and have less than 100’000 CHF. Once again, the answer is easy. You should use DEGIRO Custody account. Interactive Brokers is really too expensive for portfolio below 100’000 CHF.

- If you do not want your shares to be lent and have more than 100’000 CHF. In that case, you should go with Interactive Brokers

- If you do not wish all your shares to be lent. But you can afford the risk on some of your shares. In that particular, you may want to consider using DEGIRO for your Swiss shares and Interactive Brokers for your US shares.

Somebody may think that it is not fair to compare DEGIRO Custody and Interactive Brokers (IB). Because DEGIRO Basic is cheaper, one should compare it against IB. But this is wrong. It is a fair comparison because neither of them is lending your shares. In fact, IB has an option to allow them to lend your shares. In which case, you are getting half of the benefits. That means that IB with this option will be even cheaper!

For now, I do not plan on changing to a new broker. I am still quite satisfied with DEGIRO. But when I reach 100’000 of my US positions, I may consider switching them to Interactive Brokers. We will see about that. I still have a long way to go before that point.

If you liked this comparison, you will like the next comparison where I included the Tiered Pricing of Interactive Brokers.

Regardless of the broker, you need to remember that Investing involves risks of losses. Make sure you are aware of that before you start investing.

What do you think? Do you prefer Interactive Brokers or DEGIRO? What broker do you use?