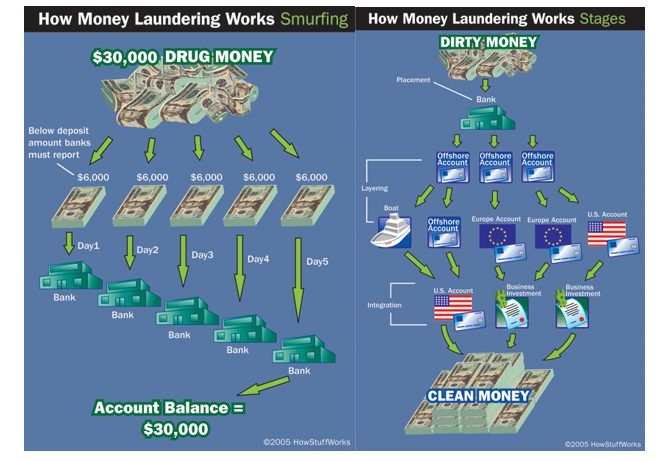

Nous avions abordé dans Dépossession la place essentielle de l’argent de la mafia et du trafic de drogue dans le marché financier globalisé. La reprise de la Wachovia Bank par la Wells Fargo nous avait amené à écrire: « Entretemps, la Wachovia est passée sous pavillon de la Wells Fargo, une des plus grandes banques américaines, présente aussi dans les Caraïbes. Un exemple typique du mixage entre argent propre et argent sale ? Accessoirement, la probité de la Wells elle-même est discutable. Elle a par exemple été condamnée en 2016, suite à la découverte de l’existence de 2 millions de comptes bancaires et de 500’000 cartes de crédit, créées à l’insu des clients. Il faut dire que la Wells Fargo avait été sévèrement exposée à la chute du prix du pétrole – via des prêts accordés à des

Topics:

Liliane HeldKhawam considers the following as important: Autres articles

This could be interesting, too:

Liliane HeldKhawam writes 2025 sera l’année de l’avènement des révolutionnaires de la BigTech au sommet de la gouvernance politique.

Liliane HeldKhawam writes Un Sauveur nous est né! Joyeux Noël.

Liliane HeldKhawam writes L’Humanité vampirisée disponible.

Liliane HeldKhawam writes L’Humanité vampirisée disponible.

Nous avions abordé dans Dépossession la place essentielle de l’argent de la mafia et du trafic de drogue dans le marché financier globalisé. La reprise de la Wachovia Bank par la Wells Fargo nous avait amené à écrire: « Entretemps, la Wachovia est passée sous pavillon de la Wells Fargo, une des plus grandes banques américaines, présente aussi dans les Caraïbes. Un exemple typique du mixage entre argent propre et argent sale ? Accessoirement, la probité de la Wells elle-même est discutable. Elle a par exemple été condamnée en 2016, suite à la découverte de l’existence de 2 millions de comptes bancaires et de 500’000 cartes de crédit, créées à l’insu des clients. Il faut dire que la Wells Fargo avait été sévèrement exposée à la chute du prix du pétrole – via des prêts accordés à des exploitants de gaz de schiste.

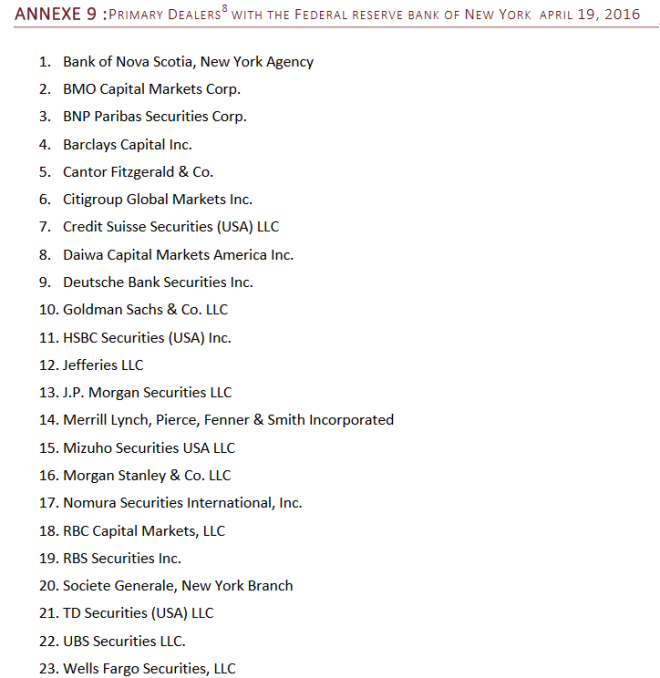

A ajouter que la Wells Fargo – un primary dealer du gouvernement fédéral américain – est aussi un actionnaire du réseau de la Fed. En rachetant la Wachovia, la Wells Fargo pouvait ainsi utiliser les capitaux de cette banque pour racheter de la dette américaine. L’argent blanchi gagne alors non seulement en respectabilité, mais également en pouvoir politique !«

Les grandes banques, pièces maîtresses de l’argent de la drogue. Elles sont incontrôlables et incontrôlées par les autorités publiques, tant elles sont plus puissantes qu’eux.

Et voilà que la JP Morgan, autre primary dealer de la dette publique de l’Etat américain, mais aussi de tous les Etats que nous avons pu contrôler, et 1ère banque planétaire y compris en matière de produits dérivés, vient raviver nos interrogations sur les liens du binôme Mafia-Haute finance internationale.

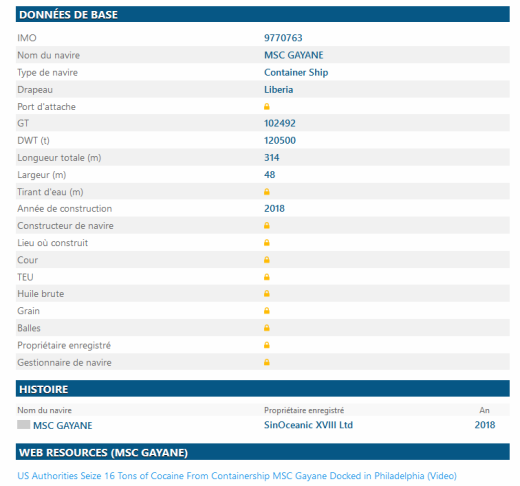

Ce juin 2019, les autorités américaines ont saisi à Philadelphie un cargo avec près de 20 tonnes de cocaïne à bord. Les agents de la force publique sont montés à bord du MSC Gayane le 17 juin et ont découvert la cocaïne, qui aurait une valeur marchande d’environ 1,3 milliard de dollars.

Il s’avère que le navire appartient à un fonds géré par le géant bancaire JPMorgan Chase. Une source proche du dossier a déclaré selon CNN que le MSC Gayane, faisait partie d’un fonds de stratégie de transport géré par l’unité de gestion des actifs de la banque.

Tout de suite après cette information détonante, passée inaperçue par nos médias francophones officiels, CNN rajoute: « Cela signifie que JPMorgan Chase (JPM) n’a aucun contrôle opérationnel sur le navire, un navire battant pavillon libérien, géré par la Mediterranean Shipping Company, basée en Suisse. »

Si ce cargo est bien enregistré dans la liste des 520 bateaux mis à disposition de MSC, entreprise basée à Bâle, une autre information vient se rajouter à ce qui précède. Un site qui gère la base de données de la flotte maritime dans le monde affiche le nom d’une société norvégienne en tant que propriétaire enregistré…

https://www.vesselfinder.com/fr/vessels/MSC-GAYANE-IMO-9770763-MMSI-636018276

Bref, un jeu de pistes qui mène dans un labyrinthe, spécialité de la haute finance globale, qui empêche une fois de plus de remonter aux responsables finaux.

Par conséquent, nous ne pouvons toujours pas répondre à la question: quelle place occupe la mafia globalisée dans la gouvernance du Nouveau Monde? Cette question est pourtant fondamentale, car il serait plus qu’utile de savoir qui contrôle l’épée de Damoclès qu’est la dette publique…

LHK

Source de l’info CNN Business https://edition.cnn.com/2019/07/10/business/jpmorgan-msc-gayane-cocaine-seizure/index.html

Liste des Primary Dealers agréés par le gouvernement US. Extrait du livre Dépossession

Qu’est-ce que le Primary Dealer auprès du gouvernement US?

Les Primary dealers sont les agents d’un système de banques et de courtiers autorisés par la Réserve fédérale américaine à traiter directement en obligations d’État. Ce système a été mis en place en 1960 par la Banque de réserve fédérale de New York (FRBNY) pour mettre en œuvre la politique monétaire au nom de la Fed. En achetant des titres sur le marché secondaire par l’intermédiaire du FRBNY Open Market Desk, le gouvernement augmente les réserves du système bancaire et, partant, la masse monétaire de l’économie. Inversement, la vente de titres entraîne une diminution des réserves, ce qui limite le montant des fonds disponibles pour le prêt. En effet, les négociants principaux sont les contreparties de la Fed aux opérations d’open market (OMO).

Exemple: https://lilianeheldkhawam.com/2018/11/16/france-un-senateur-decouvre-la-fonction-de-primary-dealers-aupres-de-la-securite-sociale-lhk/

A primary dealer is a pre-approved bank, broker-dealer, or other financial institution that is able to make business deals with the U.S. Federal Reserve, such as underwriting new government debt. These dealers must meet certain liquidity and quality requirements as well as provide a valuable flow of information to the Fed about the state of the worldwide markets.

BREAKING DOWN Primary Dealer

Primary dealers are a system of banks and broker-dealers authorized by the Federal Reserve System to deal directly in government bonds. This system was established in 1960 by the Federal Reserve Bank of New York (FRBNY) to implement monetary policy on behalf of the Fed. By purchasing securities in the secondary market through the FRBNY Open Market Desk, the government increases reserves in the banking system and, thus, increases the money supply in the economy. Conversely, selling securities results in a decrease in reserves, limiting the amount of funds that are available for lending. In effect, primary dealers are the Fed’s counterparties in open market operations (OMO).

Primary dealers, which all bid for government contacts competitively, purchase the majority of Treasury securities – Treasury bills, notes, and bonds – at auction and then redistribute or sell them to their clients, creating the initial market in the process. They are required to submit meaningful bids when new Treasury securities are auctioned. In a way, primary dealers can be said to be market makers for Treasuries. Accordingly, primary dealers trade Treasuries and typically also trade spread product.

In 2008, in response to the subprime mortgage crisis and to the collapse of Bear Stearns, the Federal Reserve set up the Primary Dealers Credit Facility (PDCF), through which primary dealers could borrow overnight at the Fed’s discount window using several forms of collateral including mortgage-backed loans. Federal Reserve Banks are authorized to accept loans and other bank obligations as collateral for advances at the discount window. The discount window is used by the Fed to rediscount private securities as a means to directly provide funding to banks at a particular interest rate and, thus, influence banks’ marginal cost of funds. The PDCF was closed on February 1, 2010.