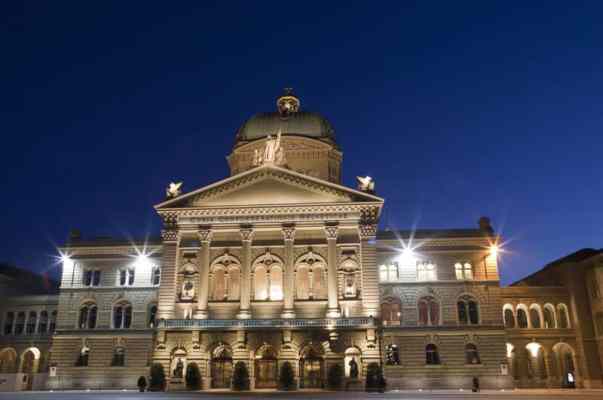

Switzerland, a nation with a reputation for well managed finances, like much of the world is struggling to cover rising costs. Projected spending on the military and state pensions are key challenges. Spending on refugees and healthcare are additional head winds. The federal government has been looking hard for savings. However, this week talk turned to the possibility of higher taxes, reported RTS. © J0hnb0y | Dreamstime.comAt around 17% of GDP, Switzerland federal debt is relatively low by world standards. However, this must be added to cantonal government debt to get a full picture. The Swiss government is essentially facing expenses that are rising faster than revenue. After Russia attacked Ukraine, the government decided to spend an additional CHF 600 million a year on the

Topics:

Investec considers the following as important: Business & Economy, Editor's Choice, Personal finance, Swiss government debt

This could be interesting, too:

Investec writes Swiss inflation falls further in January

Investec writes Catching ski pass cheats – reactions, fines and worse

Investec writes Swiss milk producers demand 1 franc a litre

Investec writes Swiss income taxes at highest level since 2008

Switzerland, a nation with a reputation for well managed finances, like much of the world is struggling to cover rising costs. Projected spending on the military and state pensions are key challenges. Spending on refugees and healthcare are additional head winds. The federal government has been looking hard for savings. However, this week talk turned to the possibility of higher taxes, reported RTS.

At around 17% of GDP, Switzerland federal debt is relatively low by world standards. However, this must be added to cantonal government debt to get a full picture.

The Swiss government is essentially facing expenses that are rising faster than revenue. After Russia attacked Ukraine, the government decided to spend an additional CHF 600 million a year on the military. In addition, the slow but inevitably rising burden of state pensions continues as the population ages. And as an alternative to elusive cost saving in healthcare the government is throwing money at subsidising premiums. Finally, the ongoing cost of funding Switzerland’s refugee efforts, particularly those related to the war in Ukraine, have blown a hole in federal finances.

Annual structural deficits of CHF 3 billion are forecast from 2025 to 2027. Some costs have been cut and some investments have already been delayed. But once this avenue is exhausted then higher taxes may need to be considered, the Federal Council said this week, suggesting higher VAT or direct federal taxes, without offering any detail.

Some in government do not agree with a strategy of higher taxes. Sarah Wyss, a parliamentarian from the Socialist Party, is one. She questioned the wisdom of the government adhering to the debt brake, a mechanism which limits government borrowing.

A number of nations, such as the US, are digging themselves into deep debt holes. US public debt is around US$34 trillion, equivalent to nearly 100% of GDP or around US$ 100,000 per person. More debt means more interest. The current interest bill on government debt in the US is nearly US $0.7 trillion, roughly 2.5% of GDP, reported the Washington Post. That is a lot of dead expenditure. It also poses risks. Billionaire investor Ray Dalio told CNBC he thinks the US might be close to a tipping point where the burden of rising interest begins to push up government bond risk and the interest demanded by investors, creating a negative feedback loop. Investors may also demand higher interest to cover the risk the US central bank creates money to plug the gap, eroding the value of the dollar. And if investors demand higher interest on government debt then debt in the US will be more expensive for nearly everyone else.

The mathematics of debt can sometimes paint a daunting picture. If the US federal government was to bring spending into line with revenue and hold it there (an unlikely scenario), and borrow only to pay interest on its current debt pile, the amount it owes would nearly double (193%) in 15 years at an interest rate of 4.5%. 4.5% is well below the average since 1966.

Switzerland is far from being in the same financial pickle as the US. However, the same dynamics of rising expenditure adding to a growing interest bill apply. And in the absence of cost savings, a tax hit today might be less painful than a lingering annual interest payment that leads to higher taxes for longer later.

Parliament will consider the issue in January 2024.

More on this:

RTS article (in French) – Take a 5 minute French test now

For more stories like this on Switzerland follow us on Facebook and Twitter.