Investec Switzerland. The Swiss Market Index, along with other European markets, is trading slightly higher this week after financials rallied on merger and acquisition rumors and hopes for improved growth. European banks, the industry group battered the most so far this year, lead gains after it emerged that Deutsche Bank AG and Commerzbank AG executives held talks about a potential merger in early August this year. Bank rally – © Valeriia Arnaud | Dreamstime.com US stocks however fell modestly this week after the release of mixed economic data and ahead of key employment data due late Friday. US manufacturing data showed an unexpected contraction on Thursday, leading to renewed concern about the stability of the world’s largest economy. Fed Chair Yellen said last week that the case for an interest-rate increase “has strengthened in recent months” and further highlighted that the central bank’s decisions on whether to raise rates will depend on the degree that data “continues to confirm” a solid outlook for the American economy. Analysts expect 180,000 new jobs to have been filed in the last month. In Switzerland the KOF Economic Barometer, which is a composite of leading indicators for the Swiss economy, fell by 3.7 points in August.

Topics:

Investec considers the following as important: Business & Economy, Editor's Choice, Investec Switzerland, SMI, Swiss Markets

This could be interesting, too:

Investec writes The global brands artificially inflating their prices on Swiss versions of their websites

Investec writes Swiss car insurance premiums going up in 2025

Investec writes The Swiss houses that must be demolished

Investec writes Swiss rent cuts possible following fall in reference rate

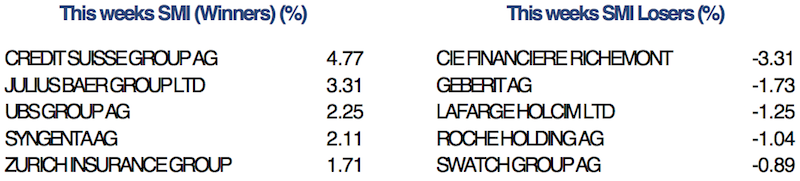

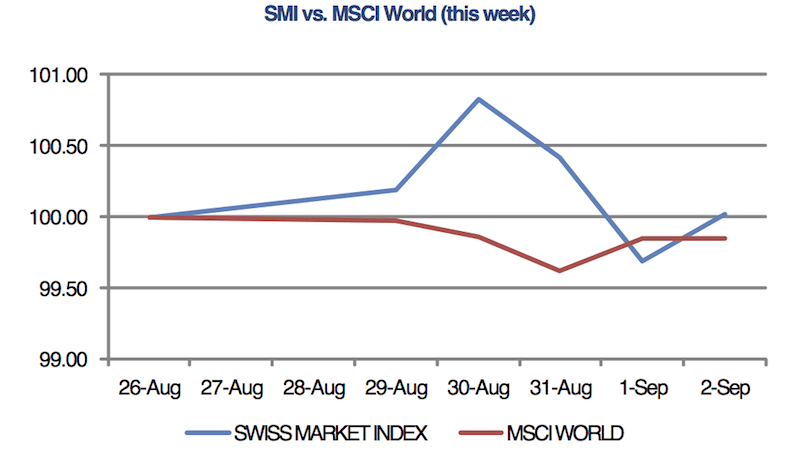

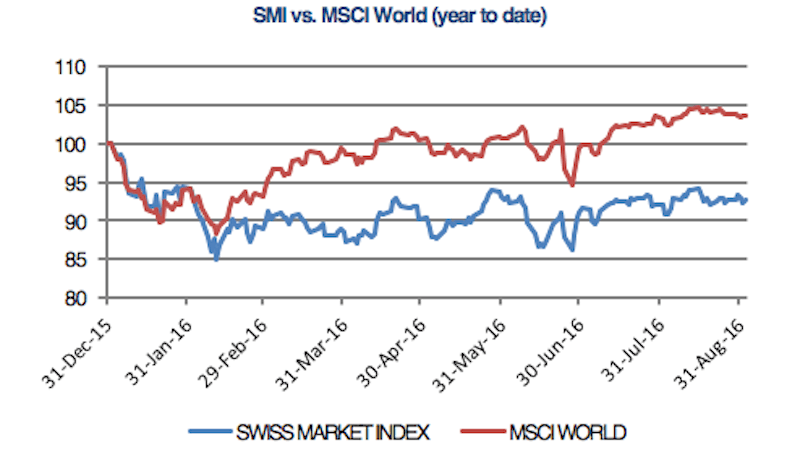

The Swiss Market Index, along with other European markets, is trading slightly higher this week after financials rallied on merger and acquisition rumors and hopes for improved growth. European banks, the industry group battered the most so far this year, lead gains after it emerged that Deutsche Bank AG and Commerzbank AG executives held talks about a potential merger in early August this year.

Bank rally – © Valeriia Arnaud | Dreamstime.com

US stocks however fell modestly this week after the release of mixed economic data and ahead of key employment data due late Friday. US manufacturing data showed an unexpected contraction on Thursday, leading to renewed concern about the stability of the world’s largest economy. Fed Chair Yellen said last week that the case for an interest-rate increase “has strengthened in recent months” and further highlighted that the central bank’s decisions on whether to raise rates will depend on the degree that data “continues to confirm” a solid outlook for the American economy. Analysts expect 180,000 new jobs to have been filed in the last month.

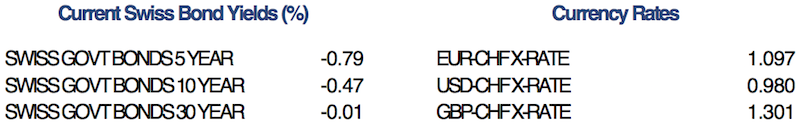

In Switzerland the KOF Economic Barometer, which is a composite of leading indicators for the Swiss economy, fell by 3.7 points in August. The barometer dipped just below its long-term average and suggests that the outlook for the Swiss economy is less upbeat than one month ago. The deteriorating outlook in the Swiss manufacturing, banking and tourism sectors account for the recorded overall drop since last month.

In company news, agencies reported that Deutsche Bank AG and Commerzbank AG executives held talks about a potential merger earlier in August. This led to anticipation that the European banking sector may be due for consolidation. Spokespersons for both Deutsche Bank and Commerzbank declined to comment although it was reported that both companies decided against pursuing a transaction as they focus on restructuring their own businesses first. Richemont, the luxury goods group, is set to finish the week as the SMI’s biggest loser after an investment house said that jewelry trends continue to deteriorate and that the company’s future earnings are at increased risk.