According to reinsurer, Swiss Re, over three quarters of private buildings in Switzerland have no earthquake coverage. Because earthquakes are rare and are quickly forgotten, public risk perception is low. Even Switzerland, with its well developed insurance culture is no exception. Earthquake in Abruzzo Italy – © Walter Graneri | Dreamstime.com Swiss Re describes Switzerland as a country with a medium seismic hazard. The strongest and most destructive earthquake recorded in Switzerland occurred in Basel in 1356. Swiss Re estimates that an earthquake of a similar 6.4 to 6.8 magnitude in Basel today, could affect over 2 million people, 275,000 buildings and cause damage of up CHF 120 billion. Basel is not the only area at risk. Valais, the Rhine valley, Central Grisons, the Engadine and central Switzerland all have a history of earthquakes. According to Swiss Re, seismic risk potentially affects the whole country. A 6.2 magnitude earthquake in central Switzerland it says, could damage 75,000 buildings, affect 500,000 people and cost CHF 17.6 billion. Andreas Götz, from the Federal Office for the Environment FOEN, estimates that a repeat of the 1356 Basel quake could cost CHF 60 billion of building and contents damage, half the Swiss Re estimate. As a comparison, he says Switzerland’s worst known flood, caused damage of less than CHF 2 billion.

Topics:

Investec considers the following as important: Compulsory earthquake insurance Switzerland, Earthquake insurance Switzerland, Earthquake risk Switzerland, Earthquake risk Vaiais Switzerland, Earthquakes Switzerland, environment, Is earthquake insurance compulsory in Switzerland?, Property

This could be interesting, too:

Investec writes The Swiss houses that must be demolished

Investec writes Swiss rent cuts possible following fall in reference rate

Investec writes The rise in rental scams in Switzerland

Investec writes The rapidly fading economics of solar panels in Switzerland

According to reinsurer, Swiss Re, over three quarters of private buildings in Switzerland have no earthquake coverage. Because earthquakes are rare and are quickly forgotten, public risk perception is low. Even Switzerland, with its well developed insurance culture is no exception.

Earthquake in Abruzzo Italy – © Walter Graneri | Dreamstime.com

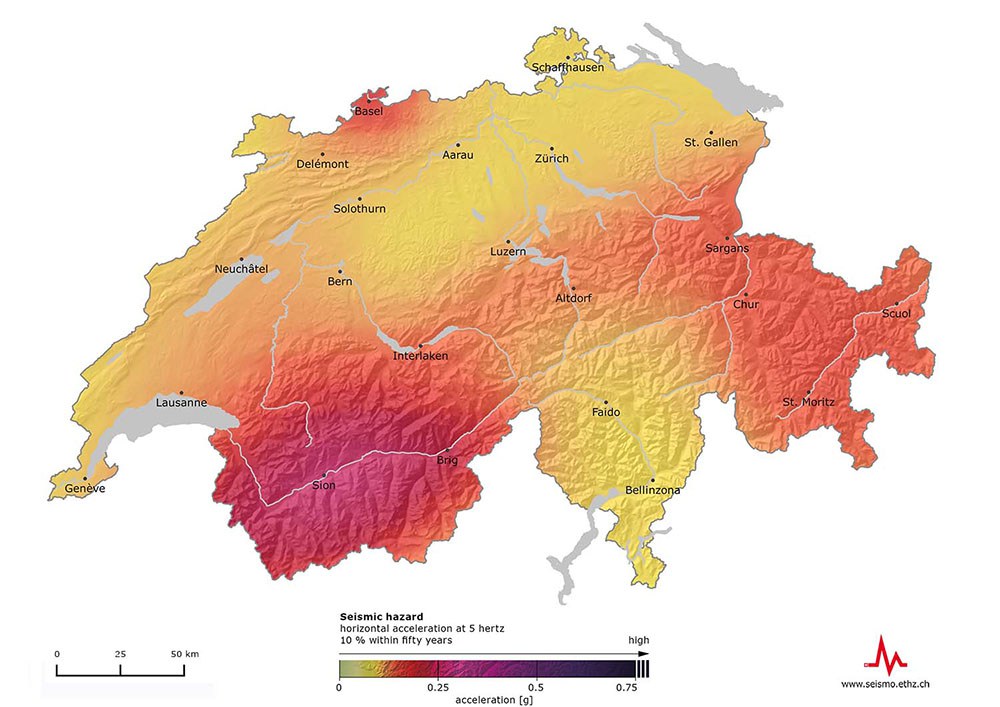

Swiss Re describes Switzerland as a country with a medium seismic hazard. The strongest and most destructive earthquake recorded in Switzerland occurred in Basel in 1356. Swiss Re estimates that an earthquake of a similar 6.4 to 6.8 magnitude in Basel today, could affect over 2 million people, 275,000 buildings and cause damage of up CHF 120 billion. Basel is not the only area at risk. Valais, the Rhine valley, Central Grisons, the Engadine and central Switzerland all have a history of earthquakes. According to Swiss Re, seismic risk potentially affects the whole country. A 6.2 magnitude earthquake in central Switzerland it says, could damage 75,000 buildings, affect 500,000 people and cost CHF 17.6 billion.

Andreas Götz, from the Federal Office for the Environment FOEN, estimates that a repeat of the 1356 Basel quake could cost CHF 60 billion of building and contents damage, half the Swiss Re estimate. As a comparison, he says Switzerland’s worst known flood, caused damage of less than CHF 2 billion. From a statistical point of view, Switzerland should expect a quake of 6 every 100 years, causing damage within a 25km radius from its centre. Over a time frame of 1,000 years, more violent shakes, like the one in Basel in 1356, should be expected, he says.

“In Switzerland, seismic activity over the last 30 years has been very low. According to the medium to long term picture we should expect a rebound in activity”, says professor Domenico Giardini, director of the Swiss seismological service.

The Swiss Seismological Service expects earthquakes of 5 or more to occur every ten to twenty years. More major earthquakes of 6 or more, are forecast every 50 to 150 years. The last major earthquake was 5.8 in Sierre, Valais in 1946.

Switzerland’s earthquake history is neatly set out in the video here. It shows earthquake magnitudes and locations from 1200 to 1974.

Earthquake building codes

According to FOEN, Switzerland has had earthquake resistance construction rules only since 1989. Countries such as Japan and New Zealand have had them for many decades. FOEN estimates that over 90% of Swiss buildings present an unknown safety risk. Swiss Re reckons 53% of residential buildings were built before earthquake construction provisions came into force.

Earthquake damage in Christchurch NZ – © Nigel Spiers | Dreamstime.com

A building’s earthquake risk depends not only on how it is constructed but also what it is built on. Rock comes with the lowest risk. “In extreme cases weak subsoil can amplify seismic shocks by up to ten times that of rock”, said Donat Fäh from the Swiss seismological service.

A FOEN guide to earthquake resistant construction can be viewed here (in French).

Construction regulations are primarily the responsibility of the cantons. The confederation issued new construction standards in 2003 however they are not systematically followed. Only the cantons of Aargau, Basel-City, Fribourg, Jura, Lucerne, Nidwalden and Valais prescribe earthquake resistent design before issuing building permits.

Earthquake insurance cover

Earthquake damage is not covered by standard compulsory insurance covering fire and flood damage and other natural events in Switzerland.

Some cantons have created voluntary earthquake insurance pools, an insurance pot that can be drawn on if needed, however the sums are small compared to the potential cost of an earthquake, like a repeat of the 1356 Basel quake.

Swiss earthquake risk ETHZ 2015

The canton of Zurich has its own pool of cover that would provide up to CHF 1 billion in the event of an earthquake, and a further CHF 1 billion for a second one in the same year. In 1978, 18 other cantons created a combined insurance pool between them, which would provide CHF 2 billion if there is an earthquake, and the same sum again if there is a second one in the same year. The canton of Bern left this pool in 2012. If you live in Bern you can pay for supplementary earthquake insurance, provided by the canton’s insurance GVA, on a voluntary basis. The 17 cantons that remain members of the pool are shown on this map – all of the cantons shown in red, except Zurich which has it’s own pool, are part of it.

The eight cantons of Appenzell Innerrhoden, Geneva, Obwalden, Schwytz, Ticino, Uri and Valais, have no specific cover for earthquake damage. Some private insurance companies provide earthquake insurance but this insurance is not compulsory and most don’t have it.

Christchurch earthquake aftermath – © Bendem | Dreamstime.com

The Swiss federal government thinks current earthquake cover is insufficient and the issue has been raised numerous times since 2005. In 2012, Switzerland’s parliament passed a motion requesting the Swiss cabinet (Federal Council) come up with a plan to introduce compulsory earthquake insurance. The cabinet’s 2013 proposal was which is yet to become law can be viewed here (in French).

One challenge is the lack of consensus among cantons. This has frustrated attempts to introduce a solution at a federal level because doing so would require Switzerland to change its federal constitution.

The proposal calls for compulsory earthquake insurance imposed at a federal level and would require cover covering at least the building and an excess of no more than 5% of the sum insured. Planned premiums would start at 0.121% of the sum insured, so a house insured for CHF 500,000 would attract a premium of CHF 605 a year. The latest (20.09.16) government discussions on compulsory federal earthquake insurance can be seen here (in French and German).

One Swiss insurance company contacted by Le News offered supplementary earthquake coverage of close to 1,000,000, with a CHF 20,000 deductible, for an additional annual premium of around CHF 200, on top of regular water damage and building related personal liability insurance. This was for a house in the Lake Geneva region in Vaud.

New Zealand has a history of earthquakes and suffered a big one measuring 6.3 in Christchurch in February 2011. Compared to Switzerland, New Zealand was well covered. In 1945, the country created a state earthquake insurance provider known as the Earthquake Commission. Earthquake insurance is not compulsory, however all those with buildings or contents insurance are automatically covered for earthquakes via an automatic levy, which is added to these policies and paid to the Earthquake Commission. This means that most are covered for earthquakes.

Swiss Re says, the average earthquake insurance penetration in exposed areas of central Switzerland is only 8.5%. This means the privately insured loss would total only CHF 1.5 billion. This and the cantonal insurance pools above would leave the affected population shouldering a huge financial burden should a large earthquake strike. In some cases uninsured homeowners could be forced to default on their mortgages, dragging down some of the banks, in particular cantonal and local banks. In central Switzerland these banks hold around 80% of mortgages.

More on this:

Earthquake insurance cover – Swiss federal environment office (in French) – Take a 5 minute French test now

Federal proposal for earthquake insurance (in French)

Earthquake insurance cover – Swiss federal environment office (in German)

Covering earthquakes for Switzerland’s mortgage lenders – Swiss Re (in English)