There are numerous reasons to be optimistic about global equities in the coming year. Capital is plentiful; central banks in Europe, the United Kingdom, and some Asian economies have an easing bias; and the equity strategists on Credit Suisse’s Global Markets team believe the equity risk premium is higher than warranted. But there are risks, too, including heightened political risk, slowing Chinese growth, and threats to existing business models from technological disruption and Chinese overinvestment. The net result: the Bank’s Global Markets strategists maintain only a benchmark weighting on global equities. But not all equities are created equal. Heading into the final four months of 2016, the Bank’s strategists have identified three investment styles that they believe offer the best opportunities within the asset class. For those looking for stocks that will perform well in either a bull market or a bear market, there are high-quality growth stocks. Value investors can look to “exceptionally cheap” high-beta stocks, while income investors should take a look at those reliable dividend-payers that Credit Suisse calls “dividend aristocrats.” Quality Growth Stocks European growth stocks have outperformed the market by 1 percent so far in 2016, while U.S. growth stocks underperformed by the same amount.

Topics:

Ashley Kindergan considers the following as important: Credit Suisse, dividend yield, dividends, equities, growth stocks, high-beta, Investing: Features, stocks

This could be interesting, too:

investrends.ch writes UBS zahlt für CS-Steuerstreit mit US-Justizministerium weitere halbe Milliarde

Dirk Niepelt writes “Report by the Parliamentary Investigation Committee on the Conduct of the Authorities in the Context of the Emergency Takeover of Credit Suisse”

Joseph Y. Calhoun writes Weekly Market Pulse: Questions

investrends.ch writes UBS transferierte erfolgreich erste CS-Kunden

There are numerous reasons to be optimistic about global equities in the coming year. Capital is plentiful; central banks in Europe, the United Kingdom, and some Asian economies have an easing bias; and the equity strategists on Credit Suisse’s Global Markets team believe the equity risk premium is higher than warranted. But there are risks, too, including heightened political risk, slowing Chinese growth, and threats to existing business models from technological disruption and Chinese overinvestment. The net result: the Bank’s Global Markets strategists maintain only a benchmark weighting on global equities.

But not all equities are created equal. Heading into the final four months of 2016, the Bank’s strategists have identified three investment styles that they believe offer the best opportunities within the asset class. For those looking for stocks that will perform well in either a bull market or a bear market, there are high-quality growth stocks. Value investors can look to “exceptionally cheap” high-beta stocks, while income investors should take a look at those reliable dividend-payers that Credit Suisse calls “dividend aristocrats.”

Quality Growth Stocks

European growth stocks have outperformed the market by 1 percent so far in 2016, while U.S. growth stocks underperformed by the same amount. In both regions, however, quality growth stocks—defined as those with the highest 12-month trailing return on equity, lowest debt-to-equity ratios, and steadiest earnings per share and cash flow return on investment growth over the last five years—outperformed their peers.

Growth stocks tend to outperform in late-cycle bull markets. That was true in Japan in the 1980s and the U.S. tech boom in the late 1990s, and Credit Suisse believes it will be true in this cycle, too. Current growth stock valuations remain well below the heights attained in those periods, and, on a 12-month trailing price-to-earnings basis, both European and U.S. growth stocks are trading well below their 20-year average relative to value stocks. Credit Suisse’s strategists point out that companies achieving steady, significant organic growth are particularly attractive for investors at a time when nominal global GDP growth is falling, pricing is under pressure both from overinvestment in China and disruptive technology, including the sharing economy, and rising wages are putting pressure on U.S. profit margins.

The strategists also believe the discount rate, or cost of equity, is due to decline in both Europe and the United States. When that happens, long-duration assets tend to re-rate and growth stocks tend to outperform. Among high-quality growth stocks, the Global Markets team recommends a close look at mobile Internet plays—one of the most enduring growth stories of the last decade, and one with plenty of room to run.

High-quality Beta Stocks

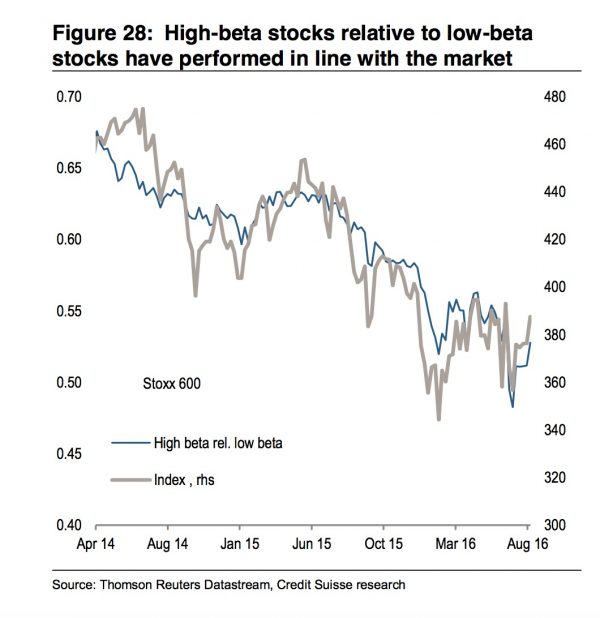

Bargain hunters can find value in high-beta stocks, which are more volatile than the overall market. The relative performance of high-volatility to low-volatility stocks has not been much different than the performance of the overall market in 2016, but high-beta stocks are among the least expensive under Credit Suisse coverage. The Bank’s Global Markets strategists call European high-beta stocks “exceptionally cheap” on a 12-month forward price-to-earnings basis, while those in the U.S. are only slightly more expensive. Credit Suisse recommends that investors focus on stocks that have delivered strong and steady growth in cash flow return on investment for the last five years.

The Global Markets strategists have long recommended that investors favor companies that have maintained their dividends for the last 10 years—the so-called dividend aristocrats. Since 1900, dividend reinvestment has accounted for 67 percent of total returns in the United States and 85 percent in the United Kingdom. Lately, too, the returns from dividend investing have outperformed strategies that focus on companies that choose to return cash to shareholders via stock buybacks. What’s more, the steadiness of dividend payments has been a more important factor in recent performance than the size of the yield, with dividend aristocrats outperforming high-yield stocks since the financial crisis.

The Bank prefers European dividend aristocrats to those in the U.S., noting that U.S. valuations are less attractive and the Fed may soon raise interest rates, while the European Central Bank and Bank of England are still buying bonds to keep rates low. When interest rates rise, all fixed-income products are vulnerable to a haircut, though not all haircuts are the same length. Over the past 20 years, dividend aristocrats only underperformed by 1 percent when yields rose 1.17 percent—the median increase—and any increase in U.S. yields is likely to be much smaller than that. Still, tilting exposure toward Europe cannot hurt.

The post Growth, Value, and Dividend Aristocrats appeared first on The Financialist.