2018 was an Annus Horribilis for the entire crypto industry. Believers and crypto enthusiasts, swept up by the rally of 2017, found themselves on the wrong side of a crashing market. On the right side where the early critics, who were once accused of cynicism and a lack of imagination for calling the crypto market a bubble, and were finally vindicated. As the media eventually turned on the sector and gleefully reported on its demise, investor sentiment soured and soon anyone who’d ever even heard of Bitcoin lost interest and faith on all things crypto. It sure seems like the dizzying highs and crypto-craze of 2017 are long gone and unlikely to return. But was it all just a deja-vu of the tulip mania, or was it more akin to the DotCom bubble? In other words, was it all merely a

Topics:

Claudio Grass considers the following as important: Economics, Finance, Gold, Monetary, Politics

This could be interesting, too:

Investec writes The Swiss houses that must be demolished

Claudio Grass writes The Case Against Fordism

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Investec writes Swiss milk producers demand 1 franc a litre

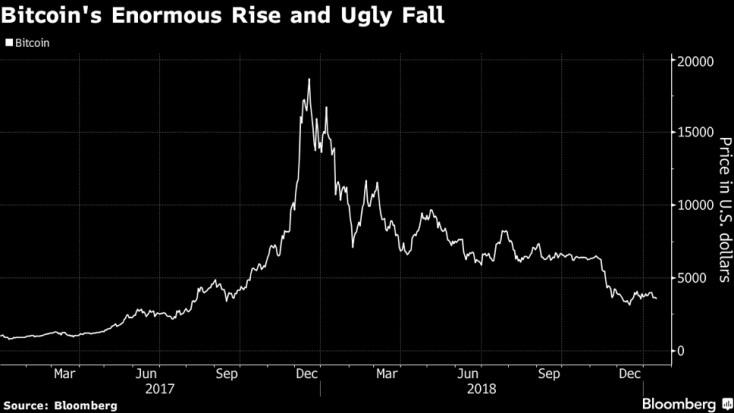

2018 was an Annus Horribilis for the entire crypto industry. Believers and crypto enthusiasts, swept up by the rally of 2017, found themselves on the wrong side of a crashing market. On the right side where the early critics, who were once accused of cynicism and a lack of imagination for calling the crypto market a bubble, and were finally vindicated.

As the media eventually turned on the sector and gleefully reported on its demise, investor sentiment soured and soon anyone who’d ever even heard of Bitcoin lost interest and faith on all things crypto. It sure seems like the dizzying highs and crypto-craze of 2017 are long gone and unlikely to return. But was it all just a deja-vu of the tulip mania, or was it more akin to the DotCom bubble? In other words, was it all merely a contagious fad that served no other purpose than to burn greedy speculators and their money? Or did the demise of the crypto hype actually mark the beginning of a new and better era for the sector?

Aftermath of the crash

Today, the state of the crypto sector paints a truly grim picture, full of gloom and desolation. After all the excitement of 2017, all the record highs and the uncontainable optimism, 2018 came as a rude awakening. The overwhelming majority of digital assets plunged to previously unthinkable lows and hundreds of billions were shaved off the crypto market cap. Bitcoin, the protagonist of the previous year’s rally, experienced a nosedive as spectacular its rise, from its near-$20,000 peak on December 17th, 2017, to just $3,212. Ethereum dropped from $1,405 to below $85 in December. The entire market was decimated, with digital assets crashing by as much as 90%.

Many companies directly or even indirectly connected to the crypto sector came under severe pressure as a result of the bubble burst. Miners were particularly affected, especially those that had invested heavily in equipment and operational expansions. As Bitcoin prices crashed, the electricity costs and resources required could no longer be covered by mining profits. According to reports by Coindesk, an estimated 800,000 mining companies had already shut down by November 2018, with millions in debt owed to creditors. Also, out of those that didn’t go out of business entirely, most either took many servers offline and made serious cuts that heavily reduced their operational capacity. As a result, the processing power that forms the fundament for Bitcoin transactions has also plunged.

Investments have also dried up. As potential returns shrunk and the entire sector took a turn for the worse, investors not only refused to fund new concepts but were also unwilling to throw lifelines at existing companies to keep them afloat. Without the much-needed cash injections, many of those collapsed. By holding their assets in crypto, they inevitably saw their funds rapidly evaporate and their operations come to a screeching halt.

There is one exception, however. Things are looking good in one corner of the crypto industry: the lending business. Creditors target both the remaining believers that want to hold on to their devalued digital assets hoping for a trend reversal and short sellers that need to temporarily borrow coins and profit from their further decline. Thus, lenders in the crypto space are catering to both sides of the market, an advantageous position as it continues to crumble.

Regulation as a trigger

As the crypto industry came under increasingly close scrutiny from regulators over the last year, the initial promise of independence, privacy and financial freedom that attracted large crowds to the sector began to faint. Talk of introducing regulatory frameworks and imposing limitations on the sector started at the beginning of 2018 and soon transformed into more concrete steps. China, a country that used to dominate Bitcoin trading and mining, imposed a ban on initial coin offerings (ICOs) and other cryptocurrency-related commercial activity, such as promotional efforts and events. South Korea banned anonymous trading of digital assets and launched a nationwide cryptocurrency account system. At the same time, the SEC finally drew a very clear line in the sand for ICOs. As SEC chief Jay Clayton put it: “If you want to do any IPO with a token, come see us.”

The implications of this regulatory wave when it comes to privacy are glaringly obvious to many members of the crypto community. Without the assurance of anonymity and independence from governments and institutions, it becomes very difficult to make the case for using a cryptocurrency over any conventional online payment system. And if personal data protection is equally dispensed within both options, Paypal and its competitors, or even normal credit cards for that matter, are much more appealing. As opposed to most crypto alternatives, they are cheaper and easier to use, they have a solid track record and provide much faster transaction execution times, with significantly more consumer protection measures in place, against fraud or non-delivery of goods and services. In this regard, the regulators’ crusade against the crypto sector, with “protection against money laundering and terror financing” as their banner, has landed a severe blow that played a significant role in stunting the industry’s growth. By removing one of its core USPs, the global regulatory fervor managed to push a lot of the true believers and the organic, real demand out of the crypto market, while pure speculation and greed festered.

In the upcoming second part, we’ll dig deeper into the core issues that finally resulted in the implosion of the crypto market and we’ll take look at what we might expect going forward, especially in relation with Gold and the precious metals sector.

Claudio Grass, Hünenberg See, Switzerland

This article has been published in the Newsroom of pro aurum, the leading precious metals company in Europe with an independent subsidiary in Switzerland. All rights remain with the author and pro aurum.

However, feel free to share this article with your audience!