Die SNB dürfte nach überwiegender Einschätzung von Experten bei ihrer Sitzung am Donnerstag ihren Zinssatz unverändert lassen – trotz des weltweiten Trends zu Zinssenkungen. Mit zwei Ausnahmen erwarten die 29 von Reuters befragten Finanzmarktteilnehmer und Analysten, dass die Währungshüter der Schweizerischen Nationalbank (SNB) den Leitzins auf dem seit mehr fünf Jahren geltenden Rekordtief von minus 0,75 Prozent belassen. Auch die Sichteinlagen von Banken bei...

Read More »Jim Bianco: “This Is One Of The Biggest Moments Of Truth In Financial Market History”

Authored by Christoph Gisiger via TheMarket.ch, To contain the economic and financial ramifications of the coronavirus pandemic, Central Banks are going all in. Jim Bianco, founder and chief strategist of Bianco Research, warns that this time, monetary policy might be unable to stop financial markets from collapsing. The Federal Reserve brings out the bazooka: It cuts the federal funds rate down to zero and will buy $700 billion in Treasuries and mortgage-backed...

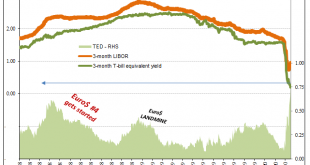

Read More »Is GFC2 Over?

Is it over? That’s the question everyone is asking about both major crises, the answer is more obvious for only the one. As it pertains to the pandemic, no, it is not. Still the early stages. The other crisis, the global dollar run? Not looking like it, either. Stocks rebounded because of “major helicopter stimulus” or because that’s just what stocks do during times like these. Some of the biggest up days have followed, and are often found in between, the greatest...

Read More »Money Supply Growth Climbs to 37-Month High

The money supply growth rate rose again in February, climbing to a 37-month high. The last time the growth rate was higher was during February of 2017, when the growth rate was 7.9 percent. During February 2020, year-over-year (YOY) growth in the money supply was at 7.49 percent. That’s up from January’s rate of 6.32 percent, and up from February 2019’s rate of 3.20 percent. The increase in money supply growth in February represents a sizable reversal of the trend...

Read More »Don’t Panic – Prepare

“Let’s Deal With The Facts Now” – Watch Interview Here ◆ Markets have collapsed around the world as we predicted as the ‘Giant Ponzi Everything Bubble’ meets the massive pin that is the coronavirus’ impact on already vulnerable indebted economies. ◆ Stocks have crashed and bond markets and banks may be next … “bank holidays”, bail-ins and currency resets are likely ◆ The virus is a final “snow flurry” which is unleashing the financial and economic avalanche. ◆...

Read More »FX Daily, March 17: Even Turn Around Tuesday is Flat

Swiss Franc The Euro has fallen by 0.21% to 1.0565 EUR/CHF and USD/CHF, March 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: While the markets are not as disorderly as they have been, the tone is fragile, and the animal spirits have been crushed. Australian stocks fell more than 10% last week and dropped another 9.7% yesterday before rebounding by almost 6% today to be one of the few Asia Pacific equity...

Read More »USD/CHF recovers but finds resistance at 0.9500

Swiss franc losses strength versus USD, EUR despite risk aversion. USD/CHF modestly lower for the day after finding resistance at 0.9500. The USD/CHF was trading around 0.9470, modestly lower from the level it closed on Friday. The pair bottomed during the European session at 0.9390, following rate cuts from many central banks. It then rebounded as the DXY turned positive, trimming losses. The 0.9500 area capped the recovery of the US dollar. From a fundamental...

Read More »USD/CHF Price Analysis: Below 100-bar SMA inside weekly rising channel

USD/CHF holds onto recovery gains inside the short-term bullish technical pattern. Key SMA, sluggish MACD question the buyers. In addition to the current risk-reset, USD/CHF takes clues from the technical indicators while rising 0.26% to 0.9493 amid the initial trading session on Tuesday. The pair recently bounced off the support-line of a one-week-old rising trend channel, which in turn pushes the quote towards a 100-bar SMA level of 0.9540. However, the quote’s...

Read More »Coronavirus: Federal Council declares ‘extraordinary situation’ and introduces more stringent measures

Bern, 16.03.2020 – At an extraordinary meeting today, 16 March 2020, the Federal Council took the decision to introduce more stringent measures to protect the public. It has declared that an ‘extraordinary situation’ now exists in Switzerland in terms of the Epidemics Act. All shops, restaurants, bars and entertainment and leisure facilities will remain closed until 19 April. Not affected by the new ruling are food stores and healthcare institutions. As of...

Read More »Swiss government announces further restrictions to slow spread of virus

At a press conference at 5pm on 16 March 2020, members of the Federal Council presented a list of further restrictions designed to slow the spread of the Covid-19 virus, that will become active from midnight tonight. A video of the conference can be viewed below. [embedded content]Alain Berset, Switzerland’s interior minister, called on the population to follow the rules. To date a significant number of people have not been following them, he said. Following these...

Read More » SNB & CHF

SNB & CHF