The SNB’s Karl Brunner Distinguished Lecture Series:Carmen Reinhart to hold fifth lecture The Swiss National Bank is honouring Carmen Reinhart with this year’s Karl Brunner Distinguished Lecture Series. Carmen Reinhart is an influential economist who has made outstanding contributions to macroeconomics. She has been Professor of the International Financial System at Harvard Kennedy School since 2012, and also currently serves on the Economic Advisory Panel of the...

Read More »Portugal set to end tax holidays for foreign residents

[caption id="attachment_414651" align="alignleft" width="400"] © Tomas1111 | Dreamstime.com[/caption] Recently, the government of Portugal said it was looking at introducing a tax on foreigners residing in the country on special tax holidays, according to the magazine Bilan. Currently, foreigners moving to Portugal who spend at least 180 days a year in the country pay no income tax for a period of 10 years under a scheme that was launched 11...

Read More »Swiss private bank Pictet to drop fossil fuel investments

© Kent Johansson | Dreamstime.com Recently, the private bank Pictet, based in Geneva, announced plans to eliminate all of its investments in companies actively associated with the production and extraction of fossil fuels, according to a press release. The bank defines companies actively associated with the production and extraction of fossil fuels as those generating more than 25% of their revenue from activities with high carbon emissions. At the end on December...

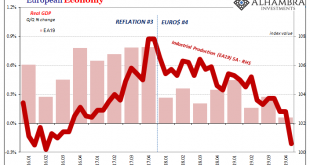

Read More »European Data: Much More In Store For Number Four

It’s just Germany. It’s just industry. The excuses pile up as long as the downturn. Over across the Atlantic the situation has only now become truly serious. The European part of this globally synchronized downturn is already two years long and just recently is it becoming too much for the catcalls to ignore. Central bankers are trying their best to, obviously, but the numbers just aren’t stacking up their way. We’ve seen all this before, repeatedly. Part of the...

Read More »Three Reasons Why Decentralization and Secession Lead to More Open Economies

When we hear of political movements in favor of decentralization and secession, the word “nationalist” is often used to describe them. We have seen the word used in both Scottish and Catalonian secession movement, and in the case of Brexit. Sometimes the term is intended to be pejorative. But not always. When used pejoratively — as was the case with critics of Brexit — the implication is that the separatists seek to exit a larger political entity for the purposes of...

Read More »The Secret to Fun and Easy Stock Market Riches

Post Hoc Fallacy On Tuesday, at the precise moment Federal Reserve Chairman Jay Powell commenced delivering his semiannual monetary policy report to the House Financial Services Committee, something unpleasant happened. The Dow Jones Industrial Average (DJIA) didn’t go up. Rather, it went down. Were the DJIA operating within the framework of a free capital market it would be normal for the index to go both up and down. But remember, the U.S. stock market is hardly a...

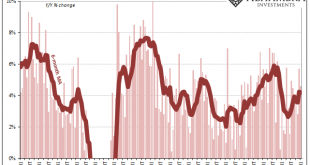

Read More »US Sales and Production Remain Virus-Free, But Still Aren’t Headwind-Free

The lull in US consumer spending on goods has reached a fifth month. The annual comparisons aren’t good, yet they somewhat mask the more recent problems appearing in the figures. According to the Census Bureau, total retail sales in January rose 4.58% year-over-year (unadjusted). Not a good number, but better, seemingly, than early on in 2019 when the series was putting out 3s and 2s. As has been the pattern in these things, global synchronized downturns, the...

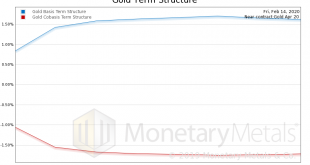

Read More »Widening Bid-Ask Spreads, Gold and Silver Market Report 17 February

The price of gold rose $14 and the price of silver fell $0.07. The gold-silver ratio rose further with this price action. Welcome to our new Gold and Silver Market Report, or “Market Report” for short. We are separating this from the economics essay, which was attached for many years. As they used to say in many toy commercials of yore, “batteries sold separately”—or in this case essays. The new Market Report is going to depart from the familiar old format of four...

Read More »FX Daily, February 17: Dismal Q4 Japanese GDP Fails to Spur Yen Movement

Swiss Franc The Euro has fallen by 0.02% to 1.0635 EUR/CHF and USD/CHF, February 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: It is only a US holiday today, but the global capital markets are subdued. In the Asia-Pacific region, equities traded lower with China and Hong Kong, the main advancers. The MSCI Asia Pacific Index has fallen in only two weeks since the end of last November, and that was during the...

Read More »Drivers for the Week Ahead

We get the first February data from the US manufacturing sector this week; the US economy remains strong; FOMC minutes will be released Wednesday Canada reports some key data this week Preliminary eurozone February PMI readings will be reported Friday; UK has a busy data week Japan has a busy data week; Australia reports January jobs data Thursday Concerns about the coronavirus are likely to keep risk sentiment under pressure, as the ultimate impact is still...

Read More » SNB & CHF

SNB & CHF