In the recent Wall Street Journal article “Inflation Surge Earns Monetarism Another Look,” Greg Ip writes that a recent surge in inflation is not likely to bring authorities to reembrace monetarism. According to Ip, money supply had a poor record of predicting US inflation because of conceptual and definitional problems that haven’t gone away. The head of the monetarist school, the late Milton Friedman, held that inflation is always and everywhere a monetary...

Read More »Nine Ways Debt and Deficit Spending Severely Harm African Societies

Systemic debt and deficit spending are intrinsic features of today’s economic system. Unlike classical economics, where markets play the leading role and governments the supporting one, the existing economic model, driven by Keynesian theory, has inverted the roles. Keynesian economics, like other statist economic theories, is distrustful of (free) markets, thus making the state, an inherently bureaucratic and coercive institution, the captain of economic and social...

Read More »Charities have yet to spend most of Ukraine donations

People wait to receive humanitarian aid in Kramatorsk, Ukraine, on May 28, 2022. Copyright 2022 The Associated Press. All Rights Reserved. Despite record public donations for Ukraine, four months since the start of the invasion by Russia, Swiss aid agencies have only been able to spend a small amount of the funds on humanitarian work. An investigationExternal link by the SonntagsZeitung newspaper published on July 10 has revealed that Swiss Solidarity, the Swiss Red...

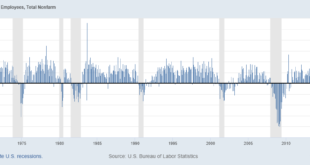

Read More »Weekly Market Pulse: A Most Unusual Economy

The employment report released last Friday was better than expected but the response by bulls and bears alike was exactly as expected. Both found things in the report to support their preconceived notions about the state of the economy. I do think the bulls had the better case on this particular report but there have been plenty of others recently to support the ursine side of the aisle too. My take is that everything about the economy right now, and really since...

Read More »Pendulum of Sentiment Swings Back against Imminent Recession Fears Despite Curve Inversion

High political drama in recent days included the assassination of former Japanese Prime Minister Abe and the resignation of UK Prime Minister Johnson. Yet, the capital markets in general, and the currency market in particular, were not roiled. This is because investors have their sights elsewhere. The dollar surged. It is partly a function of bad news elsewhere. Japan's easy monetary policy stance sticks out like a sore thumb, and the May data showed the economic...

Read More »The Economist Notes UK’s Economy was Maimed 15 Years Ago [Eurodollar University, Ep. 260]

The Economist admits to, warns of and draws attention to Britain's 15-year economic depression, labeling it a "slow-burning crisis", "long-standing", "stagnation nation" and "a chronic disease". There are many devastating socioeconomic, geopolitical consequences. It's not just Britain, it's the world. ----EP. 260 REFERENCES---- Low economic growth is a slow-burning crisis for Britain: https://econ.st/3nObojJ Britain’s productivity problem is...

Read More »Federalism, Not Centralization, Is the Way out of the Current Conflicts

The overturning of Roe v. Wade is a historic decision, upholding the highest principle of a republic. A republic is born through freedom of association in the same manner as individuals band together to form a family, families band together to make a community, and communities band together to make a society. In an ideal situation of law-based governance, the law givers and the law abiders must be the same, as it is only then that voluntary subservience to the law...

Read More »How Bad Were Recessions before the Fed? Not as Bad as They Are Now

The Federal Reserve was supposed to prevent recessions that people blamed on the lack of central banking. Not surprisingly, the post-Fed recessions have been worse. Original Article: “How Bad Were Recessions before the Fed? Not as Bad as They Are Now” With a recession looming over the average American, the group to blame is pretty obvious, this group being the central bankers at the Federal Reserve, who inflate the supply of currency in the system, that currency...

Read More »Swiss fighter jet document reveals secret French tax offer

France’s last-ditch bid to persaude Switzerland to buy its Rafale fighter jet looks to have failed. Copyright 2018 The Associated Press. All Rights Reserved. France offered Switzerland a financial sweetener, worth an estimated CHF3.5 billion, to buy its Rafale fighter jets rather than US F-35A aircraft, according to a secret document seen by Swiss public broadcaster SRF. The document sheds light on background negotiations as Switzerland seeks to replace its ageing...

Read More »Ukraine reconstruction summit was worth the risk, says Swiss press

The Swiss press has praised Foreign Minister Cassis for organising the Ukraine Recovery Conference in Lugano earlier this week. © Keystone/Alessandro Della Valle Newspaper editors in Switzerland offered praise mixed with criticism on the two-day international conference in Lugano to support war-torn Ukraine with its reconstruction efforts. The Wednesday edition of the Tages-Anzeiger and other TA Media group papers said the meeting, which ended on Tuesday, was a step...

Read More » SNB & CHF

SNB & CHF