Hello, my name is Bill Bonner. I’ve recorded this video message from my cottage near the town of Youghal, about 150 miles southwest of Dublin. After a 50-year career spent building one of the largest financial research firms of its kind… After launching offices in Poland, Spain, London, China, Russia, India, and more than a half dozen other countries… After watching my companies reach a market valuation of more than $3 billion… After earning more money than my...

Read More »Is a Post-Dollar World Coming—Soon? [Ep. 284, Eurodollar University]

A Financial Times opinion column avers not only is a "post-dollar world coming" but that it is "near" and that the "decline could last... longer". We review the argument, disagree, and note no discussion of the global monetary order. Also, a prediction where the dollar is headed next. ****SPONSOR**** Purchase shares in great masterpieces from artists like Pablo Picasso, Banksy, Andy Warhol, and more. Skip the waitlist and invest in blue-chip art for the very...

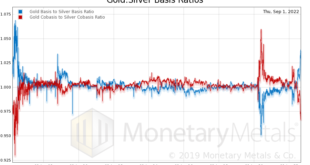

Read More »Silver Update: Scarcity Gets More Extreme

Since our last silver article, the price of silver has dropped. With due respect to Frederic Bastiat, the price is the seen. The basis mostly goes unseen. We will take a look at the market data, revised for a few more days of trading. Warren Buffett, 2008, and the Cobasis But first, let’s look at a chart we have discussed a few times over the years. It shows two ratios: gold basis to silver basis, and gold cobasis to silver cobasis. It shows a measure of gold’s...

Read More »Swiss Retail Sales, July 2022: 4.6 percent Nominal and 2.6 percent Real

01.09.2022 – Turnover adjusted for sales days and holidays rose in the retail sector by 4.6% in nominal terms in July 2022 compared with the previous year, with just under half of this upturn due to price increases. Seasonally adjusted, nominal turnover fell by 0.3% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO). Real turnover adjusted for sales days and holidays rose in the retail sector by 2.6% in July...

Read More »The System Is Busy Cannibalizing Itself

As the word suggests, cannibalism won’t end well for those consumed by the infinitely insatiable few. Cannibalize is an interesting word. It is a remarkably graphic way to describe the self-inflicted destruction of a system by stripping previously functional subsystems to sustain the illusion of system functionality. Here are some examples. An Air Force which routinely posts photos of its impressive fleet of 100 aircraft has been cannibalizing parts from 80 aircraft...

Read More »SIX Digital Exchange Goes Live With Ethereum Staking Service for Institutional Clients

SDX Web3 Services, the newly launched business unit from SIX Digital Exchange, is now live with its non-custodial Ethereum staking service. This new offering is a straightforward and secure way to launch new validators, generate yield from staking, and manage Ethereum validator nodes through a fully managed, API based infrastructure. The service is tailored to institutional clients who need to scale their Ethereum staking capabilities. SDX Web3 Services said that...

Read More »Do We Want Real Tax Cuts? How About Cutting Government Spending?

According to many economic commentators, an effective way to generate economic growth is through the lowering of taxes. The lowering of taxes, it is held, will place more money in consumers’ pockets, thereby setting in motion an economic growth. This way of thinking is based on the belief that a given dollar increase in consumer spending will lift the economy’s gross domestic product (GDP) by a multiple of the increase in consumer expenditure. Assume that out of an...

Read More »Swiss government launches energy saving campaign

On 31 August 2022, Switzerland’s federal government launched its campaign to cut energy consumption to reduce the risks of an energy shortfall over the coming winter. Photo by Castorly Stock on Pexels.comThe government stressed that there was currently no energy shortfall. However, Simonetta Sommaruga, the minister in charge of energy, said it was important to cut energy consumption to avoid the risk of forced cuts. An energy cut of a few weeks could cost the Swiss...

Read More »Steel mill applies for reduced working hours due to energy costs

© Keystone / Gaetan Bally High energy prices have forced a steel mill in Switzerland to prepare for short-time working to avoid layoffs. The Stahl Gerlafingen steel plant in the canton of Solothurn has been granted permission to resort to short-time working from October to December as a preventive measure. The mill consumes as much electricity as 70,000 households and is expecting a bill of CHF45 million for October, writes the NZZ am Sonntag. This is more than the...

Read More »Bill Bonner (The Most Anti-Social Rich Guy In America): America’s Nightmare Winter is Coming…

Watch the full presentation in HD here: https://l.px1.co/SYJYV Stephen Schwarzman, the CEO of Blackstone (America’s biggest private equity firm), recently went public on CNN predicting America is about to see serious “social unrest”. Schwarzman said: “You’re going to get very unhappy people around the world… What happens then, is you’ve got real unrest. This challenges the political system…” Bill Bonner, an ultra-wealthy...

Read More » SNB & CHF

SNB & CHF