History matters, especially as the New York City today faces still another subway crisis. The New York subway system’s history illustrates the failures of state enterprise. The subways have been bad for so long that few know when the subways were “an engineering marvel.” That was when subway private management companies made money, about a century ago. Today there’s consensus the red-ink government subways are a nightmare. The state agency operating them has wasted...

Read More »Gold Return On Gold Discussion

Gold Return On Gold Discussion | https://www.themorganreport.com/join David Morgan and Keith Weiner Interview. Monetary Metals is a different kind of gold company. Others buy or sell gold. We are a platform for products that offer investors a Yield on Gold, Paid in Gold®. We call it The Gold Yield Marketplace. Watch this video on Gold Return On Gold Discussion, then please share with your friends and family on social media and use the caption Gold Return On Gold Discussion Market...

Read More »Global Financial Crisis Jeff Snider | Indian Rupee

Global Financial Crisis Jeff Snider Indian ruppee. India #jeffsnider#treasurybills#economy#useconomy credit: Emil Kalinowski https://www.youtube.com/watch?v=O-6qgQ1FKtI DISCLAIMER : I am not a financial advisor. The ideas presented in this video are for entertainment purposes only. You (and only you) are responsible for the financial decisions that you make. This information is what was found publicly on the internet. This information could’ve been doctored or misrepresented by the...

Read More »Greetings from Switzerland

I’m back from Geneva where, among other things, I briefly visited the headquarter of the World Economic Forum (WEF) to express my appreciation for this organization. Check out my picture :-). In addition I enjoyed a conversation with Jose El Niño – you will find the podcast under the below link. Claudio Grass, Switzerland If you want to listen, please click on the following link to the podcast:...

Read More »How to Know When the Fed will Stop Rate Hikes [Ep. 283, Eurodollar University]

In 2000 and 2006 the inversion of future 2-year rates and current 2-year rates correctly predicted when the Fed would stop hiking rates. Of course, the Fed had no idea it would stop -- markets knew it though. Where is the future 2-year rate relative today? An eyelash from inversion. ****EP. 283 REFERENCES**** RealClear Markets Essays: https://bit.ly/38tL5a7 Epoch Times Columns: https://bit.ly/39ESkRf ****THE EPISODES**** YouTube: https://bit.ly/310yisL Vurbl: https://bit.ly/3rq4dPn...

Read More »Inflation continues to bite in Switzerland

The strong franc only goes so far in protecting Switzerland from inflation. © Keystone / Gaetan Bally The cost of goods and services in Switzerland rose 3.5% in August compared to the same month last year, but the inflation rate still remains below that of many other countries. Prices for imported goods leapt 8.6%, according to the Federal Statistical Office (FSO), while domestic products went up 1.8%. Rising energy and fuel costs are the main drivers of inflation –...

Read More »The Silver Phoenix Market

Listen to the audio version of this article here. The price of silver hit a peak over $26.50 on March 8. It spent about a month and a half breaking down, and then the bottom fell out. It’s currently down from that peak almost 8 bucks. Breaking Down Fundamental Silver Prices However, the opposite has been happening to silver’s scarcity. First, let’s look at a chart of the silver market price and the silver fundamental price. The market price is down a lot since that...

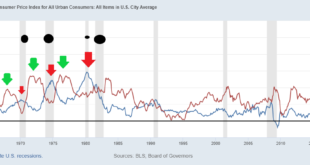

Read More »Powell’s White Whale

The lagged effect of inflation. “Just call me Ishmael,” Jay. . [embedded content] Tags: economy,Featured,Federal Reserve/Monetary Policy,newsletter

Read More »Goldilocks Calling

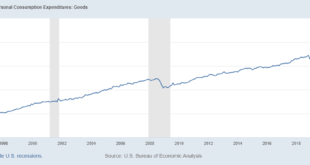

Since the summer of 2020, my expectation for the US economy has been that once all the COVID distortions are gone, it would revert to its previous trend growth of around 2%. And that seems to be exactly what is going on with the economy right now. There was a shift in consumption preference during COVID for goods over services with the goods consumption rising well above the pre-COVID trend: . Now, some of that, as we know, is due to inflation so if we correct for...

Read More »87,000 New IRS Agents Will Reduce Inflation?

REMINDER: I will be speaking at the Ron Paul Institute’s annual conference, which this year is being held at the The Westin Washington Dulles Airport. The theme of the conference is “Anatomy of a Police State.” See my blog post of yesterday. If you can make it, I am sure you’ll be happy you did. If you do attend, please come up and say hello. Register here. — Jacob ****** Just about everyone, including the most ardent proponents of public (i.e., government) schools,...

Read More » SNB & CHF

SNB & CHF