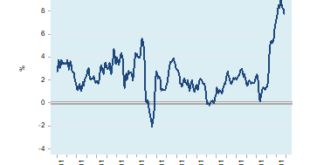

The yearly growth rate of the Consumer Price Index (CPI) fell to 7.7 percent in October from 8.2 percent in September. Note that in October 2021 the yearly growth rate stood at 6.2 percent. Some experts are of the view that it is quite likely that the momentum of the CPI might have peaked. We suggest that the decline in the yearly growth rate of the CPI is from the sharp decline in the momentum of money supply. The yearly growth rate of our monetary measure for the...

Read More »On Secession and Small States

The international system we live in today is a system composed of numerous states. There are, in fact, about two hundred of them, most of which exercise a substantial amount of autonomy and sovereignty. They are functionally independent states. Moreover, the number of sovereign states in the world has nearly tripled since 1945. Because of this, the international order has become much more decentralized over the past eighty years, and this is largely due to the...

Read More »Live Panel with Steven Van Metre, Tracy Shuchart and Jeff Snider – Traders Summit Event October 2022

Blake Morrow hosts a fantastic 3-way live panel with Steven Van Metre of MarketsInsiderPro.com, Tracy Shuchart of Intelligence Quarterly and Jeff Snider of Atlas Financial. Steven expressed fears that the housing market has not yet shown signs of weakness in light of global monetary tightening, but it's only a matter of time till it does. Tracy discussed the energy markets - focusing on oil, gas and electricity - and talked about supply constraints and the supply chain disruption. Jeff...

Read More »December 2022 Monthly

As the year of aggressive monetary tightening winds down, the Federal Reserve, the European Central Bank, and the Bank of England will likely slow the pace of rate hikes. All three delivered 75 bp hikes in November and will probably hike by 50 bp this month and moderate the pace again in the first part of next year.Price pressures remain elevated even if near or slightly past the peaks. The G10 central banks are not finished tightening, though central banks from...

Read More »The way forward:

A practical roadmap to reclaiming individual and financial sovereignty – Part II of II Essential ingredients There have always been people with a passion for liberty. Since the earliest historical records, we can find questioners, dissenters, “trouble makers”, contrarians and all kinds of free and inquisitive minds. In this day and age, however, technology has played a decisive role in the influence they can have. Sure, the “bad guys” might be taking...

Read More »What Did Powell Say?

Overview: Asia Pacific stocks rallied on the heels of the surge in US equities. China’s CSI 300 led the large bourses higher with a 1% advance. Europe’s Stoxx 600 is matching yesterday’s gain of a little more than 0.6%, while US futures are a touch softer. European yields are 9-13 bp lower, with the peripheral premiums shrinking. The US 10-year yield, which tumbled 14 bp yesterday is little changed now near 3.60%. The dollar is broadly lower. The strongest of the G10...

Read More »Who Really Owns Big Digital Tech?

By now it should be perfectly clear that the most prominent Big Digital companies are not strictly private, for-profit companies. As I argued in Google Archipelago, they are also state apparatuses, or governmentalities, undertaking state functions, including censorship, propaganda, and surveillance. Katherine Boyle, “a general partner at Andreessen Horowitz where she invests in companies that promote American dynamism, including national security, aerospace and...

Read More »A.P. Moller – Maersk and IBM to Discontinue Blockchain Trade Platform Tradelens

A.P. Moller – Maersk and IBM announced the decision to withdraw the TradeLens offerings and discontinue the platform. Starting immediately, the TradeLens team is taking action to withdraw the offerings and discontinue the platform, and the intent is that the platform will go offline by end of quarter one, 2023. During this process all parties involved will ensure that customers are attended to without disruptions to their businesses. Maersk will continue its efforts...

Read More »If even the Fed Chairman can sense it…

Even before Jay Powell's remarks today, the economic situation was shown to have deteriorated here and abroad. A couple of American jobs reports indicate layoffs and further looming setbacks. Meanwhile, China's economy is suffering a lot more than lockdowns and protests. No wonder Powell turned "dovish." Eurodollar University's Money & Macro Analysis Article discussed in today's video: The U.S. Labor Market Is Less Tight Than It Appears...

Read More »This Is of Course Insane

Greed is a powerful motivation to be an ardent believer in the central banking cult. The ideal cult convinces its followers that it isn’t a cult, it’s simply the natural order of things.In current terms, this normalizes insane behaviors and beliefs. Sacrificing youth to appease the gods isn’t a cult; it’s simply the natural order of things. If we don’t sacrifice youth, bad things will happen, so we have to follow the natural order of things. Despite the lofty claims...

Read More » SNB & CHF

SNB & CHF